In the captivating realm of finance, where opportunities dance amidst uncertainty, options trading has emerged as a transformative force. For those seeking to harness the power of these financial instruments, private placement memorandums (PPMs) serve as invaluable roadmaps, illuminating the intricate strategies that pave the way to market navigation.

Image: templates.udlvirtual.edu.pe

Embark on this enlightening journey as we delve into the depths of options trading strategy descriptions found within PPMs. We shall meticulously dissect the mechanics of these investment vehicles, empowering you with the knowledge to confidently navigate the dynamic financial landscape.

Options Trading: A Gateway to Calculated Risk

Options trading presents investors with both tantalizing rewards and calculated risks. These versatile instruments grant the holder the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a specified price (strike price) by a predetermined date (expiration date).

Harnessing the power of leverage, options allow investors to magnify their potential gains while limiting their losses. However, prudent risk management is paramount, as these instruments can amplify both profits and potential setbacks.

Private Placement Memorandums: Illuminating the Market

Private placement memorandums serve as the cornerstone of options trading strategy descriptions, providing investors with crucial information to make informed decisions. These comprehensive documents meticulously outline the investment opportunity, meticulously detailing its objectives, risks, and potential rewards.

Within the confines of a PPM, investors will find an exhaustive exploration of the underlying asset, meticulously analyzing its market position, industry dynamics, and future prospects. This in-depth analysis serves as a beacon of clarity, guiding investors towards investment strategies that align with their risk tolerance and financial goals.

