Introduction

In today’s complex financial landscape, navigating the world of options trading can seem daunting. However, with the help of Khan Academy’s comprehensive resources, you can gain a solid foundation and unleash the power of options to enhance your investment strategy. Options trading provides both opportunities and risks, and understanding the intricacies is paramount. Khan Academy serves as a guiding light, meticulously unraveling the fundamentals of options trading, empowering you to make informed decisions that drive your financial success.

Image: www.npr.org

Understanding Options

An option, in the financial realm, represents a contract granting the holder the “option,” but not the obligation, to buy (in the case of a call option) or sell (in the case of a put option) an underlying asset (such as a stock or bond) at a predetermined price (the strike price) on a specific date (the expiration date). Call options confer the right to purchase the underlying asset, while put options provide the right to sell it. These contracts open the door to a myriad of strategies, catering to varying investment goals and risk appetites.

Features of Options Trading

Options trading comes with several key features that distinguish it from other investment vehicles. First, unlike owning the underlying asset itself, options provide investors with leverage. This increased buying power, however, carries the potential for greater returns and risks simultaneously. Second, options have a finite lifespan, marked by their expiration date. The value of an option depreciates over time, leading to the concept of time decay. Finally, options are often traded in standardized contracts, ensuring robust liquidity in the markets.

Benefits of Options Trading

Harnessing the power of options trading offers several potential benefits to astute investors:

- Enhanced Returns: Options can amplify returns compared to investing directly in underlying assets, albeit with the inherent increased risk.

- Hedging Risks: Options serve as powerful tools for risk management, allowing investors to protect their portfolios from adverse market movements.

- Income Generation: Selling options (known as writing options) can generate income, especially when volatility levels are high.

- Tailoring Strategies: The versatility of options enables investors to customize strategies based on their specific financial goals and risk tolerance.

