In the exhilarating yet treacherous landscape of options trading, traders navigate a river strewn with risks. Volatility, like a tempestuous wind, can turn profits into losses in an instant. To navigate this perilous route, savvy traders deploy a powerful tool: the stop limit order. A stop limit order acts as a beacon of stability, safeguarding gains while mitigating the sting of market downturns.

Image: valoreazioni.com

Understanding the Stop Limit Order: A Safety Net for Traders

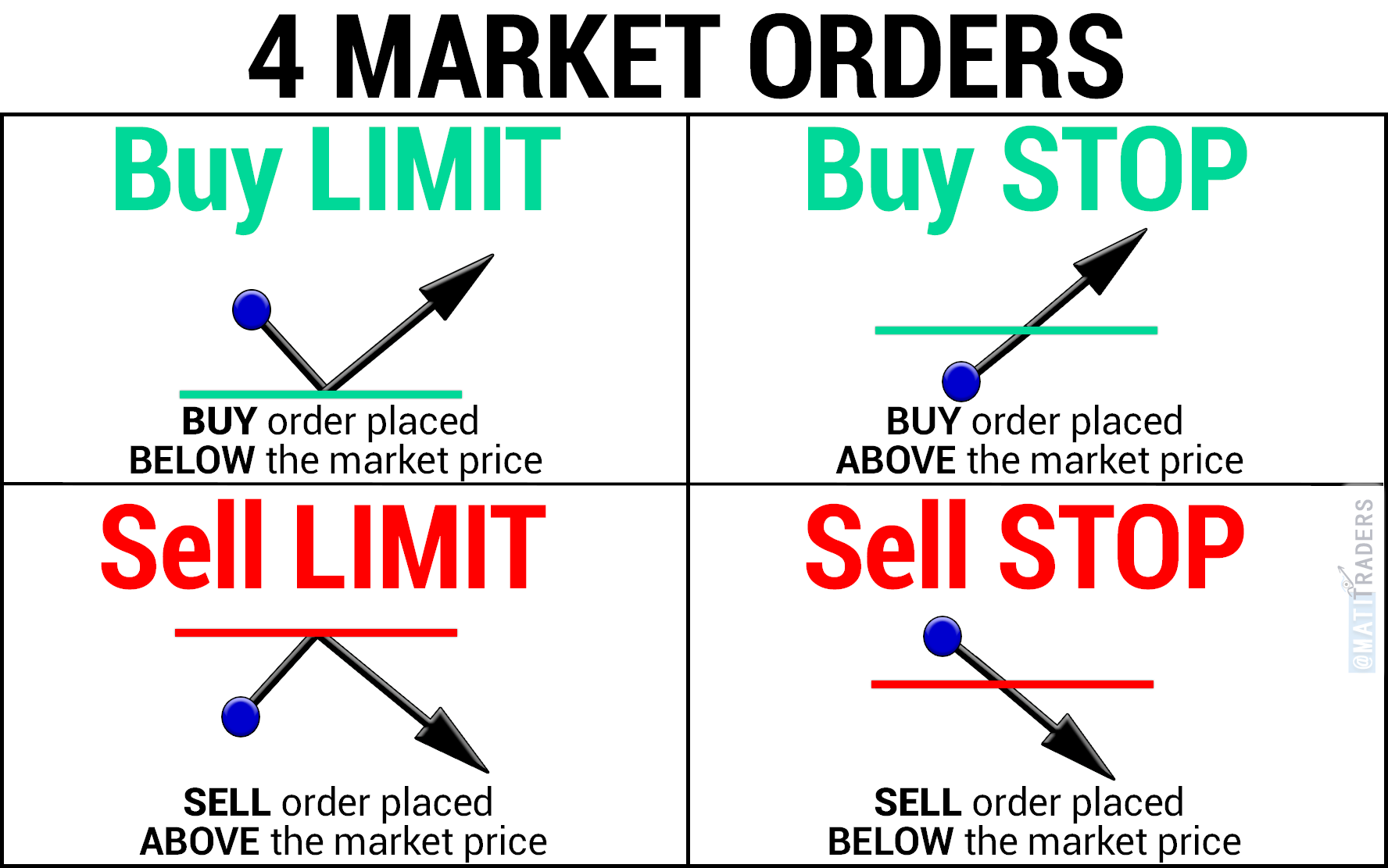

At its core, a stop limit order is a contingent command to buy or sell an underlying asset once a specific price point, the “trigger price,” is reached or breached. Unlike a stop order, which becomes a market order immediately upon hitting the trigger price, a stop limit order is more conservative, only executing when the specified limit price is met or surpassed. This distinction allows traders to set a buffer zone between the trigger and limit prices, reducing the likelihood of premature executions due to market fluctuations.

Benefits of the Stop Limit Order: Shielding Gains and Limiting Losses

The advantages of employing stop limit orders in options trading are manifold. Primarily, it enables traders to safeguard their profits by locking in gains when the market moves in their favor. By setting a stop limit order above their entry point, traders can capture a substantial portion of their earnings while protecting against potential reversals.

Conversely, stop limit orders provide a safety net in falling markets, safeguarding against excessive losses. By setting a stop limit order below their entry point, traders can limit the downside exposure and avoid catastrophic losses. This risk management tool allows traders to sleep soundly, knowing that their portfolio is shielded from the full force of market turbulence.

Applications of the Stop Limit Order: Timing the Market with Precision

The versatility of stop limit orders extends to various trading strategies, enhancing the trader’s ability to time market entries and exits with precision. For instance, traders can utilize stop limit orders to trail their profits, systematically adjusting the stop price as the underlying asset appreciates in value. This technique, known as a trailing stop, ensures that gains are protected and maximized throughout a bull run.

Moreover, stop limit orders serve as valuable tools for entering trades at favorable prices. By setting a stop limit order below resistance levels or above support levels, traders can enter positions with a higher probability of success, capitalizing on breakout or breakdown opportunities.

Image: timonandmati.com

Options Trading Stop Limit

Image: www.gunbot.discount

Conclusion: A Vital Tool for Risk Management

In the dynamic world of options trading, where risks lurk around every corner, the stop limit order emerges as an indispensable tool for risk management. It empowers traders to protect their profits, limit losses, and improve their chances of success. By incorporating stop limit orders into their trading arsenal, traders can navigate the market’s complexities with greater confidence, knowing that they have a safety net in place to safeguard their hard-earned capital.