The National Stock Exchange (NSE) of India has emerged as a pivotal hub for options trading, offering traders a unique and versatile financial instrument. NSE options have gained immense popularity in recent years due to their potential for high returns and tailored risk-management strategies. In this comprehensive guide, we will delve into the intricacies of NSE options trading, empowering you to navigate this dynamic market with confidence and unlock its lucrative potential.

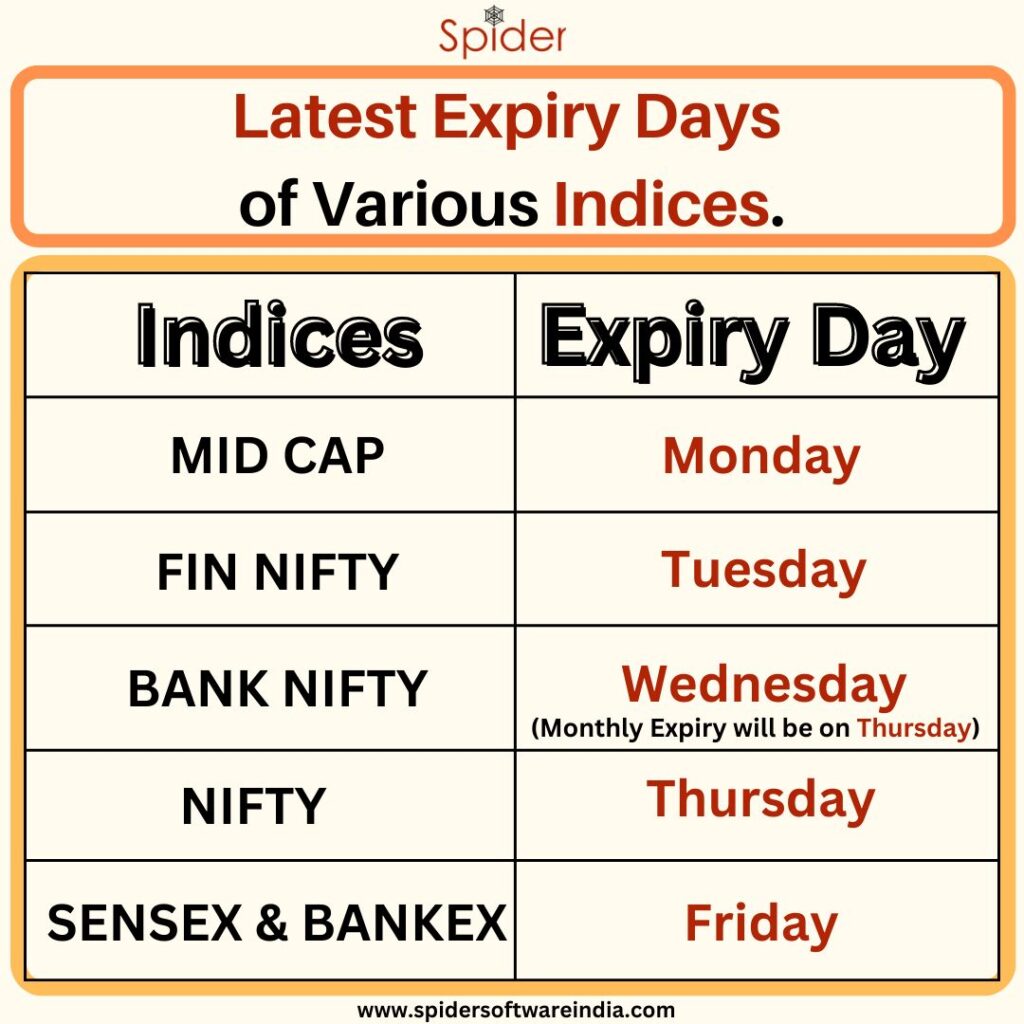

Image: www.spidersoftwareindia.com

Understanding the Basics of NSE Options Trading

Options contracts are derivative financial instruments that grant the buyer the right, not the obligation, to buy (in the case of call options) or sell (in the case of put options) a specified asset (in this case, an underlying stock) at a predetermined price (strike price) on or before a specific date (expiration date). The buyer of an options contract pays a non-refundable premium to the seller, who incurs the obligation to fulfill the contract if the buyer chooses to exercise it. Key characteristics of NSE options include:

- Flexibility: Options contracts provide traders with the flexibility to choose whether to trade, the underlying asset, the strike price, the expiration date, and the premium they are willing to pay or receive.

- Leverage: Options offer leverage, allowing traders to amplify their potential returns with a relatively small investment compared to buying or selling the underlying asset directly.

- Risk-Defined Strategies: Options trading enables traders to implement risk-defined strategies by setting specific limits on their potential losses and gains.

Types of NSE Options Trading Strategies

The versatility of NSE options empowers traders to adopt a diverse range of trading strategies, each with unique objectives and risk profiles. Some common strategies include:

- Bullish Strategies: These strategies are designed to profit from an anticipated increase in the underlying stock’s price. Popular bullish strategies include calls and call spreads.

- Bearish Strategies: These strategies aim to generate profit from a predicted decline in the underlying stock’s price. Common bearish strategies include puts and put spreads.

- Neutral Strategies: These strategies aim to profit from market volatility rather than from directional price movements. Neutral strategies include straddles and strangles.

- Covered Strategies: These strategies involve selling an option while simultaneously holding an offsetting position in the underlying asset. Covered strategies are popular for generating income or hedging existing positions.

Market Analysis and Trading Techniques

Successful NSE options trading hinges on in-depth market analysis and the application of sound trading techniques. Key factors to consider include:

- Historical Analysis: Analyzing historical price data can provide insights into the underlying stock’s volatility, trends, and seasonal patterns.

- Technical Analysis: Chart patterns, indicators, and other technical tools assist traders in identifying potential trade setups.

- Fundamental Analysis: Assessing the company’s financial health, industry trends, and macroeconomic factors can influence the underlying stock’s price.

Expert traders often combine multiple analysis methods to enhance their trading decisions and manage risk prudently.

Image: kovivygoqabut.web.fc2.com

Risk Management in NSE Options Trading

Options trading involves a degree of risk that must be carefully managed to protect capital and achieve long-term success. Effective risk management practices include:

- Position Sizing: Limiting the size of your positions relative to your capital ensures that you do not expose yourself to excessive risk.

- Diversification: Spreading your trades across multiple underlyings reduces the impact of any single trade’s outcome on your overall portfolio.

- Margin Management: Utilize margin responsibly to increase your buying power but be mindful of the potential risks associated with overleveraging.

By implementing sound risk management strategies, traders can mitigate their losses and protect their profits in the ever-changing market landscape.

Nse Options Trading

Image: www.samco.in

Conclusion

NSE options trading offers a compelling opportunity to harness the potential of India’s stock market. As you delve deeper into the realm of options trading, remember the importance of thorough research, a disciplined approach, and a comprehensive understanding of market dynamics. Embrace the power of NSE options as you embark on a journey of financial empowerment and unlock a world of lucrative trading possibilities.