Introduction

In the dynamic world of finance, options emerge as powerful tools for both risk management and profit potential. Exchange-traded funds (ETFs) offer a convenient avenue to harness the benefits of options trading with their diversified baskets of underlying securities. Enter top ETFs for options trading, where meticulous analysis and expert craftsmanship converge to empower investors with the instruments they need to navigate the market with confidence.

Image: www.iqoptionmag.com

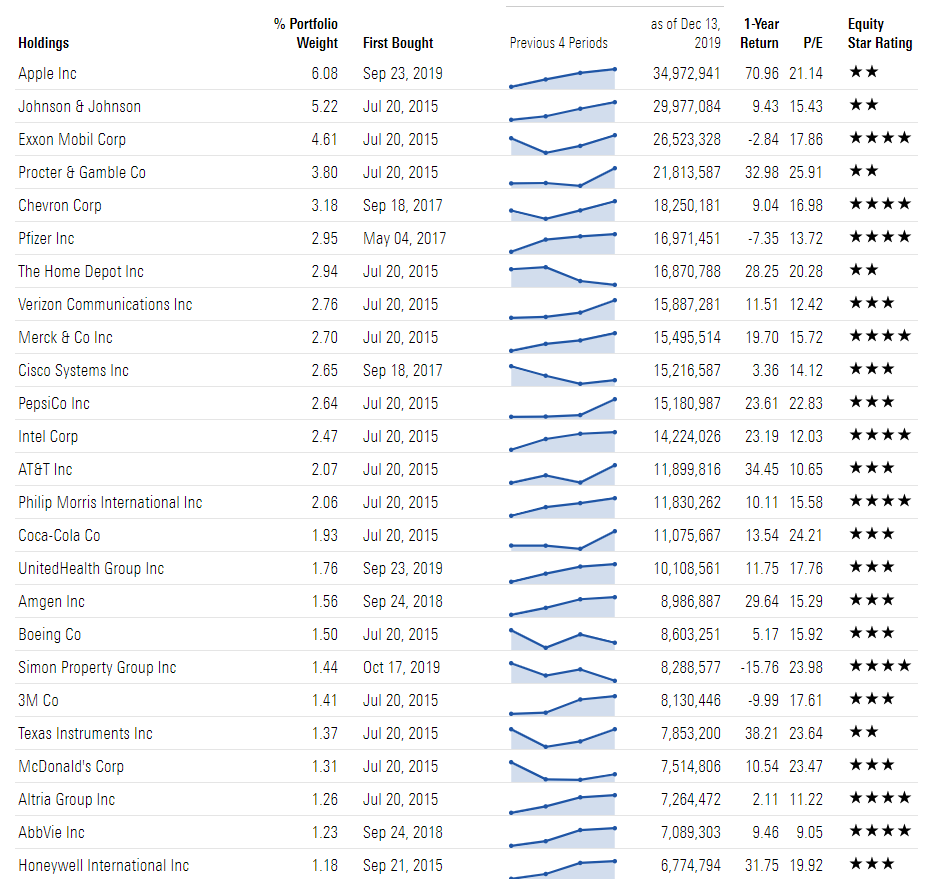

Top ETF Contenders for a Successful Options Strategy

A myriad of ETFs cater specifically to options traders, each with its unique characteristics and risk-return profile. Here are some of the most sought-after options trading ETFs:

