Introduction: Unveiling the Secrets of Long-Term Options Strategies

In the financial realm, where volatility reigns and opportunities abound, options trading emerges as a potent tool for discerning investors seeking to navigate market fluctuations and generate substantial returns over extended time frames. Unlike traditional equity investing, options trading involves contracts that grant the holder the right, but not the obligation, to buy or sell an underlying asset at a predetermined price within a specific timeframe. This unique characteristic empowers traders to participate in market movements while mitigating downside risk.

Image: www.projectfinance.com

Long-term options strategies, designed to harness the power of compounding gains and capitalize on long-term market trends, have gained immense popularity among savvy investors. These strategies employ a horizon that extends beyond short-term fluctuations, allowing traders to capture the underlying asset’s growth potential while managing risk prudently.

Exploring the Landscape of Long-Term Options Strategies

The universe of long-term options strategies is vast, each designed to address specific market conditions and risk appetites. Some of the most widely employed strategies include:

-

Covered Calls:

Generating Income while Reducing Risk

Covered calls entail selling call options against an underlying asset that the trader owns. This strategy allows investors to collect premium income while simultaneously limiting potential losses on the underlying asset. The premium received provides a cushion against potential declines in the asset’s value, offering an added layer of protection to the trader’s portfolio.

-

Protective Puts:

Insuring Against Market Downturns

Protective puts involve purchasing put options to hedge against potential losses in the underlying asset. These options grant the holder the right to sell the asset at a predetermined price, effectively setting a downside limit and ensuring that losses are capped. This strategy is particularly valuable in volatile markets where sudden downturns can wreak havoc on unprotected portfolios.

-

Image: in.pinterest.comBull Calls:

Betting on Continued Growth

Bull calls are employed when investors anticipate an uptrend in the underlying asset’s value. This strategy entails purchasing call options, granting the holder the right to buy the asset at a predetermined price. If the asset’s price surpasses the strike price, the trader stands to profit handsomely from the difference. Bull calls offer the potential for significant returns in bull markets.

-

Bear Puts:

Capitalizing on Market Declines

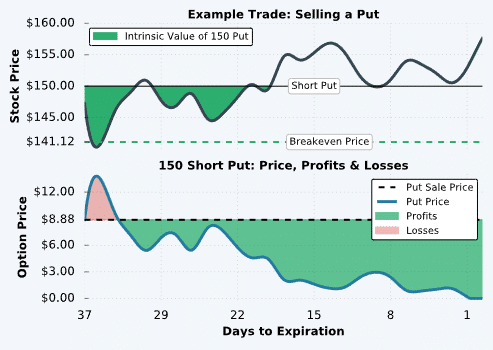

Bear puts are designed to profit from anticipated downturns in the underlying asset’s value. This strategy involves selling put options, granting the holder the right to sell the asset at a predetermined price. If the asset’s price falls below the strike price, the trader receives a premium that compensates for the decline in the asset’s value. Bear puts provide a compelling opportunity to generate income in bear markets.

Keys to Successful Long-Term Options Trading

Navigating the complexities of long-term options trading calls for a prudent approach that balances risk and reward. Here are some guiding principles to enhance your trading experience:

-

Rigorous Risk Management:

Discipline is Paramount

Effective risk management lies at the heart of successful long-term options trading. Traders must meticulously evaluate market conditions, assess their tolerance for risk, and establish clear trading parameters to minimize potential losses.

-

Option Selection:

Precision is Key

Choosing the appropriate options for your strategy is crucial. Consider factors such as strike price, expiration date, and premium cost. The strike price should align with your market outlook, while the expiration date should provide adequate time for the trade to unfold.

-

Market Analysis:

Informed Decision-Making

Thoroughly analyzing market trends and economic indicators is essential. Keep abreast of geopolitical events, economic data, and technical analysis to gain insights into future market movements and make informed trading decisions.

-

Patience and Discipline:

The Power of Staying Calm

Long-term options strategies require patience and discipline. Avoid impulsive trading decisions and allow sufficient time for your trades to mature. Remember, market fluctuations are inherent to investing, and adhering to your strategy can lead to long-term success.

Options Trading Strategies Long Term

Image: www.slideshare.net

Conclusion: Unlocking the Potential of Long-Term Options Trading

In the ever-evolving world of investing, long-term options trading strategies present a compelling avenue for generating substantial returns while prudently managing risk. By implementing the strategies outlined in this article, investors can harness the power of options to participate in market movements, generate income, and capitalize on long-term trends. Remember, thorough research, meticulous risk management, and unwavering discipline are the keys to unlocking the true potential of long-term options trading.