As an avid options trader, I recall the initial confusion I faced regarding the trading start time. It’s a crucial factor that can significantly impact your trading decisions. Embark on this journey into the intricacies of options trading start times, delving into the complexities that govern this intriguing realm.

Image: seekingalpha.com

Navigating the Options Market: Start Times Explained

Understanding the options trading start time is paramount, as it marks the moment when traders can begin executing trades. This start time varies across the globe, depending on the respective exchanges and underlying assets. In the United States, for instance, the options market opens congruently with the underlying stock market at 9:30 AM Eastern Time.

However, specific exchanges may tweak the start time for certain options contracts. Consequently, it’s imperative to verify the specific start times for the options you intend to trade through the relevant exchange or your brokerage platform.

The Mechanics of Options Trading Start Times

On the commencement of options trading, the market opens with an auction period. During this initial window, which typically spans from 9:30 AM to 9:45 AM Eastern Time in the United States, traders place their limit orders. These limit orders effectively express their willingness to buy or sell options contracts at particular prices.

Upon the conclusion of the auction period, the opening prices for options contracts are set based on the equilibrium between supply and demand reflected in the limit orders placed during the auction. Subsequently, ongoing trading takes place during regular market hours, ranging from 9:45 AM to 4:00 PM Eastern Time.

The Strategic Significance of Trading Start Times

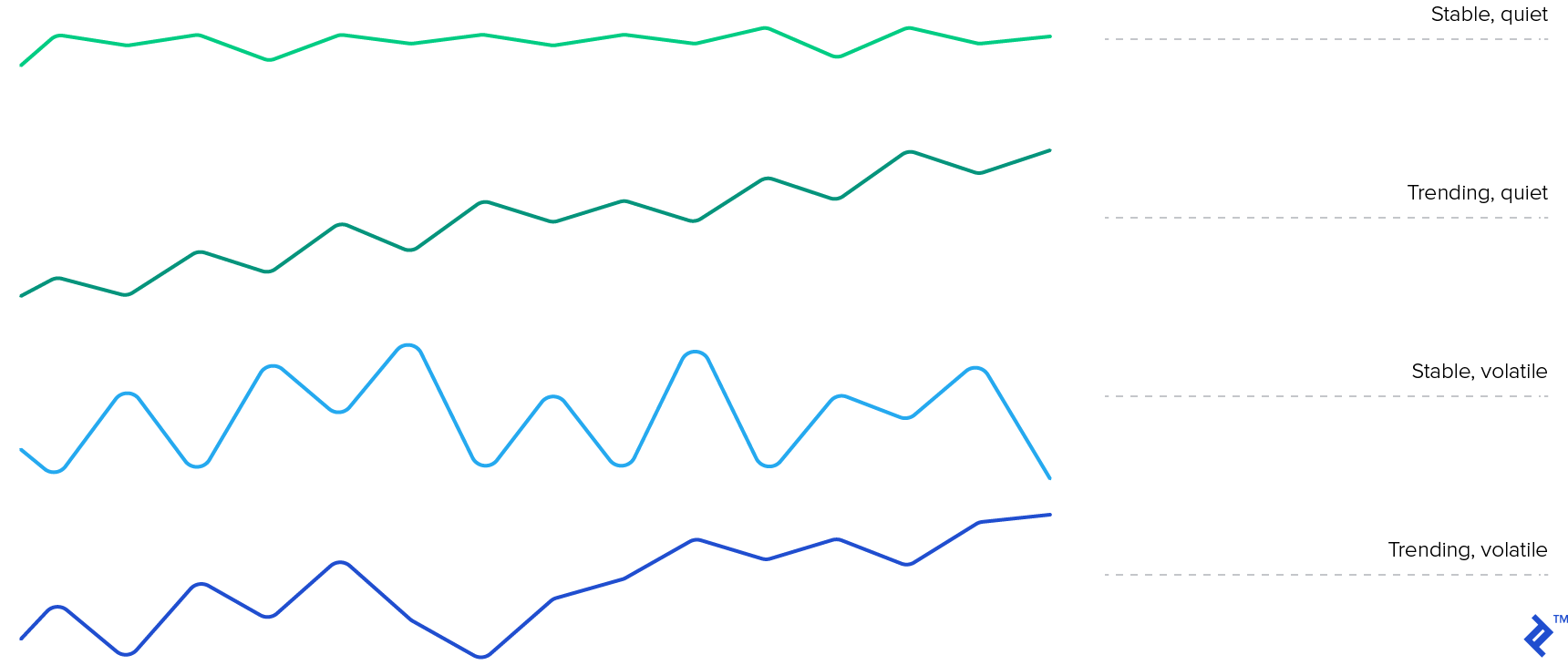

Options trading start times carry substantial strategic significance, particularly for short-term traders and scalpers. The initial price discovery process can yield substantial volatility, creating opportunities for quick profits or losses.

Traders employing high-frequency trading strategies often attempt to capitalize on the momentary price fluctuations that occur during the opening auction. Additionally, because options contracts are time-sensitive, the start time can influence the available trading window and the potential profit or loss.

Image: www.fondazionealdorossi.org

Expert Insight: Maximizing Trading Potential

To optimize your options trading strategy, consider these valuable tips from seasoned experts:

- **Research thoroughly:** Before venturing into any options trades, arm yourself with comprehensive knowledge. Study the underlying asset’s history, volatility, and recent news developments to make informed decisions.

- **Set realistic expectations:** While opportunities certainly exist, options trading can be unpredictable. Set reasonable profit targets and never risk more capital than you can afford to lose.

- **Manage your risk:** Employ risk management strategies such as stop-loss orders to mitigate potential losses. Understand the potential risks and rewards associated with each trade before you execute.

- **Stay informed:** Keep abreast of market news and updates that may impact the underlying asset’s price. Monitor the volatility of the options contracts you’re trading to anticipate fluctuations.

- Q: Why do options trading start times vary?

- A: Start times may differ across exchanges and options contracts due to factors such as trading regulations and underlying asset availability.

- Q: What is the significance of the auction period?

- A: The auction period is crucial for price discovery, establishing the opening prices for options contracts based on the balance between supply and demand.

- Q: How can I determine the start time for a specific options contract?

- A: Consult the relevant exchange or your brokerage platform to obtain the start time for the options contract you intend to trade.

- Q: What is the optimal time to trade options?

- A: While trading throughout the regular market hours is possible, the opening auction period and the first hour after the start time often offer elevated volatility and increased trading volume.

Frequently Asked Questions about Options Trading Start Time

Options Trading Start Time

Image: www.projectfinance.com

Conclusion

The options trading start time is an integral element that can profoundly influence your trading strategy. By delving into the complexities that govern trading start times, you can effectively navigate the options market and maximize your trading potential. Whether you’re a seasoned trader or just starting, bear in mind the expert tips and insights shared here to enhance your understanding and decision-making abilities.

We trust that this exploration of options trading start times has enriched your knowledge and ignited your curiosity further. Are you eager to delve deeper into this enthralling realm of options trading?