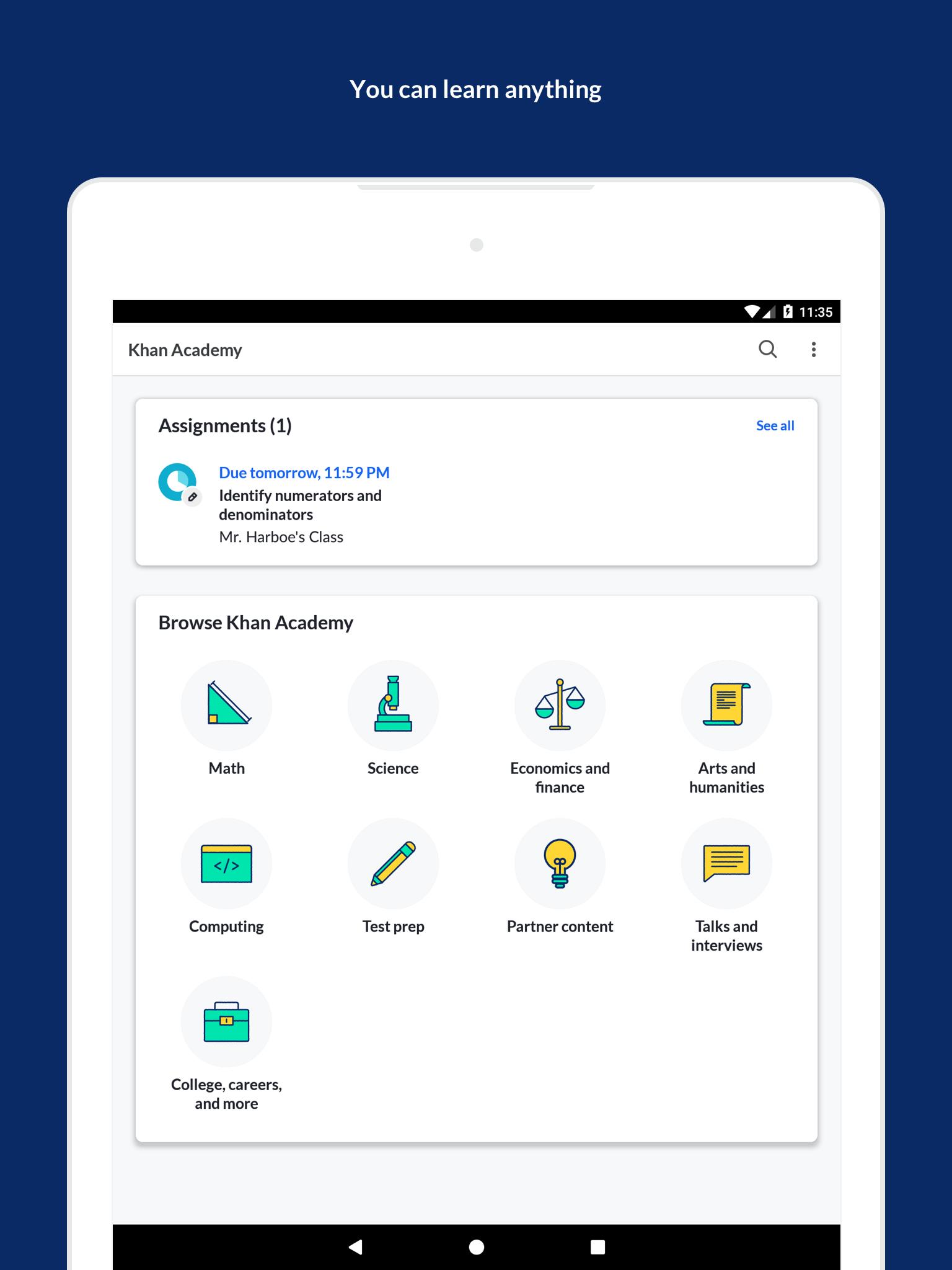

Image: apkpure.com

Types of Options Strategies

The world of options trading encompasses a vast spectrum of strategies, each catering to unique investment objectives and risk profiles. Some widely recognized strategies include:

- Call and Put Options: These straightforward strategies grant investors the right to buy or sell the underlying asset at the strike price on or before the expiration date.

- Covered Call: Here, an investor sells (or “writes”) a call option against an underlying asset they already own, earning a premium while retaining the possibility of maintaining ownership.

- Protective Put: This strategy involves buying a put option to safeguard an underlying asset against a potential price decline, providing a safety net for downside protection.

- Bull and Bear Spreads: These advanced strategies combine multiple options contracts, allowing investors to profit from specific market movements, such as gradual price changes or range-bound price fluctuations.

Understanding Volatility in Options Trading

When it comes to options trading, volatility plays a pivotal role. Volatility measures the magnitude of price fluctuations in the underlying asset. High volatility signifies tumultuous price movements, making options more attractive for both speculative and hedging purposes. Options premiums, which represent the price paid for these contracts, are directly influenced by volatility levels, with higher volatility leading to higher premiums.

Risks of Options Trading

While options trading offers a tantalizing array of opportunities, it’s crucial to be cognizant of the associated risks. Options carry the potential for significant losses, particularly in volatile markets. Inexperienced investors or those dabbling in options trading without a thorough understanding of the underlying concepts can fall prey to financial setbacks. Unrealistic expectations and a lack of risk management strategies can exacerbate these risks.

Getting Started with Options Trading

Embarking on your options trading journey requires a structured approach, encompassing the following steps:

- Education: Arm yourself with knowledge by exploring the plethora of educational resources and courses offered by reputable platforms like Khan Academy.

- Practice: Test your understanding and hone your trading skills by practicing with paper trading or simulated trading platforms. This invaluable experience allows you to gain hands-on exposure without risking real capital.

- Risk Management: Devise a comprehensive risk management plan that aligns with your financial goals and tolerance for risk. This includes setting stop-loss orders, limiting position sizes, and diversifying your portfolio.

- Choosing a Broker: Select a reputable brokerage firm that aligns with your trading needs and provides a robust platform for options trading. Factors to consider include trading fees, margin requirements, and access to research tools.

Khan Academy Options Trading

Additional Resources from Khan Academy

Khan Academy is a treasure trove of options trading knowledge, providing learners with a wealth of resources:

- Interactive Exercises: Engage in interactive exercises and quizzes, solidifying your grasp of key concepts through practical application.

- Videos: Learn from industry experts as they lucidly explain intricate concepts, catering to diverse learning styles and preferences.

- Community: Join an online community of fellow learners and experienced traders, fostering collaboration and knowledge sharing.

- Articles and Tutorials: Access a comprehensive library of articles and detailed tutorials that delve into specific aspects of options trading, empowering you with a deeper understanding.