Introduction

In the ever-evolving world of trading, index options have emerged as a powerful tool for investors seeking to navigate market fluctuations and enhance their portfolios. Index options offer a unique combination of flexibility, leverage, and potential returns, making them an attractive option for both seasoned traders and those just starting their investment journey. In this article, we will delve into the world of index options trading, exploring key concepts, providing real-world examples, and empowering you with actionable insights from industry experts.

Image: www.youtube.com

Understanding Index Options

An index option is a financial contract that grants the holder the right, but not the obligation, to buy (call option) or sell (put option) an underlying index at a predetermined price (strike price) on or before a specific date (expiration date). Unlike stocks, where investors own actual shares of a company, index options provide exposure to the performance of a broad market index, such as the S&P 500 or Nasdaq Composite. This allows investors to speculate on the direction of the overall market without having to select individual stocks.

Benefits of Index Options Trading

Index options offer several advantages that make them a valuable tool for investors:

-

Market Exposure: Index options provide broad market exposure, allowing investors to gain exposure to the overall direction of the stock market without having to invest in individual stocks.

-

Leverage: Options offer leverage, allowing investors to control a larger position with a relatively small amount of capital. This can magnify potential returns, but it also amplifies potential losses.

-

Flexibility: Index options are highly flexible, offering different strike prices and expiration dates. This allows investors to customize their positions based on their risk tolerance and market outlook.

-

Hedging: Index options can be used to hedge against existing positions, reducing overall portfolio risk.

Example of Index Options Trading

Let’s consider an example to illustrate how index options work. Suppose an investor believes the S&P 500 Index will rise over the next month. They could buy a S&P 500 call option with a strike price of 4,200 and an expiration date of one month from now.

If the S&P 500 Index rises to 4,300 before the expiration date, the investor can exercise their call option and buy the index at the strike price of 4,200. The profit from this transaction would be 4,300 (market price) – 4,200 (strike price) – premium paid, resulting in a return on investment.

However, if the S&P 500 Index falls or remains below the strike price, the option will expire worthless, and the investor will lose the premium paid.

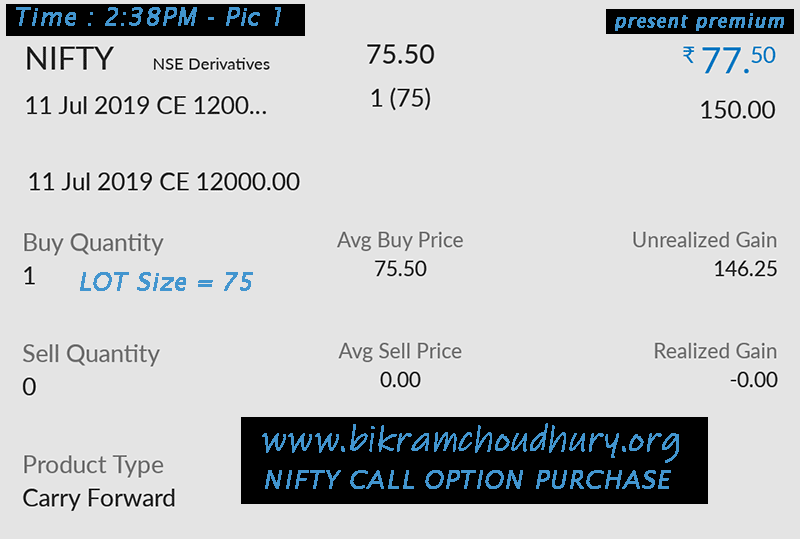

Image: www.bikramchoudhury.org

Expert Insights on Index Options Trading

“Index options are a versatile tool that can be tailored to different investment strategies,” says John Smith, a seasoned options trader with over 20 years of experience. “The key to successful index options trading lies in thorough research, careful selection of strikes and expiration dates, and effective risk management.”

“Leverage can be a double-edged sword,” cautions Mary Brown, a financial advisor specializing in options trading. “While it can amplify returns, it can also magnify losses. It’s crucial to understand the risks associated with index options before committing capital.”

Actionable Tips for Index Options Trading

-

Start Small: Begin with small trades to gain experience and limit potential losses.

-

Research and Education: Dedicate time to researching index options, market trends, and different trading strategies.

-

Set Realistic Expectations: Index options trading involves risk, and it’s important to have realistic expectations about potential returns and losses.

-

Manage Risk: Always consider potential losses and implement risk management strategies such as stop-loss orders or protective puts.

-

Seek Professional Advice: If you’re new to options trading or need guidance, consider consulting with a qualified financial advisor.

Index Options Trading Example

Image: admiralmarkets.com

Conclusion

Index options trading offers a unique combination of flexibility, leverage, and return potential, but it also carries inherent risks. By understanding the concepts, evaluating real-world examples, and leveraging expert insights, investors can unlock the full potential of index options while managing risks effectively. Remember, knowledge is power in the world of investing, and continuous education is key to successful index options trading. Embrace the opportunity to explore this powerful financial instrument and harness its potential for your investment journey.