Stock option trading holds immense allure for traders seeking to grow their capital. Options, intricate instruments derived from underlying stocks, offer a flexible avenue to profit from price fluctuations while mitigating risk. However, navigating the complexities of option trading requires a solid foundation in its underlying concepts, strategies, and techniques. This comprehensive journal will serve as your trusted companion, equipping you with the essential knowledge and practical guidance to excel in this dynamic market.

Image: chartyourtrade.com

Understanding Stock Option Trading: The Basics and Beyond

Stock options, distinct from stocks themselves, confer the right, but not the obligation, to buy (call option) or sell (put option) a specific number of shares of an underlying stock at a specified price (strike price) on or before a predetermined date (expiration date). The value of options stems from their ability to amplify the potential profits and limit the losses associated with stock price movements.

Delving deeper, Greeks emerge as crucial parameters that quantify the sensitivity of option prices to changes in various factors. Delta measures the change in option price for every $1 fluctuation in the underlying stock price. Theta represents the time decay effect, indicating the value loss options experience as they approach expiration. Vega gauges an option’s sensitivity to volatility, while Gamma assesses its sensitivity to Delta changes.

Strategies for Option Trading: Navigating Market Dynamics

Option trading encompasses a vast spectrum of strategies, each tailored to specific market conditions and trader preferences. Covered calls generate income by selling call options against a trader’s existing stock holdings. Cash-secured puts oblige traders to buy a stock at a set price if it falls below that price. Protective puts safeguard stock positions against price downturns, while naked puts entail selling put options without owning the underlying stock, potentially exposing traders to unlimited losses.

Bull call spreads combine the purchase of a lower-strike call option and the simultaneous sale of a higher-strike call option, benefiting from limited risk and potential profit in rising markets. Bear put spreads mirror this strategy in falling markets, with traders selling a lower-strike put option and buying a higher-strike put option. Butterfly spreads, consisting of multiple options with different strike prices and expiration dates, offer defined risk-reward profiles.

Technical Analysis for Option Trading: Unveiling Market Patterns

Technical analysis, the study of historical price movements, provides invaluable insights into potential market trends and stock behavior. Candlestick charts, showcasing price changes over specific time intervals, serve as a powerful visual tool. Moving averages smooth out price fluctuations, identifying broader market trends. Relative Strength Index (RSI) gauges the magnitude of price changes to determine overbought or oversold conditions.

Trendlines connect key points on a price chart, denoting support and resistance levels where prices tend to bounce off or face resistance. Fibonacci retracements, based on the Fibonacci sequence, identify potential support and resistance zones. Bollinger Bands, encompassing a moving average surrounded by standard deviations, indicate price volatility and potential breakout points.

Image: pokayadoma.ru

Risk Management and Trading Psychology: Cornerstones of Success

In the realm of option trading, risk management assumes paramount importance. Position sizing, determining the appropriate number of contracts to trade, is crucial for limiting potential losses. Stop-loss orders safeguard capital by closing trades at predefined levels if prices move against a trader’s position.

Trading psychology, often overlooked, plays a pivotal role in success. Discipline and patience are essential, as waiting for the right trading setups and adhering to predefined strategies is paramount. Managing emotions, such as fear or greed, prevents rash decisions that can lead to significant losses.

Education and Continuous Learning: The Path to Mastery

Continuous education is the lifeblood of successful option trading. Webinars, seminars, and online courses provide ample opportunities to deepen understanding and refine trading strategies. Books by renowned traders, such as “Options, Futures, and Derivatives” by John C. Hull, offer comprehensive frameworks and invaluable insights.

