Ever dreamed of becoming a Wall Street wizard, pulling off savvy investment moves like the legendary Warren Buffett? Option trading, with its potential for high rewards and even higher risks, might be calling your name. But before you dive headfirst into the unpredictable waters of the options market, a powerful tool awaits: the option trading simulator. It’s like a virtual trading playground where you can hone your skills and test your strategies, all without risking a single real dollar.

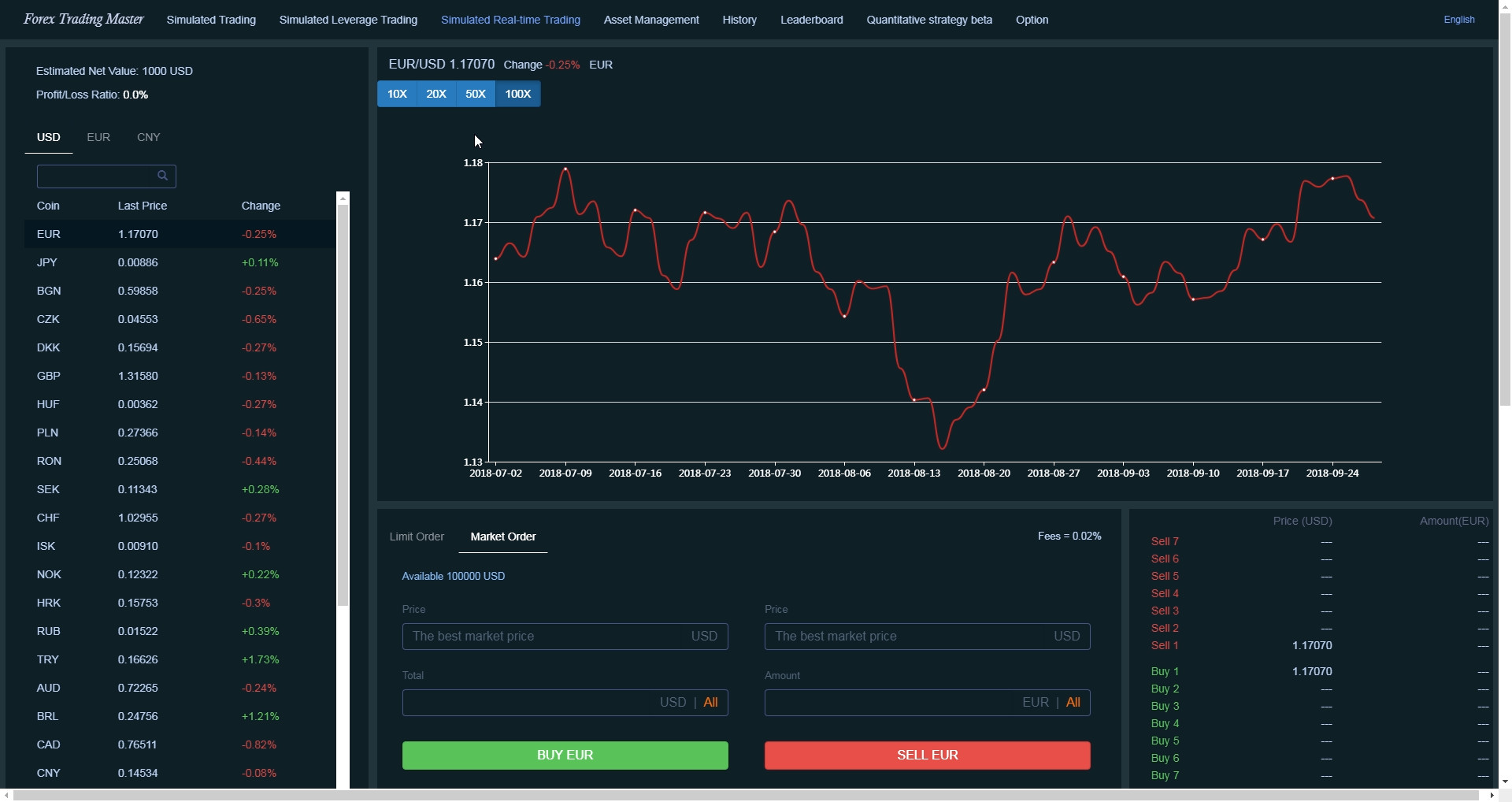

Image: store.steampowered.com

This article will be your guide to understanding option trading simulators, how they work, their benefits, and how to choose the best one for you. We’ll delve into the world of virtual options trading, exploring its intricacies, and empowering you to step into the exciting world of options with confidence.