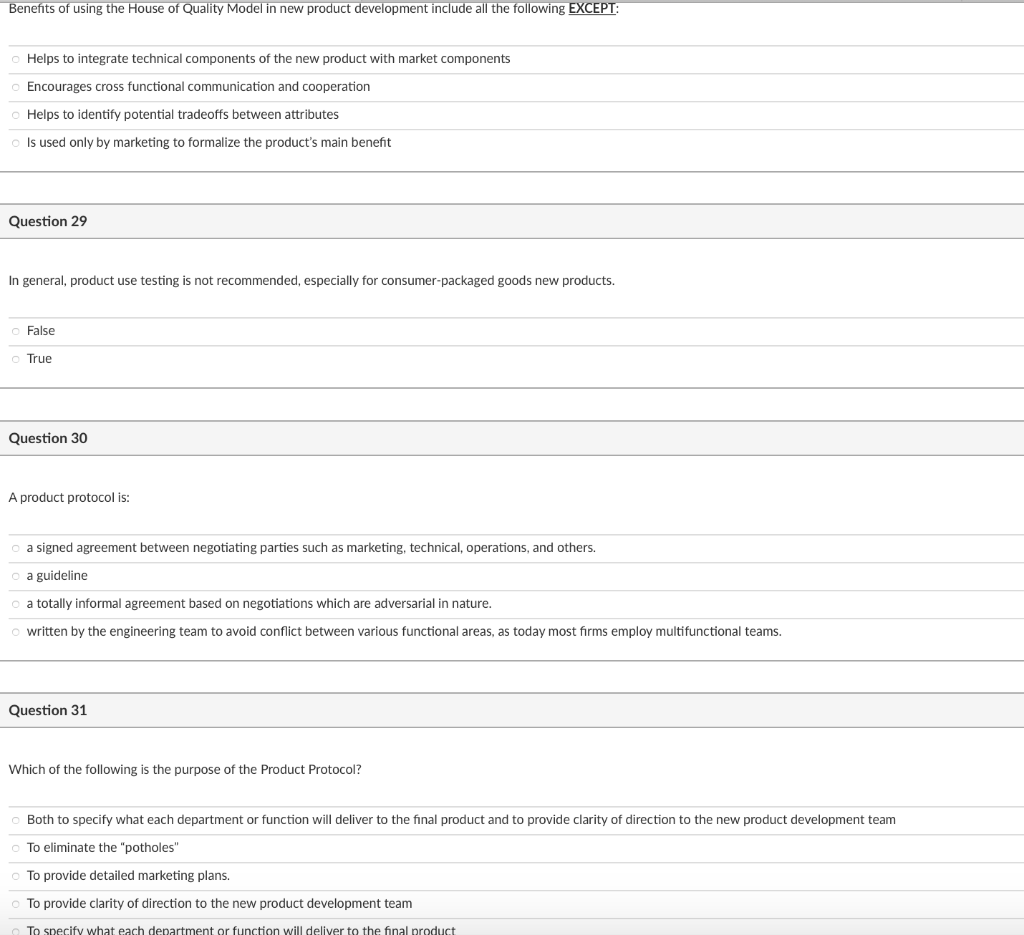

Anatomy of an Options Trading Strategy Description

At the heart of a PPM lies the options trading strategy description, a detailed blueprint that orchestrates the investor’s market maneuvers. This meticulously crafted masterpiece unveils the intricate interplay between options, providing a panoramic view of the investment’s intended course.

The strategy description meticulously outlines the investment horizon, articulating the proposed holding period for the options. This timeframe serves as a guiding star, shaping the selection of options with expiration dates aligned with the anticipated market cycles.

Image: www.chegg.com

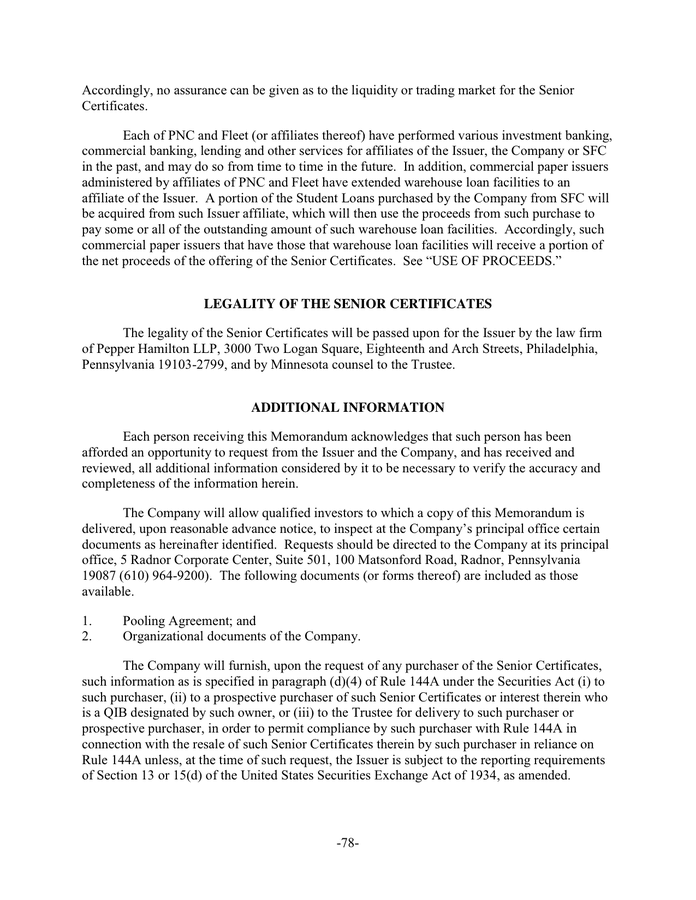

Unveiling Risk Management Strategies

Options trading, while alluring in its potential, demands prudent risk management. PPMs meticulously delineate the risk management strategies employed within the proposed investment. These strategies, like armor in the financial arena, safeguard investors from potential market vagaries.

The PPM will explicitly define stop-loss orders, protective strategies, and hedging techniques, ensuring that the investor’s financial well-being remains paramount. These measures act as sentinels, vigilantly monitoring market movements and automatically executing trades to mitigate losses when pre-determined thresholds are crossed.

Options Trading Strategy Description Private Placement Memorandum

Image: www.dexform.com

Conclusion

In the labyrinthine world of finance, options trading stands as a beacon of potential, offering investors a path to navigate market complexities. Private placement memorandums serve as invaluable guides, illuminating the strategies that fuel successful options trading endeavors.

By deciphering the options trading strategy descriptions within PPMs, investors gain the knowledge and confidence to make informed decisions, empowering them to harness the potential of these versatile financial instruments. Remember, financial prudence and meticulous due diligence are the unwavering companions on this exciting journey of investment and growth.