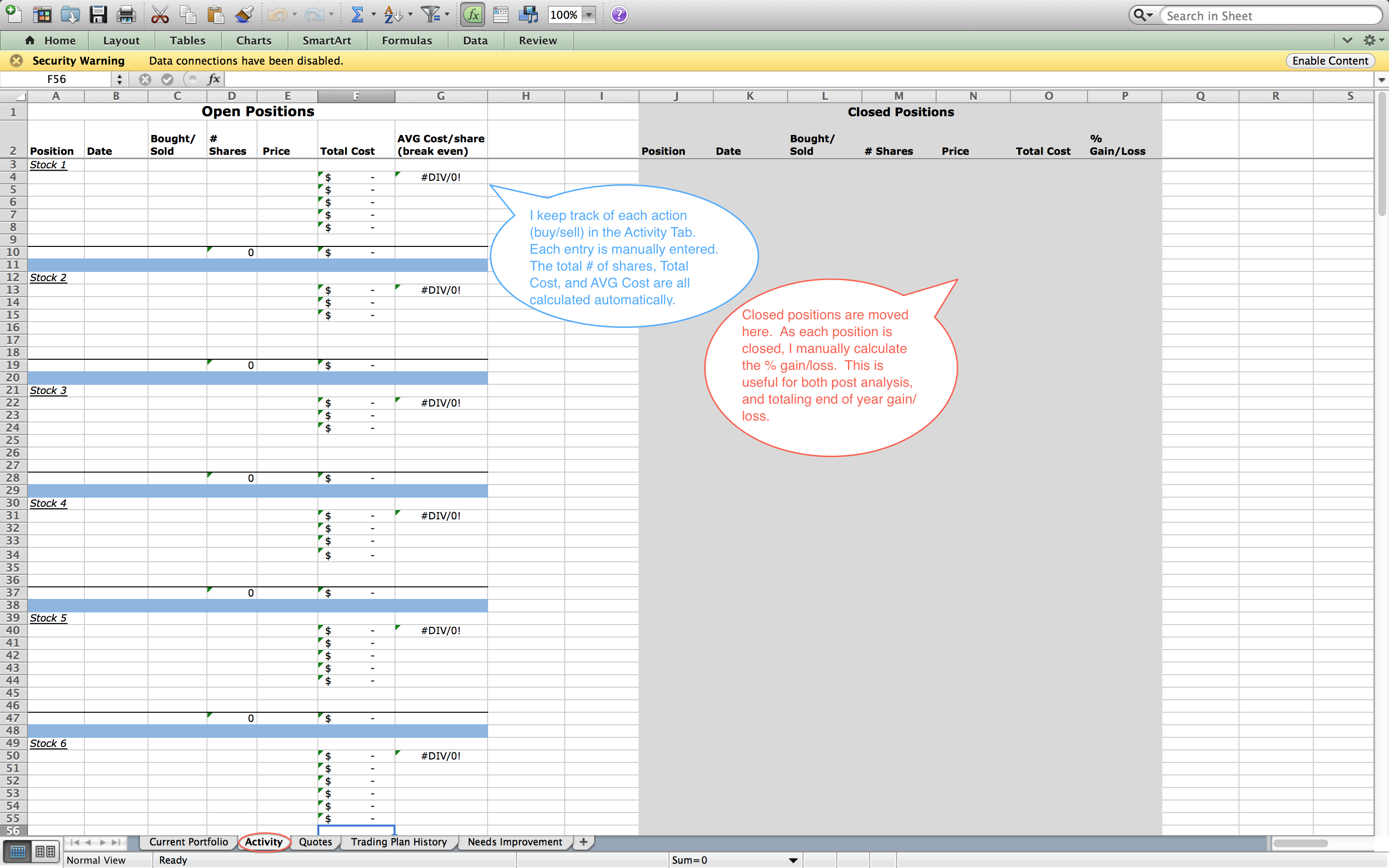

Dedicated trading journals serve as a perpetual record of trades, noting entry and exit points, rationale behind decisions, and lessons learned. Regularly reviewing trading journals helps identify patterns, strengths, and areas for improvement.

Stock Option Trading Journal

Image: alcoholjohn8.gitlab.io

Embracing the Exponential Growth Potential of Option Trading

Stock option trading presents an exceptional avenue for both novice and experienced traders to enhance their financial prospects. Thorough understanding of option trading fundamentals, an arsenal of effective strategies, and meticulous risk management are the cornerstones of success in this dynamic market.

Remember, option trading is not without its risks. However, by equipping yourself with the insights and guidance provided in this comprehensive journal, you embark on a path towards informed decision-making, prudent risk management, and potentially exponential growth in the exciting world of stock option trading.