What is an Option Trading Simulator?

An option trading simulator is a software program that replicates the real-world environment of trading options. It provides a virtual platform where you can buy, sell, and manage options contracts, just as you would in the real market. However, instead of using actual money, you trade with virtual funds, allowing you to experiment freely without financial repercussions.

Why Use An Option Trading Simulator?

A good option trading simulator is like a training ground for aspiring options traders. Here’s why it’s an invaluable tool for both beginners and seasoned traders:

- Risk-Free Learning: The most significant advantage of a simulator is the absence of financial risk. You can experiment with different strategies, manage trades, and even make mistakes without losing real money.

- Developing Trading Skills: A simulator allows you to practice various aspects of options trading, from understanding option pricing and Greeks to managing risk and developing profitable strategies. You’ll gain practical experience in analyzing market data, placing orders, managing positions, and understanding the impact of market volatility on your trades.

- Testing Trading Strategies: Backtesting your strategies is crucial to identify potential weaknesses and optimize your approach. Simulators provide historical market data allowing you to test your strategies on past market conditions, uncovering their effectiveness and limitations.

- Gaining Confidence: The confidence that comes from successfully navigating a simulated trading environment can be invaluable. You’ll become more comfortable with the intricacies of options trading and build the confidence needed to transition into real-world trading.

Types of Option Trading Simulators

There are several types of option trading simulators catering to different needs and experience levels:

