In the turbulent waters of the financial market, options trading strategies serve as guiding lights, empowering traders to navigate the complexities and maximize their potential. My journey into this captivating realm began with a serendipitous encounter with an experienced trader who unveiled the transformative power of options. It ignited a spark within me, propelling me on a quest to unravel the intricacies of this multifaceted investment tool.

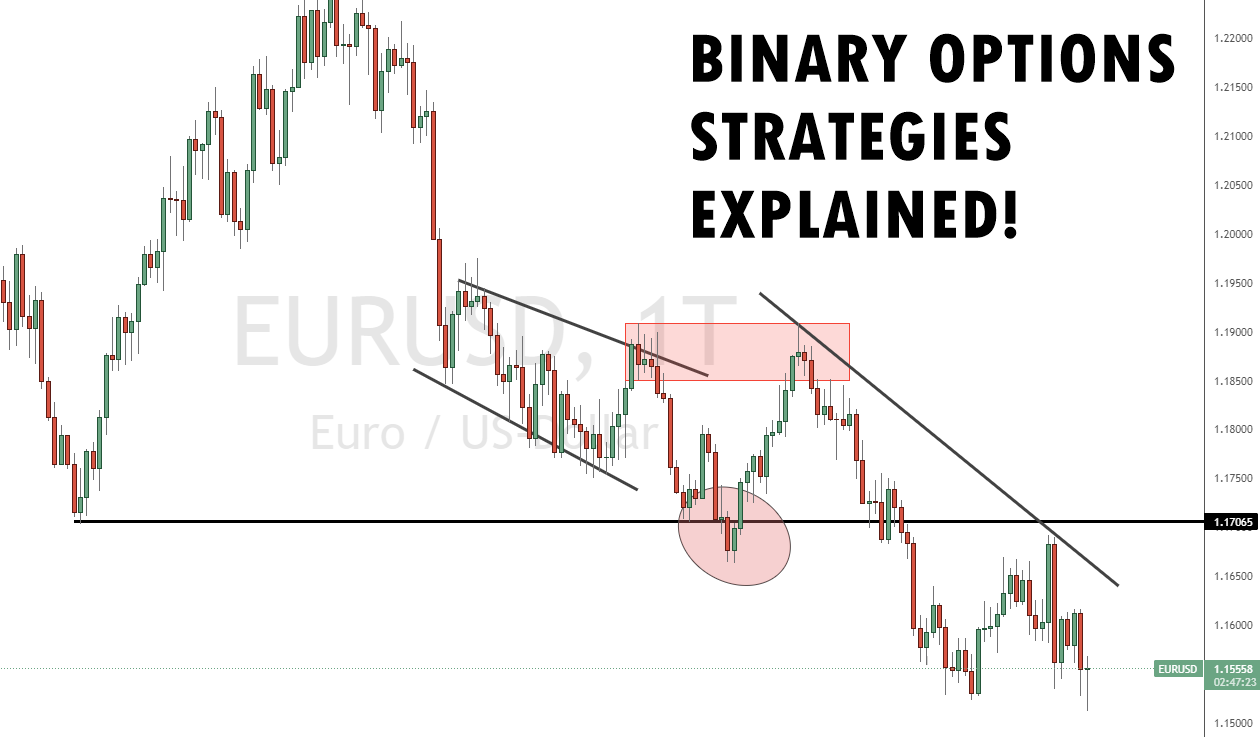

Image: www.tradingtrainer.com

Unveiling the World of Options Trading

Options trading involves the exchange of contracts that convey the right, but not the obligation, to buy or sell an underlying asset at a specified price on or before a predetermined date. This flexibility allows traders to devise sophisticated strategies that cater to their unique risk tolerance and market outlook.

Decoding the Options lingo

Comprehending the language of options trading is paramount. Some key terms include:

- Call option: Grants the holder the right to buy the underlying asset at a specified price.

- Put option: Confers the right to sell the underlying asset at a specified price.

- Premium: The price paid to acquire the option contract.

- Strike price: The predetermined price at which the option can be exercised.

- Expiration date: The final day on which the option can be executed.

Exploring Popular Options Trading Strategies

The realm of options trading harbors a multitude of strategies, each tailored to specific market conditions and trader objectives. Some popular approaches include:

- Covered call: Sell a call option against an underlying asset that you already own.

- Protective put: Purchase a put option to hedge against the potential decline in the value of an underlying asset.

- Iron condor: Simultaneously sell one call option and one put option at higher and lower strike prices, respectively, while buying two call options and two put options at even higher and lower strike prices.

- Straddle: Purchase both a call option and a put option with the same strike price and expiration date.

- Strangle: Similar to a straddle, but the call and put options have different strike prices.

Image: www.listenmoneymatters.com

Empowering Traders with Expert Advice

Mastering the art of options trading requires a blend of strategy and expertise. Here are some tips to enhance your trading acumen:

- Know Your Objectives: Determine your investment goals and risk tolerance before embarking on any options trade.

- Research the Underlying Asset: Thoroughly evaluate the underlying asset’s fundamentals, technical indicators, and market trends.

- Diversify Your Portfolio: Spread your investments across different options strategies and underlying assets to mitigate risk.

- Consider Risk Management: Utilize stop-loss orders and hedging techniques to safeguard your capital.

- Stay Updated with Market Trends: The financial landscape is constantly evolving. Stay abreast of market news and expert insights to make informed decisions.

Common Questions on Options Trading

Q: Is options trading a viable means of consistent profitability?

A: While options trading offers the potential for substantial returns, it also carries significant risks. Consistent profitability requires in-depth knowledge, strategic planning, and disciplined risk management.

Q: What type of options trading strategy is suitable for beginners?

A: Covered calls and protective puts are relatively low-risk strategies that can help beginners gain exposure to options trading while limiting potential losses.

Options Trading Strategies Ally

Image: fabalabse.com

Conclusion

Embracing options trading strategies empowers investors with a dynamic toolkit to enhance their market navigation. By mastering the intricacies, leveraging expert advice, and embracing continuous learning, you can transform options trading into a valuable ally in your financial endeavors.

Do you seek to delve deeper into the world of options trading and unlock its potential? Share your thoughts and questions in the comments section below.