Introduction

In the realm of options trading, Precision Conversion Rate Agreements (PCRAs) present unique opportunities for investors seeking precision in their portfolio hedging and speculation strategies. Joining forces with an established brokerage firm like Schwab opens up a world of options trading possibilities, paving the way for savvy traders to harness the power of PCRAs. This comprehensive guide delves into the intricate world of Schwab PCRA options trading, empowering you to navigate the complexities and unlock the potential returns waiting to be discovered.

Image: psdscanner.blogspot.com

Understanding PCRAs

PCRAs, a variant of convertible bonds, add a layer of flexibility to options trading by offering built-in conversion features. Essentially, PCRAs grant investors the option to convert their bonds into a fixed number of underlying shares at a pre-determined strike price. This conversion privilege introduces a hybrid element, allowing investors to potentially benefit from both fixed income and equity returns.

Why Trade PCRAs with Schwab

Opting for Schwab as your PCRA options trading partner comes with a multitude of advantages. Schwab’s renowned reputation and extensive trading platform offer investors peace of mind and a robust ecosystem to execute their strategies seamlessly. With Schwab’s expert guidance and comprehensive resources, the intricacies of PCRA options trading become more manageable, empowering investors to make informed decisions.

PCRA Trading Strategies

The versatility of PCRAs opens up an array of trading strategies tailored to different investment goals and risk appetites. Investors can leverage PCRAs for hedging, speculation, or income generation. Hedging strategies employ PCRAs to offset potential losses in underlying assets, while speculative strategies aim to capture potential price appreciation. Income-oriented strategies focus on harnessing the fixed income component of PCRAs, providing a steady stream of revenue.

Image: ramtrf.com

Real-World Applications

Let’s delve into practical scenarios where PCRA options trading can excel. Imagine a scenario where an investor anticipates a surge in a particular stock’s price. By purchasing a PCRA on that stock, they gain the option to convert their bond into shares at a favorable price, potentially reaping significant rewards if the stock’s price rises. Conversely, investors concerned about potential market downturns can use PCRAs to hedge their positions, mitigating potential losses in their underlying stock holdings.

Market Trends and Developments

Keeping abreast of the latest trends and developments in the PCRA options market is crucial for successful trading. The continuous evolution of market dynamics necessitates adaptability and informed decision-making. By staying attuned to changes in interest rates, economic indicators, and industry-specific factors, traders can enhance their strategies and exploit emerging opportunities.

Expert Insights from Industry Analysts

“PCRAs have emerged as a powerful tool for options traders due to their unique risk-return profile,” says industry analyst Mark Jones. “Schwab’s sophisticated platform and expertise in PCRA options trading provide investors with a competitive edge.”

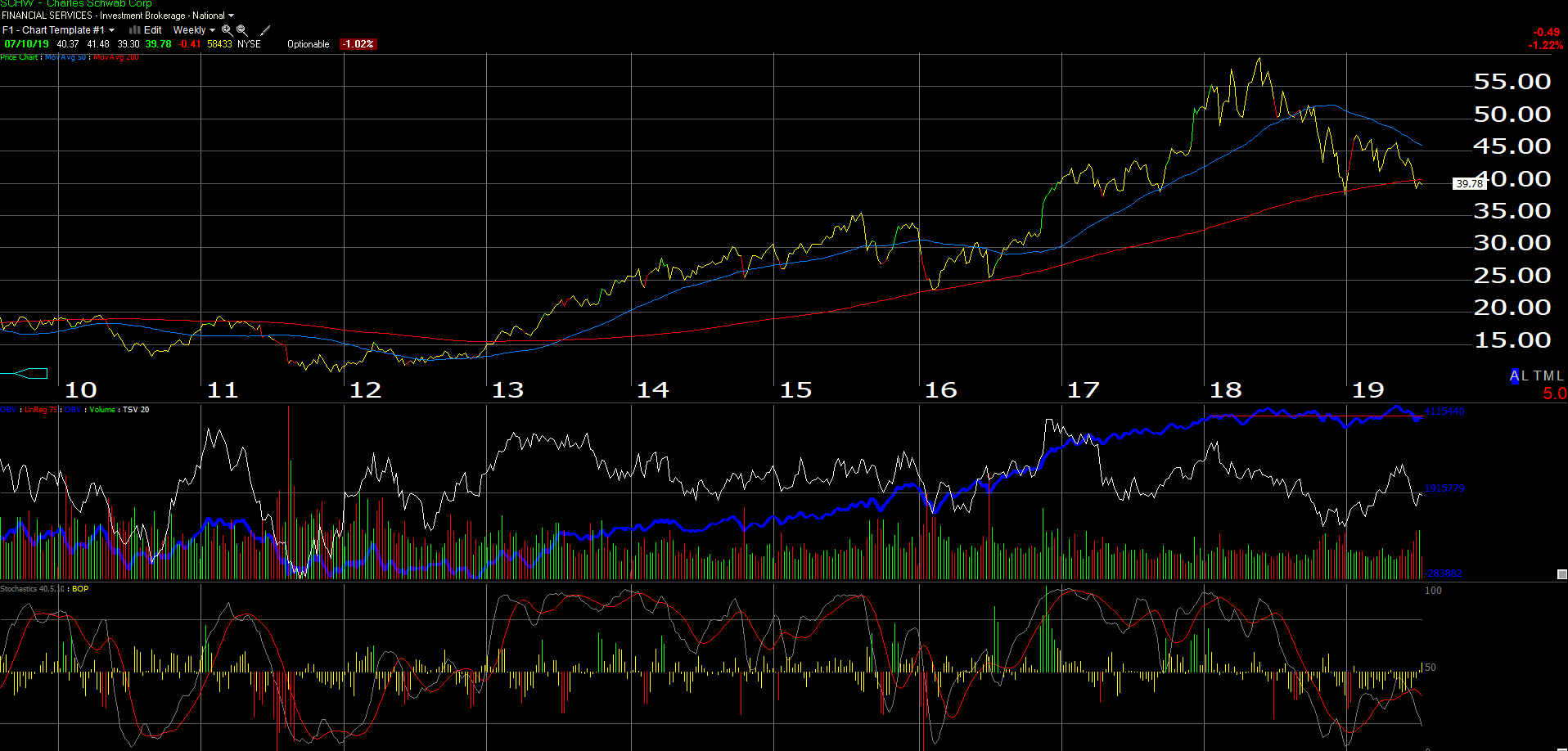

Schwab Pcra Options Trading

Image: seekingalpha.com

Conclusion

Mastering the art of schwab pcra options trading empowers investors with a versatile tool for hedging, speculation, and income generation. Seizing this opportunity to trade PCRAs with schwab unlocks a realm of possibilities, allowing investors to navigate market fluctuations with greater precision. By understanding the intricacies of PCRAs and implementing sound trading strategies, investors can potentially unlock substantial rewards. Through continuous learning, diligent research, and leveraging the expertise of trusted brokers like Schwab, individuals can chart their path to success in the dynamic arena of PCRA options trading.