Options trading can be a powerful tool for savvy investors and traders looking to enhance their financial strategies. With the right knowledge and tools, navigating the intricacies of options trading can unlock a world of opportunities. In this comprehensive guide, we delve into the dynamic realm of options trading, empowering you with the insights and guidance you need to master this sophisticated investment technique.

Image: treewallpaperkeren.blogspot.com

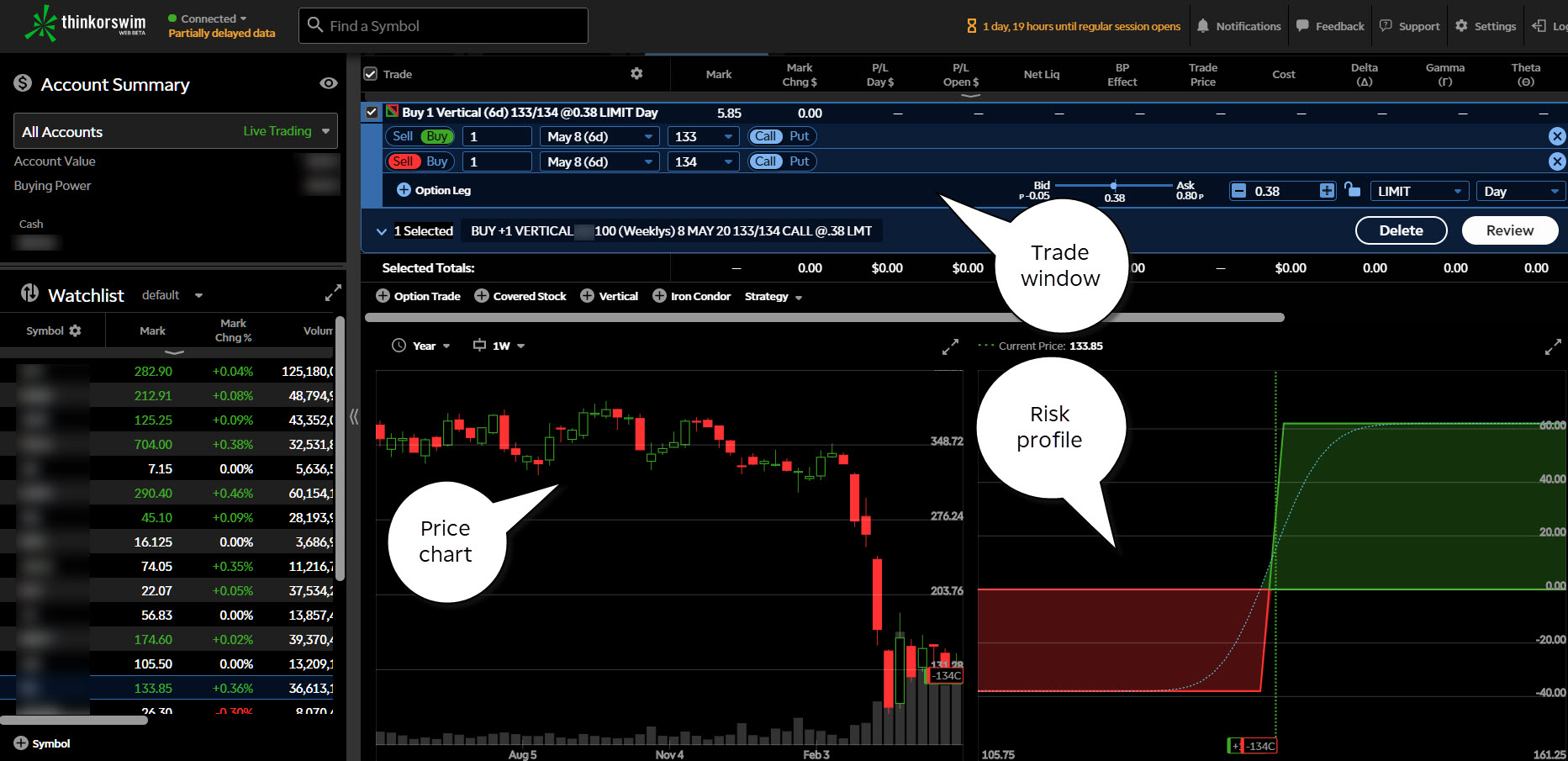

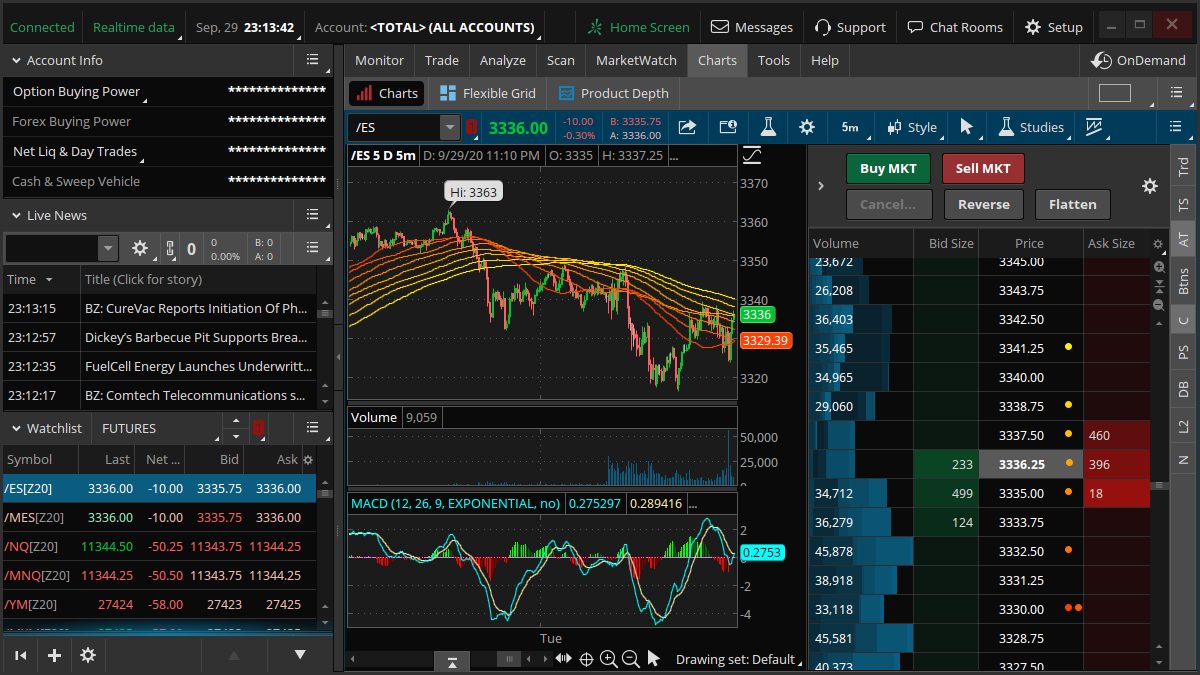

thinkorswim, a cutting-edge trading platform, emerges as a beacon of innovation in empowering options traders. Its user-friendly interface and robust analytical capabilities streamline the options trading process, enabling informed decision-making and maximizing profit potential.

Understanding the Foundation: Decoding Options Trading

An option is an agreement that grants the buyer the right, but not the obligation, to purchase or sell an underlying asset at a pre-determined price on or before a specified date. At the core of options trading lies the ability to speculate on the future direction of an underlying asset’s price.

In the stock market, for instance, an investor might purchase a call option if they anticipate a rise in share prices. Conversely, a put option affords the trader the right to sell shares at a set price if a downward price trend is foreseen.

Embracing thinkorswim: A Gateway to Options Trading Mastery

thinkorswim revolutionizes the options trading experience, providing traders with a powerful arsenal of features to optimize their strategies. Its advanced charting capabilities empower users to analyze historical price data, identify trends, and forecast future price movements.

The platform’s intuitive tools for options chain analysis enable traders to examine available options contracts, their pricing, and potential profitability. With real-time data and customized alerts, thinkorswim equips traders with the timely insights they need to make informed decisions in fast-paced markets.

Unveiling the Options Trading Strategies: Crafting Your Path to Success

Options trading strategies encompass a diverse range of approaches, each tailored to specific market conditions and investor objectives. Some of the most popular strategies include:

-

Bull Call Spread: This strategy combines the purchase of a lower-priced call option and the sale of a higher-priced call option with the same expiration date. The potential profit lies in the difference between the two option premiums, creating a bullish outlook on the underlying asset.

-

