Introduction:

In the fast-paced world of financial markets, options trading plays a crucial role in managing risk and speculating on future stock price movements. When companies announce their quarterly earnings, it provides a significant catalyst for options trading activity and can have a profound impact on stock prices. Understanding the relationship between options trading volume and the subsequent stock price response can significantly enhance an investor’s decision-making in the ever-evolving options market.

Image: www.chegg.com

This article delves into the intricacies of options trading and unravels the dynamics that connect options trading volume to stock price response. We will examine how historical data, implied volatility, and market sentiment influence options trading patterns and stock price reactions around earnings announcements.

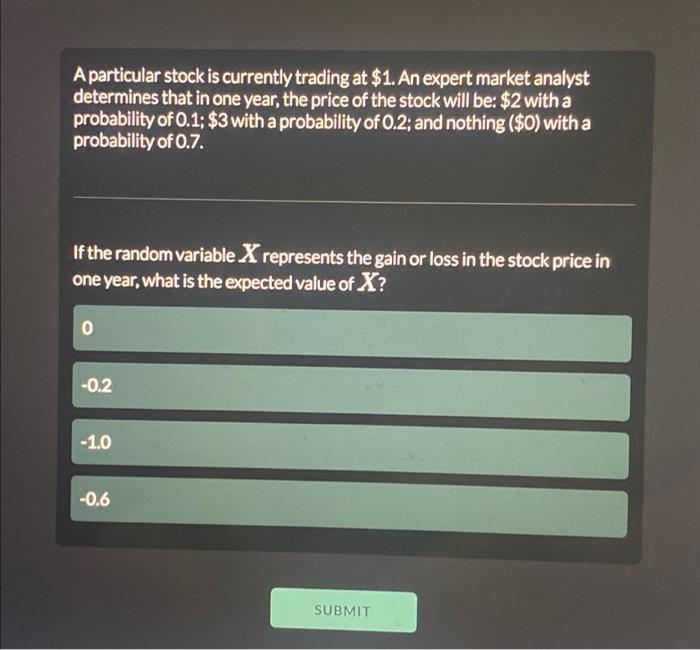

Options Trading Volume: A Manifestation of Market Expectations

Options trading volume serves as a gauge of market expectations and investor sentiment towards a particular stock. When a company is set to report earnings, a surge in options trading volume indicates elevated levels of anticipation and potential for price volatility. A high volume of call options, which give the buyer the right but not the obligation to buy the underlying stock at a specific price (the strike price), reflects bullish sentiment and expectations of a price increase. Conversely, elevated put option volume, which grants the buyer the right but not the obligation to sell the underlying stock at the strike price, suggests bearish sentiment and anticipations of a price decline.

Historical Trends and Implied Volatility: Setting the Stage

Historical data on options trading activity and stock price responses to earnings announcements provides valuable insights into potential trading strategies. By analyzing past patterns, traders can identify companies that have consistently exhibited a significant increase in options trading volume and subsequent stock price fluctuations. Additionally, implied volatility, which measures the market’s expectations of future price volatility, is a key factor to consider. Higher implied volatility indicates that the market anticipates greater uncertainty and potential price swings around the earnings announcement. Options traders often use implied volatility to gauge the potential risks and rewards of their trading strategies.

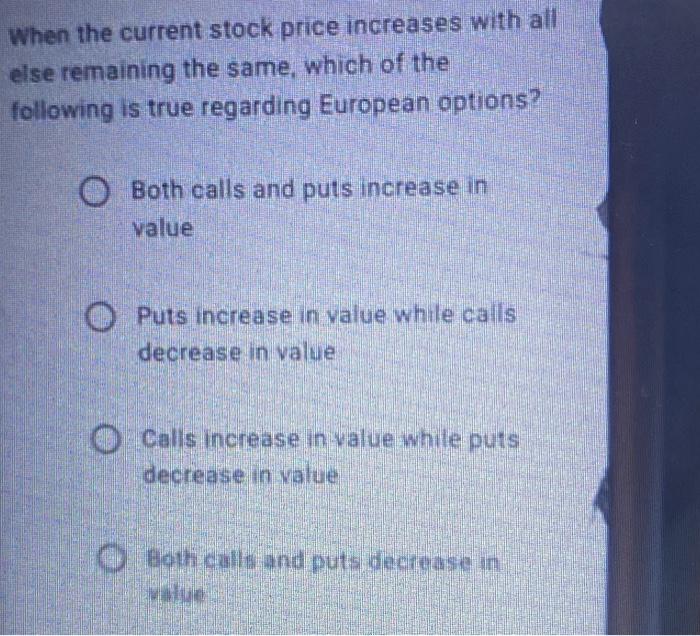

Earnings Surprises and the Market’s Reaction: A Tale of Two Outcomes

Earnings announcements provide a moment of truth, revealing a company’s financial performance and its impact on its stock price. When a company beats or misses analysts’ earnings expectations, the market responds accordingly. Suppose a company reports stronger-than-anticipated earnings. In that case, call option volume may gain further momentum, driving the stock price higher, as investors seek to capitalize on the positive news. Conversely, a disappointing earnings report may trigger a surge in put option volume and a sell-off in the stock, as investors react to the unfavorable news.

Image: www.chegg.com

Market Sentiment and Momentum: The Power of Psychology

Market sentiment and momentum play a significant role in amplifying or mitigating the impact of earnings announcements on stock prices. When the overall market is bullish, positive earnings surprises tend to be met with even more enthusiasm, leading to a more pronounced stock price increase. Similarly, during bearish market conditions, negative earnings news can have a more severe impact, exacerbating the stock price decline. Momentum, the tendency for a stock’s price to continue moving in the same direction, can also influence the reaction to earnings announcements. A stock that has been trending up is more likely to continue rising on positive earnings news, while a downtrending stock may face greater resistance to a price rebound.

Implications for Options Traders: Strategic Positioning and Risk Management

The relationship between options trading volume and stock price response to earnings announcements has important implications for options traders. Understanding these dynamics can assist in formulating well-informed trading strategies. For example, traders may seek to buy call options on stocks with historically high options trading volume and positive earnings surprises. Alternatively, they may employ put options when a company is anticipated to miss earnings expectations. Additionally, options traders must carefully manage their risk, considering the potential for large price fluctuations around earnings announcements. Employing proper risk management strategies, such as setting stop-loss orders and position sizing, is crucial to mitigating potential losses.

Adapting to the Ever-Changing Market: The Key to Successful Options Trading

The options market is constantly evolving, influenced by macroeconomic factors, industry trends, and corporate developments. Successful options traders must adapt to this dynamic environment by continuously monitoring market news, economic data, and company-specific announcements. Staying informed about the latest market events will provide traders with the context to make informed decisions and adjust their strategies as needed. Additionally, ongoing education and analysis of options trading techniques and market behavior are essential for ongoing success in this challenging but rewarding domain.

Options Trading Volume And Stock Price Response To Earnings Announcements

Image: www.chegg.com

Conclusion:

Understanding the relationship between options trading volume and stock price response to earnings announcements is critical for options traders seeking to navigate the complex world of financial markets. By analyzing historical trends, implied volatility, market sentiment, and company-specific factors, traders can develop well-informed strategies and position themselves for potential gains. Additionally, prudent risk management, ongoing education, and adaptability are essential traits for success in options trading. As the market landscape continues to evolve, those who embrace these principles will be well-equipped to harness the power of options trading and achieve their financial goals.