Are you intrigued by the allure of options trading? As a seasoned investor, I’ve witnessed firsthand the captivating yet complex nature of this financial instrument. In this comprehensive guide, I’ll take you on a journey into the depths of options trading, guiding you through the myriad of options types that populate this dynamic market.

Image: www.pinterest.jp

A Glimpse into the Options Market

Traditionally, when you invest in stocks, you purchase shares representing a fraction of ownership in a company. However, options introduce a unique twist to this concept. Instead of direct ownership, options grant you the contractually binding right, but not the obligation, to buy or sell an underlying asset, such as a stock, at a predetermined price on a specific date.

This flexibility inherent in options contracts has made them a versatile financial tool, allowing investors to customize their strategies based on market conditions and risk tolerance. Let’s delve into the various types of options to unravel their distinct characteristics and applications:

Call Options

Call options empower you with the opportunity to buy an underlying asset at the strike price before the expiration date. Buying a call option confers the right to purchase the asset at a fixed price, regardless of whether its market price fluctuates upward or downward. Investors typically use call options when they anticipate a rise in the underlying asset’s value.

Put Options

Put options, on the other hand, grant you the ability to sell an underlying asset at the strike price before the contract expires. By purchasing a put option, you secure the right to sell the asset at a fixed price, irrespective of the market’s direction. Put options are often employed by investors who expect a decline in the underlying asset’s value.

Image: steadyoptions.com

Call vs. Put Options: A Comparative Overview

| Feature | Call Option | Put Option |

|---|---|---|

| Transaction Type | Right to buy | Right to sell |

| Profit Motive | Bullish outlook | Bearish outlook |

| Underlying Asset Value | Hoped-for increase | Anticipated decrease |

Other Types of Options Contracts

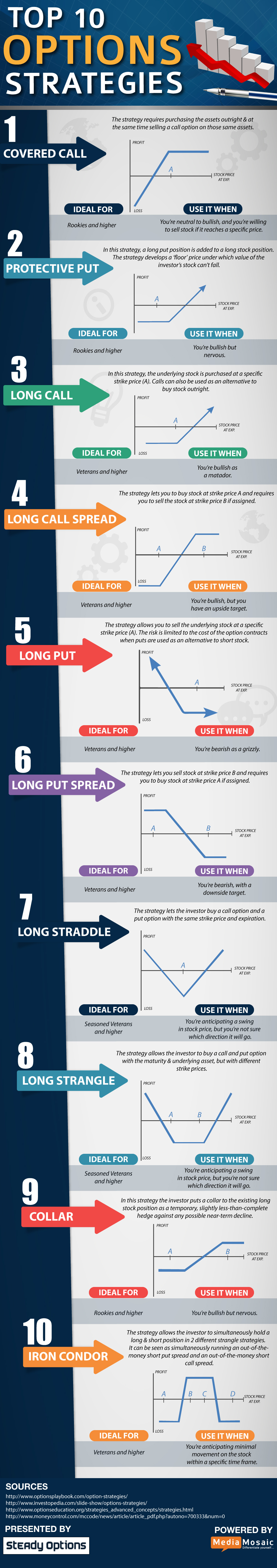

Beyond straightforward call and put options, the world of options trading offers a range of specialized contracts:

- Covered Calls: Allow you to sell call options against the underlying stocks you already own.

- Married Puts: Combine buying an underlying stock with simultaneously purchasing a put option on the same stock.

- Collar: Involve a combination of buying a put option and simultaneously writing a call option at a higher strike price.

Expert Insights and Practical Tips

Understanding the different types of options is the foundation for successful options trading. To empower you further, I’ve compiled insights from seasoned experts in the field:

- Seek Knowledge: Embark on a journey of continuous education, researching options strategies, market dynamics, and risk management techniques.

- Start Small: As you venture into options trading, it’s prudent to begin with smaller positions, gradually increasing your exposure as you gain confidence.

- Manage Risk: Options trading carries inherent risks, so it’s essential to implement strict risk management strategies, such as setting stop-loss orders and position sizing.

Frequently Asked Questions

To quench your curiosity, here are some frequently asked questions regarding options trading:

-

Q: What is the difference between a call and a put option?

A: Call options provide the right to buy an underlying asset, while put options confer the right to sell an underlying asset.

-

Q: Can I lose more money than I invested in options trading?

A: Yes, options trading involves the possibility of losing more money than the initial investment due to unlimited potential losses.

-

Q: What is leverage in options trading?

A: Leverage in options trading magnifies potential profits and losses by allowing investors to control a larger underlying asset value with a smaller upfront investment.

Options Trading Types Of Options

Image: www.stockradar.in

Conclusion

Navigating the intricate world of options trading demands a comprehensive understanding of the various options types, their nuances, and the potential risks involved. By embracing the knowledge and insights provided in this guide, you’ll be well-equipped to embark on your options trading journey with greater confidence.

So, are you ready to embrace the empowering world of options trading? Remember, continuous learning, measured risk-taking, and strategic execution are the cornerstones of success in this dynamic market. Join me on this exciting odyssey as we unravel the captivating realm of options trading together. Let’s unravel its potential and unlock the opportunities it presents.