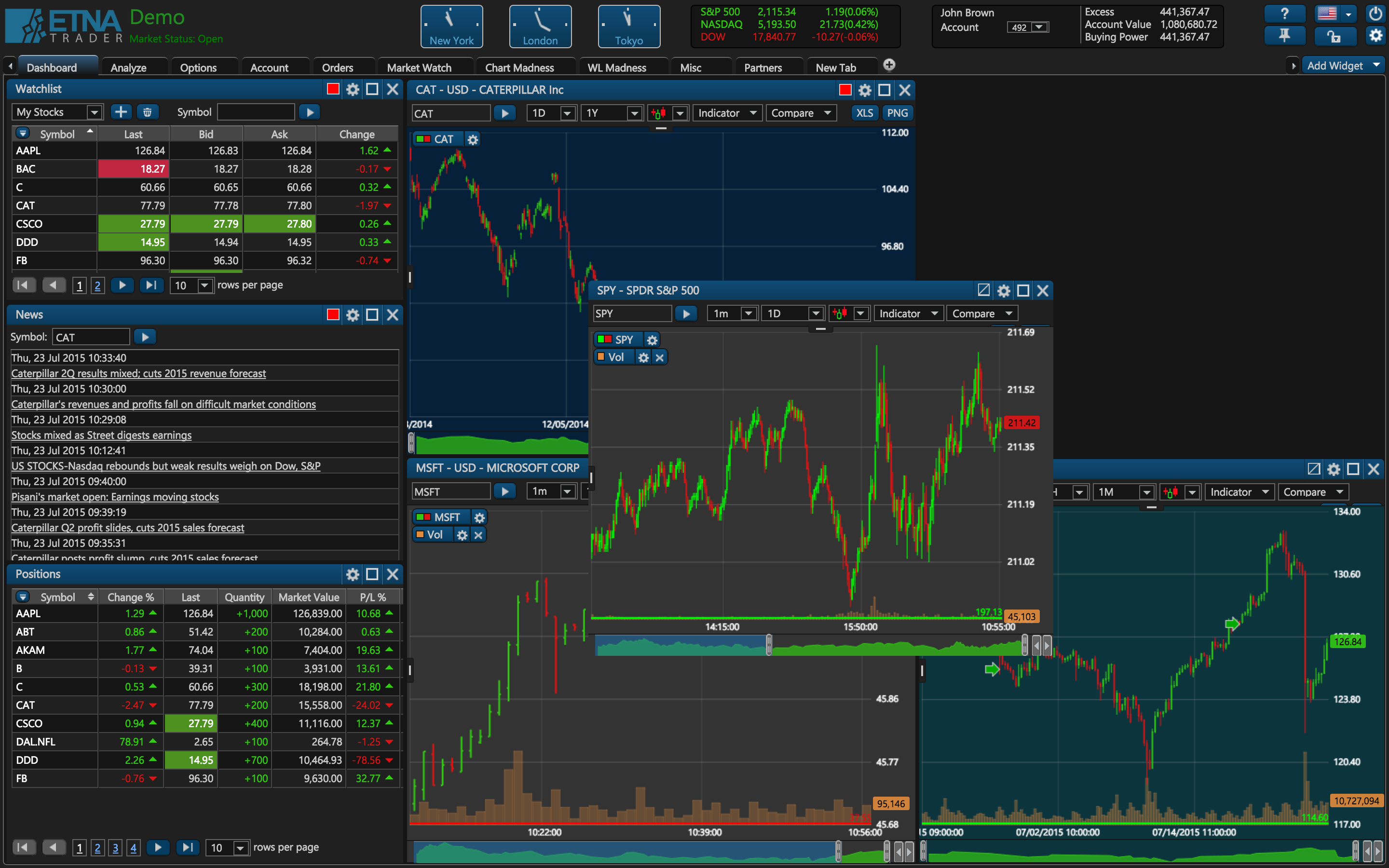

Image: www.etnasoft.com

1. Free Simulators:

These are readily available online and offer a basic platform to learn the fundamentals of option trading. You can practice placing orders, managing positions, and understand basic concepts. However, they often lack advanced features like historical market data or sophisticated charting tools.

2. Paid Simulators:

These offer a more robust trading environment with features such as real-time market data, advanced charting tools, and historical data to facilitate backtesting. They might also provide educational resources and personalized support.

3. Brokerage Platform Simulators:

Some online brokers offer built-in paper trading platforms that mimic the features of their live trading platforms. These are useful for getting familiar with the specific platform you’ll be using for actual trading.

Choosing the Right Simulator for You

When selecting a simulator, consider the following factors to ensure you choose the best fit for your needs:

- Ease of Use: The simulator should be intuitive and user-friendly, especially if you’re new to options trading.

- Features: Look for features like real-time market data, charting tools, advanced analytics, backtesting capabilities, and historical data to aid learning and strategy development.

- Support: Ensure the simulator offers reliable customer support and resources for help with technical issues and educational guidance.

- Compatibility: Choose a simulator compatible with your preferred trading platform and devices.

How to Get Started with an Option Trading Simulator

Here are some steps to help you get started with your simulator journey:

- Choose A Simulator: Research and select a simulator that aligns with your experience level, budget, and desired features.

- Familiarize Yourself with the Interface: Spend time navigating the simulator’s interface to understand its functionalities and become comfortable with the platform.

- Start with Basic Concepts: Begin with learning basic options concepts like calls, puts, premiums, strikes, and expirations.

- Practice Simple Trades: Start with straightforward option trading strategies, gradually increasing complexity as you gain confidence.

- Analyze Your Trades: Thoroughly review your simulated trades, understanding your profitability or losses and analyzing your decision-making process.

- Backtest Strategies: Use the historical data feature to test your strategies on past market conditions, gauging their effectiveness and identifying areas for improvement.

- Adjust Your Strategies: Based on your simulated trading results, continuously evaluate and refine your strategies to optimize them for future performance.

The Importance of Risk Management

Remember, even in a simulated environment, risk management is crucial. As you practice, develop a solid risk management strategy, such as setting stop-loss orders to limit potential losses, and avoid over-leveraging your capital.

Real-World Applications of Option Trading Simulators

Option trading simulators are not just for aspiring traders. They hold significant value for experienced traders as well:

- Evaluating New Strategies: Simulators allow traders to test new trading strategies without risking significant capital.

- Stress Testing Portfolios: Traders can evaluate the impact of different market scenarios on their portfolios, allowing them to make informed adjustments.

- Improving Decision-Making: By providing a safe space to experiment and learn, simulators can enhance a trader’s decision-making processes, leading to more informed and confident trading decisions.

The Future of Option Trading Simulators

The future of option trading simulators is promising. With advancements in artificial intelligence and machine learning, we can expect simulators with even more realistic market data, sophisticated analytics, and personalized learning experiences.

Option Trading Simulator

Conclusion

Option trading simulators are powerful tools for traders of all levels. They provide a safe and effective way to acquire skills, experiment with strategies, and ultimately, become a more confident and successful trader. Whether you’re a beginner or a seasoned professional, an option trading simulator can be your best friend in conquering the exciting world of options trading.