Unveiling the Enigma of Options Trading Tokens: A Comprehensive Guide

Options trading, a dynamic arena of financial markets, presents an array of opportunities for investors seeking to leverage price fluctuations. At the heart of this realm lies a crucial element: the options trading token. In this article, we embark on a captivating journey to unravel the enigmatic world of options trading tokens, illuminating their intricacies and exploring their significance in the financial landscape.

Image: www.mintme.com

What are Options Trading Tokens?

Options trading tokens, also known as option contracts, represent a unique type of financial instrument that grants the holder the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a predetermined price on or before a specified expiration date. These contracts differ from traditional stocks or bonds, as they do not confer ownership of the underlying asset. Instead, they grant the token holder the optionality to exercise their rights at the stipulated price strike.

Understanding the Anatomy of Options Trading Tokens

To fully grasp the mechanics of options trading tokens, it’s essential to decipher their key components:

-

Underlying Asset: The asset associated with an options trading contract can vary, encompassing stocks, commodities, currencies, or indices.

-

Expiration Date: This date marks the point in time when the option contract ceases to be valid and the token holder’s right to exercise their option expires.

-

Strike Price: The predetermined price at which the underlying asset can be bought (in the case of a call option) or sold (in the case of a put option) upon exercising the option.

-

Option Premium: The price paid upfront by the token holder to acquire the option trading contract, which represents the cost of holding the option.

Devising Trading Strategies with Options Trading Tokens

Recognizing the distinct nature of options trading tokens, investors can employ these contracts to construct diverse trading strategies that align with their risk appetite and financial objectives.

-

Hedging: Options can serve as a protective shield against potential losses, enabling investors to mitigate risk while maintaining exposure to the underlying asset.

-

Speculating: For those seeking potential rewards, options trading tokens offer opportunities to speculate on price movements and profit from volatile markets.

-

Income Generation: Options can be utilized to generate income through strategies such as selling covered calls or writing puts, leveraging the time decay of the option premium.

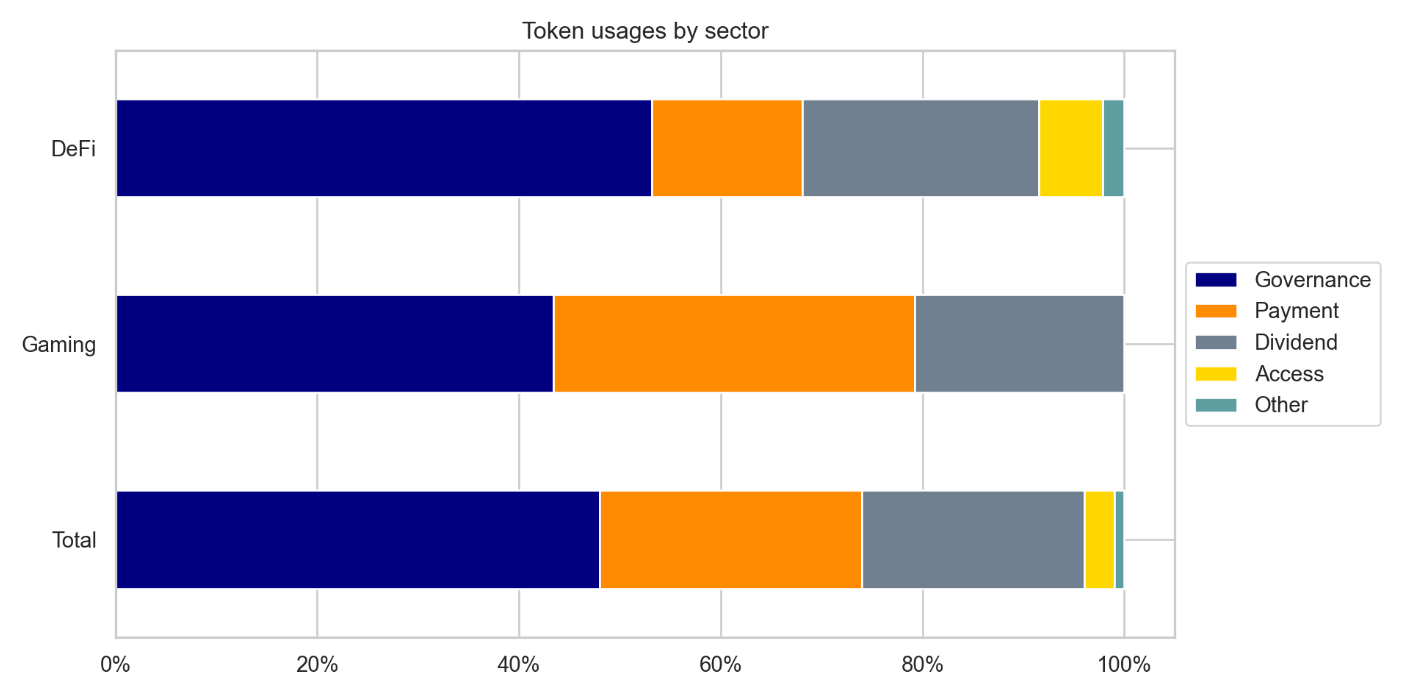

Image: www.moonfire.com

The Role of Options Trading Tokens in Modern Markets

Within the contemporary financial landscape, options trading tokens have assumed a pivotal role, fulfilling various functions:

-

Risk Management: Options provide a versatile tool for managing risk, allowing investors to tailor their positions and mitigate potential losses.

-

Market Access: Options trading tokens offer a multifaceted avenue for investors to gain exposure to a wide range of underlying assets, regardless of their capital constraints.

-

Volatility Hedging: In volatile markets, options serve as an effective means of hedging against price fluctuations, safeguarding portfolios from adverse market conditions.

Options Trading Token

Image: tokenlisted.com

Conclusion

Options trading tokens, with their inherent flexibility and diverse applications, have established themselves as indispensable components of modern investing. By harnessing the power of these contracts, investors can construct robust trading strategies that align with their unique risk profiles and seek to maximize returns while mitigating potential losses. As the financial world continues to evolve, options trading tokens will undoubtedly remain a pivotal instrument for savvy investors navigating the ever-changing labyrinth of financial markets.