Stock options, a powerful yet complex tool, have the potential to yield significant returns or substantial losses. To navigate the intricacies of this market, equipping yourself with a tailored trading plan is crucial.

Image: www.pinterest.com

Defining Your Trading Strategy

A comprehensive stock option trading plan outlines your objectives, strategies, and risk tolerance. It should define the types of options you will trade, such as calls or puts, and establish clear criteria for entry and exit points.

Three Principles for Stock Option Trading

- Position Sizing: Determine the appropriate number of contracts to trade, based on your portfolio size and risk tolerance.

- Risk Management: Set stop-loss and take-profit orders to limit potential losses and secure gains.

- Diversification: Spread your trades across different underlying assets and option types to reduce overall risk.

Trading Psychology and Discipline

Maintaining discipline is paramount in option trading. Emotional decision-making can lead to costly mistakes. Your trading plan should help you stay focused, control your impulses, and adhere to your strategies.

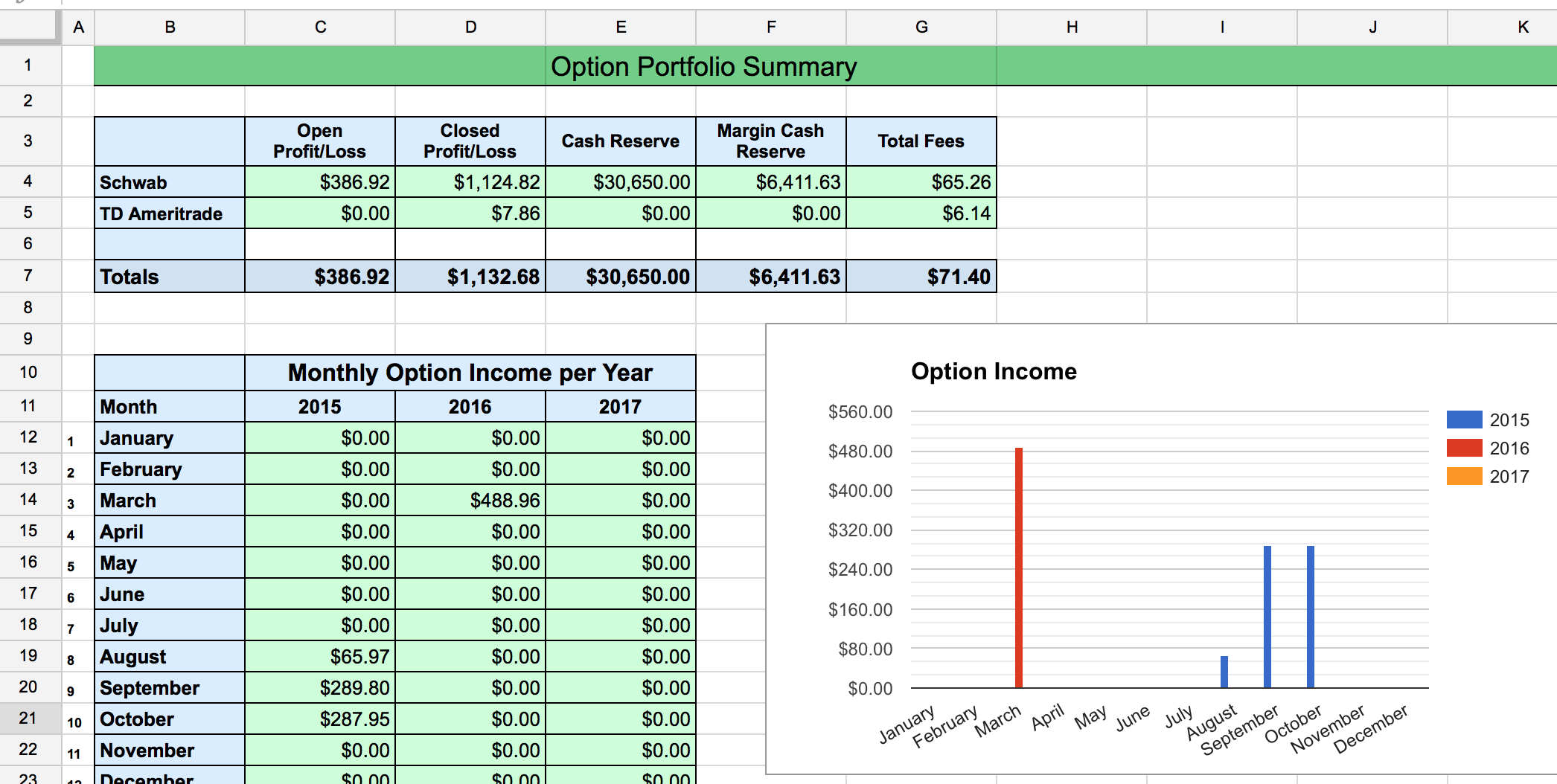

Image: www.twoinvesting.com

The Power of a Journal

Keep a detailed trading journal to track your trades, record your thought processes, and identify areas for improvement. This objective record will provide valuable insights and enhance your self-discipline.

Technical and Fundamental Analysis

Combining technical and fundamental analysis techniques is essential for stock option trading success. Technical analysis involves studying price charts to identify trends and potential trading opportunities.

Fundamental analysis examines company financials, news, and industry dynamics to assess the intrinsic value of an underlying asset. By integrating both perspectives, you can make informed trading decisions based on both price action and the underlying company’s performance.

Monitoring and Adjustment

Regularly review your trading plan and make adjustments as needed. Market conditions and your own understanding may evolve over time. Stay adaptable and be prepared to modify your strategy to align with new insights and market developments.

Don’t hesitate to consult with experienced traders or financial advisors for additional guidance and support. Continuous learning is key in this ever-changing market.

FAQs

Q: What is the difference between call and put options?

A: Calls give you the right to buy an underlying asset at a specified price, while puts give you the right to sell.

Q: How do I determine a target profit percentage?

A: Consider your risk tolerance, market conditions, and the specific option you are trading to set a realistic profit target.

Q: Can stock option trading make me rich quickly?

A: While stock options can yield high returns, it’s essential to approach trading with a long-term perspective and manage risks diligently.

Stock Option Trading Plan

Image: dorinbrynja.blogspot.com

Conclusion: Empowering Your Success

Developing and adhering to a tailored stock option trading plan is the cornerstone of consistent profitability. By defining your strategy, embracing discipline, and不断学习, you can navigate the complexities of this market with confidence and achieve your financial goals.

Are you ready to embark on the exciting journey of stock option trading? Start crafting your plan today and unlock the potential for long-term wealth creation.