-

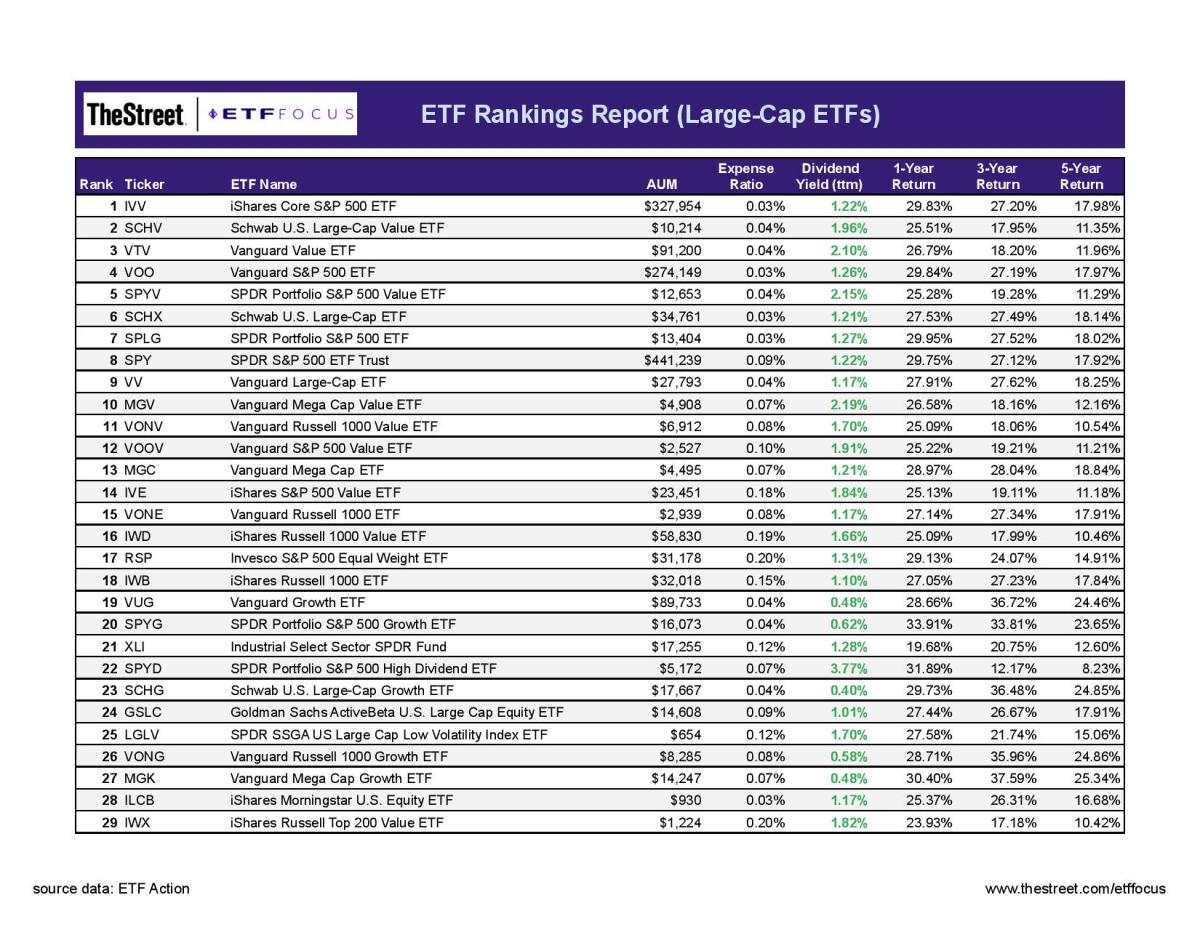

SPDR S&P 500 ETF (SPY): A stalwart in the ETF landscape, SPY grants exposure to the broader U.S. equity market, providing a diversified base for options plays. Its ample trading volume ensures liquidity and serrate bid-ask spreads.

-

iShares Core High Yield Bond ETF (HYG): For income-oriented investors, HYG offers a blend of high-yield corporate debt, providing opportunities for generating income through covered calls or buying puts for downside protection.

-

Invesco QQQ ETF (QQQ): This ETF tracks the Nasdaq 100 Index, home to some of the most influential tech companies. QQQ’s impressive liquidity and high option premiums attract traders seeking upside potential in a tech-heavy portfolio.

-

iShares MSCI Emerging Markets ETF (EEM): Emerging markets can offer higher returns, but also greater volatility. EEM provides exposure to a broad swath of emerging market equities, enabling traders to tap into global growth potential while managing risk through options strategies.

-

Direxion Daily S&P 500 Bull 3X Shares (SPXL): For risk-tolerant traders, SPXL amplifies the daily performance of the S&P 500, offering leveraged exposure that can magnify both gains and losses. A careful understanding of risk management is crucial when trading SPXL.

Expert Insights and Actionable Advice

Mastering options trading requires guidance from those who have navigated the markets before you. Here are insights and tips from renowned options experts:

-

“Understand the Greeks before diving into options trading. These measures will help you assess risk and tailor your strategies accordingly.” – Mark Sebastian, Options Trading Coach

-

“Leverage technology to your advantage. Trading platforms offer sophisticated tools that can streamline your options trades and optimize your decision-making.” – Kim Klaiman, Options Trading Educator

-

“Don’t be afraid to adjust your trades. Market conditions can change rapidly, so be prepared to modify or close your positions as needed.” – John Carter, Author of “Mastering the Trade”

Conclusion

Top ETFs for options trading serve as invaluable tools, providing investors and traders with access to various strategies and risk profiles. By selecting the right ETFs and applying the insights of experienced professionals, you can empower yourself to navigate the options market with confidence and potentially grow your financial portfolio. Remember, options trading carries risks, so always conduct thorough research and trade within your risk tolerance.

Image: www.stofenstijl.nl

Top Etfs For Options Trading

Image: www.thestreet.com