In the bustling world of financial markets, swing trading stands out as a strategic approach that leverages short-term price fluctuations. As a swing trader, my journey into this realm began with a fascination for the intricate dance of supply and demand, where market cycles revealed patterns ripe for exploitation.

Image: www.cmegroup.com

My initial forays into swing trading were marked by a series of hard-earned lessons. I navigated the treacherous waters of market volatility, learning to anticipate the ebbs and flows of price movements. Over time, I honed my skills, developing an intuitive understanding of market dynamics and the ability to identify opportune entry and exit points.

ES Futures Options: A Gateway to Limitless Possibilities

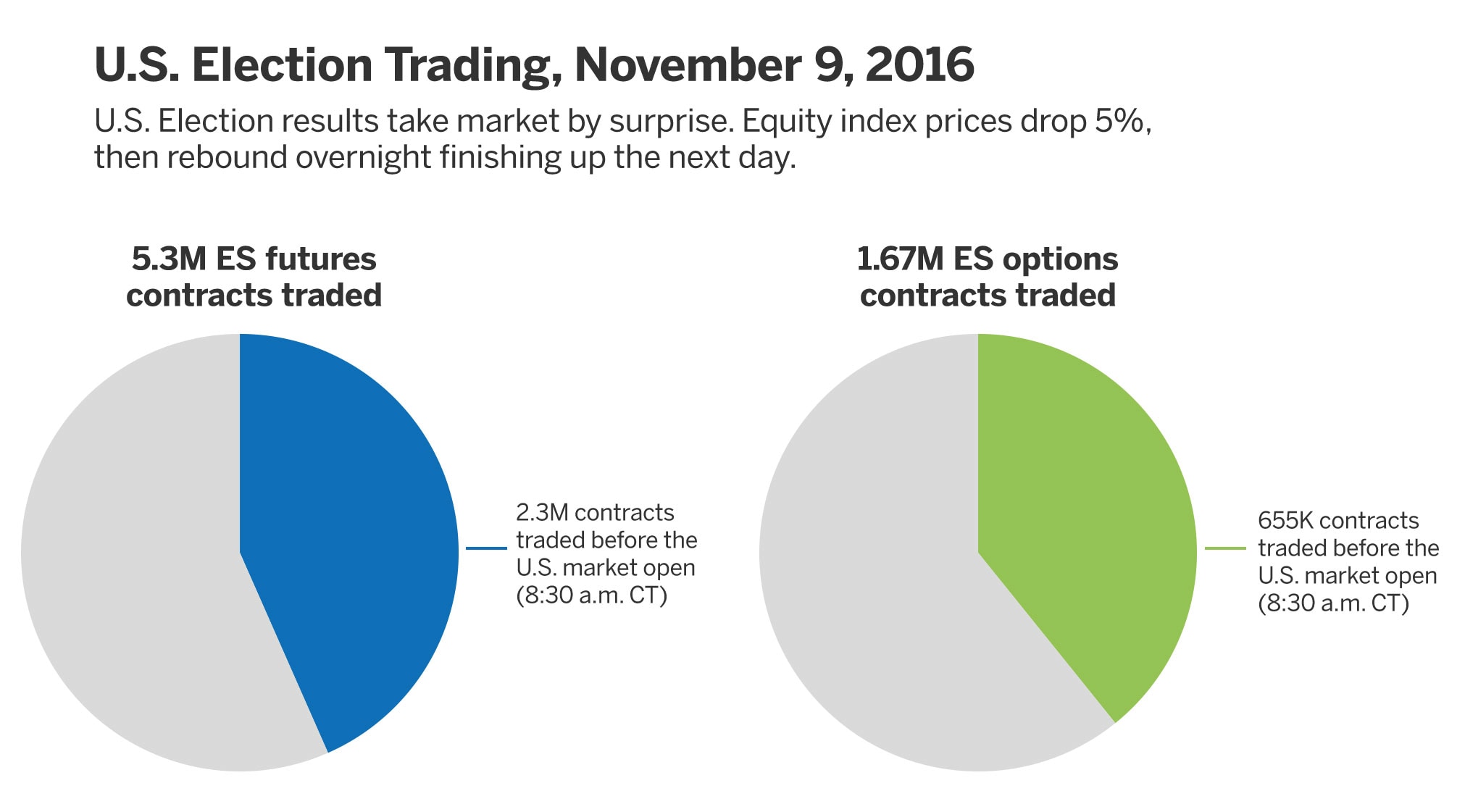

Enter ES futures options, derivatives that grant traders the right, but not the obligation, to buy or sell underlying S&P 500 futures contracts at a specified price on a particular date. These options provide a powerful tool for swing traders, allowing them to capitalize on market swings without the full capital commitment required for direct futures trading.

The realm of swing trading ES futures options presents a kaleidoscope of opportunities, where traders can employ a multitude of strategies to suit their risk tolerance and trading objectives. Whether it’s capturing profits from short-term market swings using delta-neutral spreads or leveraging directional biases with long or short option positions, the possibilities are boundless.

Unlocking the Secrets of Swing Trading ES Futures Options

Mastering the art of swing trading ES futures options requires a thorough comprehension of market dynamics, coupled with disciplined execution. Here are key considerations for success:

1. Understanding Market Trends

Identifying prevailing market trends is paramount. Technical analysis, a powerful tool for discerning market patterns, provides insights into price movements, helping traders identify potential swing trading opportunities.

Image: thetradinganalyst.com

2. Selecting Appropriate Timeframes

Swing trading thrives on the subtle shifts of market momentum. Selecting the right timeframe, such as daily or weekly charts, allows traders to gauge price movements at an optimal level.

3. Risk Management

Risk management is the cornerstone of successful swing trading. Establishing clear stop-loss levels and position sizing strategies protects against adverse market movements, ensuring long-term profitability.

4. Position Monitoring

Once a trade is initiated, diligent monitoring is essential. Continuously assessing market conditions and adjusting positions accordingly allows traders to maximize profits and minimize losses.

Expert Advice for Navigating the Market

Drawing upon years of experience, here are invaluable tips from seasoned swing traders:

1. Patience is Power

Swing trading requires patience and discipline. Resisting the temptation to overtrade and waiting for the right market conditions can lead to greater rewards.

2. Trade with the Trend

Align your trades with the prevailing market trend. Trading in the direction of the trend increases the likelihood of profitable outcomes.

3. Emotionless Execution

Emotions can cloud judgment. Develop a systematic trading plan and adhere to it, minimizing the impact of emotions on decision-making.

Frequently Asked Questions about Swing Trading ES Futures Options

Q: What is the minimum capital required to swing trade ES futures options?

A: While the minimum capital requirement varies depending on the broker, it is generally recommended to have a minimum of $5,000 to effectively capitalize on trading opportunities.

Q: What are the advantages of swing trading ES futures options?

A: Swing trading ES futures options offers several advantages, including leverage, the ability to profit in both rising and falling markets, and the potential for higher returns compared to traditional swing trading stocks.

Swing Trading Es Futures Options

Image: blog.spectrocoin.com

Conclusion

Swing trading ES futures options is a rewarding endeavor for those who approach it with a disciplined and well-informed strategy. By mastering the nuances of market behavior and implementing sound trading practices, traders can harness the power of futures options to generate consistent returns over the long haul.

Are you ready to embark on the exciting journey of swing trading ES futures options? Take the next step and explore the wealth of resources available to empower your trading endeavors.