In the fast-paced world of investing, options trading stands out as a powerful tool for investors seeking to amplify their gains or hedge against potential losses. For those embracing the crypto market, understanding options trading for Mu is paramount. Mu, the native token of the MixMarvel platform, holds immense promise, and options trading provides a unique avenue to harness its true potential.

Image: www.tradingview.com

What is Options Trading?

Options trading involves contracts that grant the holder the right, but not the obligation, to buy or sell an underlying asset at a predetermined price on or before a specified date. These contracts come in two forms: calls, which provide the holder the right to buy an asset, and puts, which confer the right to sell. Options traders can capitalize on market fluctuations by speculating on an asset’s price movements and exercising these rights when profitable opportunities arise.

Key Concepts of Options Trading for Mu

-

Call Option: This option gives the holder the right to buy Mu tokens at a predetermined strike price on or before the expiration date.

-

Put Option: This option gives the holder the right to sell Mu tokens at a predetermined strike price on or before the expiration date.

-

Strike Price: The price at which the option can be exercised.

-

Expiration Date: The date on which the option expires, after which it becomes worthless.

Options Trading Strategies for Mu Holders

With a solid grasp of the fundamentals, investors can delve into options trading strategies tailored to their risk appetite and investment goals.

Call Option Strategy:

-

If you believe the price of Mu will rise, you can purchase a call option at a strike price above the current market price. By exercising this option, you can acquire Mu at a price potentially lower than market value.

-

Protective Put Strategy: This strategy aims to limit losses if the price of Mu falls below a desirable level. You can purchase a put option at a strike price below the current market price. The put option allows you to sell Mu at the strike price, protecting your portfolio from deep losses.

-

Covered Call Strategy: If you own Mu tokens and anticipate a lateral movement or slight increase in price, you can sell a call option at a strike price higher than the current market price. This generates additional income but limits your potential gains if Mu’s price rises significantly.

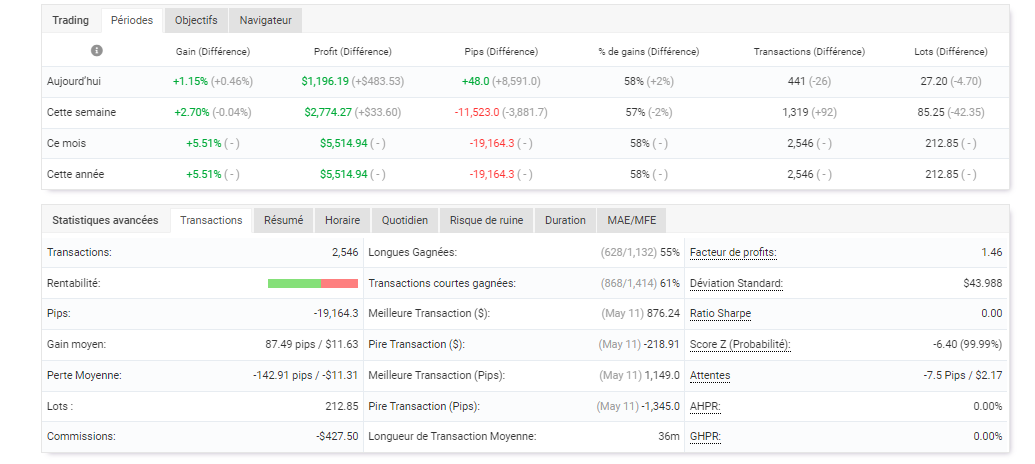

Image: www.mql5.com

Expert Insights and Actionable Tips

-

Embrace patience and a long-term perspective when engaging in options trading. Avoid emotional decision-making and focus on well-informed trades.

-

Determine your risk tolerance and invest only what you can afford. The most suitable strategies depend on your individual financial situation and goals.

-

Seek guidance from seasoned traders or reputable resources to enhance your knowledge and refine your approach.

Options Trading For Mu

Image: yuriymatso.com

Conclusion

Options trading presents both opportunities and risks for Mu investors. By gaining a solid understanding of options concepts and implementing strategic trades, investors can leverage this tool to enhance their investment returns or protect their assets. Remember, the key to successful options trading lies in thorough research, risk management, and a disciplined approach. Embrace the power of options and unlock new possibilities for financial growth and asset preservation within the dynamic Mu ecosystem.