Bear Put Spread: For traders anticipating a decline in an asset’s price, the Bear Put Spread involves buying a lower-priced put option and selling a higher-priced put option with the same expiration date. The profit zone is defined by the spread between the option premiums, mirroring a bearish market sentiment.

-

Covered Call: This strategy entails owning an underlying asset while simultaneously selling a call option against it. The covered call strategy suits investors seeking to generate income from their holdings while limiting potential downside risk.

Image: www.kingdavidsuite.com

Expert Insights and Actionable Tips: Elevating Your Trading Prowess

“Effective options trading demands a blend of knowledge, discipline, and risk management,” counsels renowned trader Mark Douglas. “By mastering these principles, traders can navigate market complexities and enhance their chances of success.”

Seasoned investor Warren Buffett emphasizes the importance of understanding the underlying asset before venturing into options trading. “If you don’t understand the underlying business of the company, you shouldn’t be trading options on it,” he advises.

To maximize your options trading potential, consider these actionable tips:

-

Educate Yourself: Immerse yourself in the intricacies of options trading through books, online courses, and mentorship programs. Knowledge is the foundation upon which successful trading strategies are built.

-

Practice with Paper Trading: Before risking real capital, hone your skills through paper trading. This simulated trading environment replicates real-world market conditions, allowing you to experiment with strategies without financial repercussions.

-

Manage Risk: Options trading inherently carries risk. Implement sound risk management techniques, such as setting stop-loss orders and position sizing appropriately to mitigate potential losses.

-

Monitor the Market: Stay abreast of economic news and market movements that can influence underlying asset prices. Continuous monitoring empowers you to make informed decisions and adjust your strategies as needed.

Options Trading In Thinkorswim

Image: en.opensuse.org

Conclusion: Embracing the Empowerment of Options Trading

Options trading, coupled with the cutting-edge capabilities of thinkorswim, presents a potent opportunity for financial empowerment. By understanding the foundational concepts, embracing the strategies, and incorporating expert insights, you can unlock the potential of this sophisticated investment technique.

Options trading, however, demands a measured approach. Approach it with a commitment to continuous learning, prudent risk management, and a disciplined trading mindset. By embracing these principles, you can harness the power of options trading to enhance your financial journey and achieve your investment aspirations.