Trading Hours for SLV Options

If you’re venturing into the realm of options trading, it’s imperative to be aware of market hours. The trading hours for SLV options (options based on the iShares Silver Trust ETF) are aligned with the U.S. stock market, which typically runs from 9:30 AM to 4:00 PM Eastern Time (ET) on weekdays. However, it’s crucial to note that pre-market and after-hours trading sessions may extend beyond these hours, allowing for additional trading opportunities.

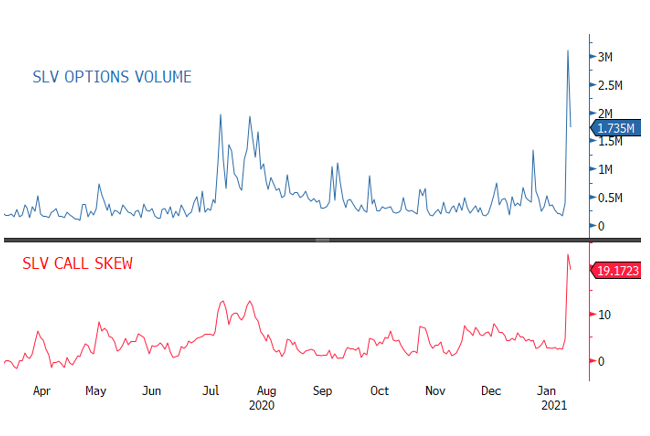

Image: www.investing.com

Extended Trading Sessions

During the pre-market session (starting around 4:00 AM ET), there’s limited trading activity, but it enables traders to place orders before the market opens and gauge market sentiment. Similarly, the after-hours session (beginning around 4:00 PM ET) provides traders with added flexibility, allowing them to execute trades beyond the regular market hours. It’s worth noting that liquidity may be lower during these extended sessions compared to regular trading hours.

Trading Process

To trade SLV options effectively, it’s essential to understand the underlying concept. Options are contracts that give buyers the right, but not the obligation, to buy (in the case of calls) or sell (for puts) a specific number of shares of the underlying asset (SLV) at a predetermined price on or before a set expiration date. As an options trader, you can choose whether to buy or sell options contracts based on your market outlook and risk tolerance.

Benefits of Trading SLV Options

SLV options trading offers several advantages for investors. Firstly, it provides leverage, allowing traders to control a considerable number of shares with a relatively smaller investment. Secondly, options offer flexibility in risk management as traders can customize their strategies based on their risk appetite. Additionally, options can be used for income generation or hedging purposes, adding versatility to investment portfolios.

Image: www.tradingview.com

Tips for Successful SLV Options Trading

Seasoned options traders recommend adhering to certain guidelines to optimize their success. First and foremost, it’s crucial to thoroughly understand the basics of options trading, including the Greek letters that measure risk and sensitivity. Diversification is another key strategy, where traders spread their investments across multiple options contracts or underlying assets to mitigate risk. Discipline and risk management are paramount, as options trading can involve substantial losses. Setting clear profit targets and stop-loss levels can help traders protect their capital.

Expert Advice

Experienced options traders emphasize the importance of patience and research. Avoid impulsive trades and take the time to analyze market trends, news events, and company fundamentals before making decisions. Constant learning and adaptation are essential in this dynamic market, as new strategies and techniques emerge frequently. By staying abreast of industry developments, traders can enhance their chances of successful SLV options trading.

FAQ on SLV Options Trading

Q: What are the trading fees associated with SLV options?

A: Trading fees vary across brokers and depend on the type of options contract traded and the order size.

Q: Can I sell SLV options without owning the underlying shares?

A: Yes, it’s possible to sell (or write) options without owning the underlying shares, but this strategy carries higher risk.

Q: Is it better to buy or sell SLV options?

A: The decision to buy or sell SLV options depends on your market outlook and risk tolerance. Buying options provides leverage and limited risk, while selling options generates income but involves potentially unlimited risk.

Slv Options Trading Hours

Image: sprott.com

Conclusion

SLV options trading presents opportunities for investors seeking leverage, risk management flexibility, and potential income generation. Understanding the intricacies of the topic, embracing expert advice, and adhering to sound trading practices can help traders navigate the SLV options market with greater confidence.

Would you like to delve deeper into the world of options trading? Sign up for our newsletter today and receive exclusive insights, expert analysis, and up-to-date market news, empowering you to make informed decisions in your investment journey.