Begin Your Journey into the World of Options Trading with Vanguard

The realm of investing, an ever-evolving landscape of financial opportunities, has recently witnessed the burgeoning popularity of options trading. As a newcomer to this intriguing domain, embarking on this journey can be both exhilarating and daunting. However, with the guidance of a reputable brokerage such as Vanguard, the complexities of options trading can be demystified, allowing you to unlock the potential for enhanced returns and strategic portfolio management.

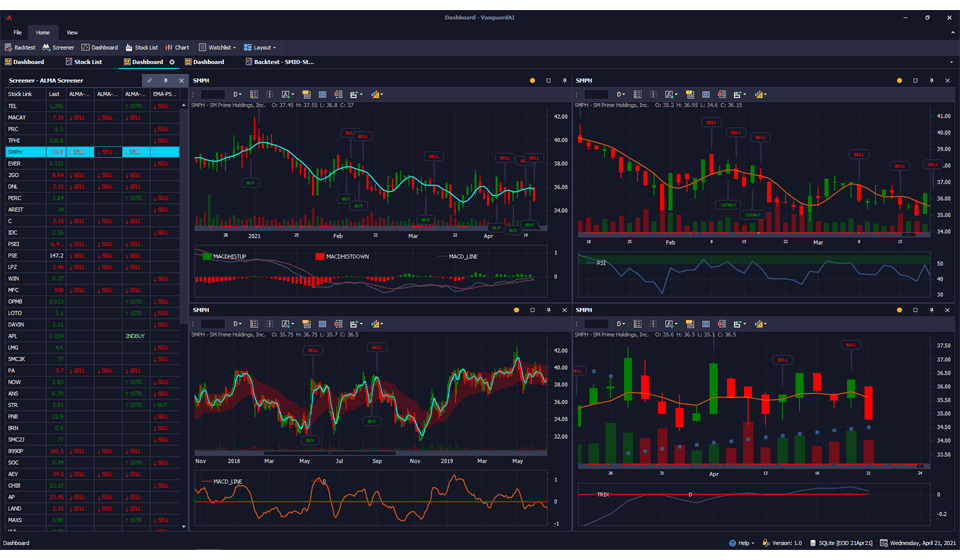

Image: www.devexpress.com

Vanguard: A Bastion of Trust and Innovation in the Trading Arena

Vanguard stands as a beacon of stability and expertise in the financial services industry. With decades of experience in empowering investors, Vanguard has consistently garnered accolades for its commitment to low fees, transparent practices, and unwavering customer support. By placing your trust in Vanguard for your options trading endeavors, you align yourself with a partner who prioritizes your long-term financial well-being.

Unveiling the Enigma of Options Trading

Options trading, while alluringly complex, essentially revolves around acquiring contracts that confer upon you the right, but not the obligation, to buy or sell a specific underlying asset at a predetermined price on or before a stipulated expiration date. These contracts, aptly named options, empower you to speculate on the future price movements of assets, potentially leading to substantial gains or losses.

Embarking on the Options Trading Odyssey

To embark upon the options trading journey, you must first establish an account with Vanguard. Once your account is active, you can delve into the vast array of options available, each tailored to specific underlying assets, strike prices, and expiration dates. As you navigate this dynamic landscape, it is crucial to develop a comprehensive understanding of the risks and rewards associated with options trading.

Image: www.ultraalgo.com

Navigating the Nuances of Options Pricing

The pricing of options is a captivating interplay of intricate factors, including the underlying asset’s price, the strike price, time to expiration, volatility, and interest rates. Comprehending the dynamics underlying option pricing will provide you with a solid foundation for making informed trading decisions.

A Spectrum of Options Trading Strategies

The realm of options trading offers a vast expanse of strategies, empowering you to tailor your approach to your aspirations and risk tolerance. Whether employing bullish or bearish strategies, you can harness the versatility of options to navigate the ever-shifting market tides.

Vanguard’s Comprehensive Support System

As you traverse the terrain of options trading, Vanguard stands as your trusted ally, providing an array of educational resources, analytical tools, and expert support tailored to elevate your trading acumen. By utilizing these invaluable resources, you can refine your trading strategies and confidently navigate the complexities of the market.

Expert Insights and Proven Tips for Options Trading Success

To enhance your options trading prowess, consider incorporating the following tips into your repertoire:

-

Establish a Strong Options Trading Foundation: Ground your trading endeavors in a comprehensive understanding of options concepts, mechanics, and risk management.

-

Embrace Discipline and Risk Management: Adhere to predefined trading parameters, diligently monitoring your portfolio and adhering to strict risk management principles.

-

Diversify Your Portfolio: Spread your wings across a range of underlying assets, options types, and expiration dates to mitigate risks and enhance your chances of consistent returns.

-

Seek Education and Guidance: Continuously expand your knowledge through ongoing education and consult with experienced traders or financial advisors to hone your trading prowess.

Frequently Asked Questions: Unraveling the Options Trading Enigma

Q1: What is the fundamental difference between calls and puts?

A1: Call options grant you the right to purchase an underlying asset at a predetermined price, while put options confer the right to sell.

Q2: How does the duration of an option’s life cycle impact its price?

A2: Options with longer times to expiration generally command higher prices due to the increased potential for price fluctuations.

Q3: What are the primary advantages of options trading?

A3: Options trading offers versatility, allowing you to speculate on future price movements, hedge against potential losses, and generate income through premiums.

Options Trading Vangaurd

Image: www.ultraalgo.com

Conclusion: Options Trading with Vanguard – A Pathway to Financial Empowerment

Options trading presents a thrilling and potentially lucrative opportunity for investors seeking to enhance their portfolios. With the unwavering support of Vanguard, you can navigate the options trading landscape with confidence. Whether you are a seasoned trader or just beginning your journey, the resources and expertise provided by Vanguard will empower you to unlock the full potential of options trading and achieve your financial aspirations. Embark on this exciting path today and witness the transformative power of options trading with Vanguard.

Are you eager to delve deeper into the captivating world of options trading with Vanguard?