Prologue: The Enigmatic World of Options

In the financial landscape, options trading stands as an alluring instrument, enabling investors to navigate the complexities of the market with calculated risks. At its core, an option represents a contract granting the holder the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a predetermined price within a specified time frame. Intriguingly, the settlement date holds immense significance in the options trading arena, marking the day when the transaction is finalized and ownership of the underlying asset is transferred or the obligation to buy or sell is fulfilled.

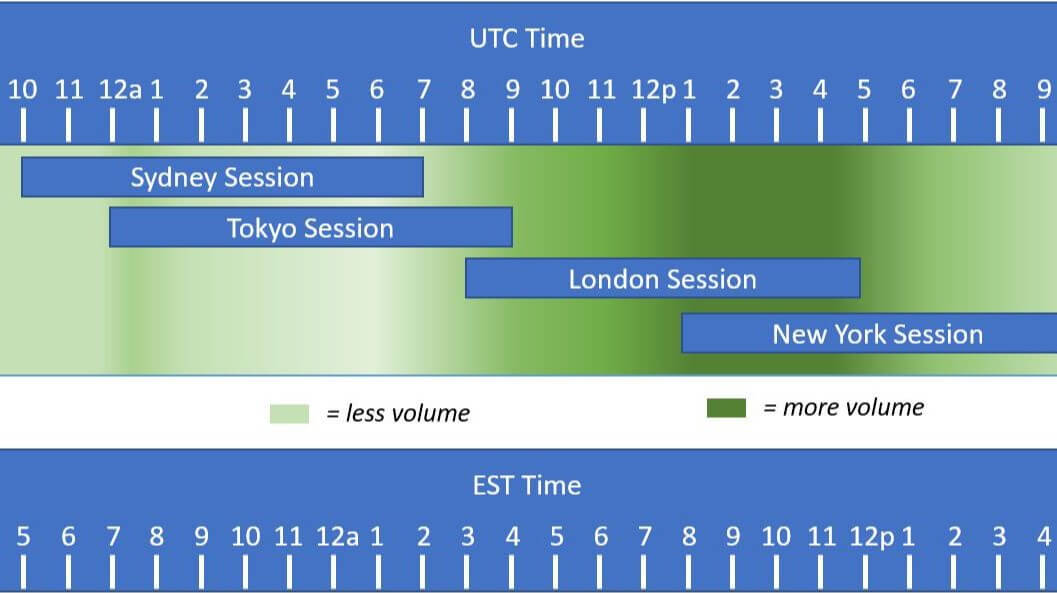

Image: www.investingbunker.com

Navigating the Settlement Date Maze

The settlement date in options trading, typically set two business days following the trade execution date, serves as a crucial milestone in the transaction process. For instance, if an investor purchases a call option on a Monday, the settlement date would fall on Wednesday, representing the deadline for exercising the right to buy the underlying asset at the strike price stipulated in the contract. Conversely, if the investor decides not to exercise their right, the option expires worthless, and the premium paid becomes a sunk cost.

Understanding the settlement date is paramount for options traders as it directly influences their profit or loss potential. If an underlying asset’s price rises above the strike price, traders who have purchased call options can exercise their right to buy the asset at a lower cost, potentially yielding a profit. However, if the price falls below the strike price, the option loses its value and becomes worthless upon expiration.

Essential Considerations: Exercise or Expiration

As the settlement date approaches, options traders face a pivotal decision: exercise their right or allow it to expire. Exercising an option involves fulfilling the contract’s obligation, which can entail acquiring ownership of the underlying asset (in the case of a call option) or selling the underlying asset (in the case of a put option). Alternatively, if an option is not exercised, it expires, rendering the investment null and void.

For call options, exercising the right to buy becomes advantageous when the market price of the underlying asset surpasses the strike price, generating a profit. However, if the market price remains below the strike price, exercising the option would result in a loss. Conversely, with put options, exercising the right to sell is beneficial when the market price of the underlying asset falls beneath the strike price. Yet again, exercising a put option at a higher market price leads to a loss.

Expert Insights: Mastering Options Settlement Date

“The settlement date is a critical juncture for options traders,” emphasizes Mark Holden, a seasoned options trading expert. “Understanding its implications empowers traders to make informed decisions, maximizing their profit potential while mitigating risks.”

Holden elucidates the significance of monitoring market trends and news events that may influence the underlying asset’s price leading up to the settlement date. “Traders should stay abreast of economic indicators, industry-specific developments, and geopolitical factors that could sway the market,” he advises.

Beyond technical analysis, Holden stresses the importance of emotional control in options trading. “Emotions can cloud judgment, leading to rash decisions. Maintaining a level head and adhering to a disciplined trading strategy is crucial for long-term success.”

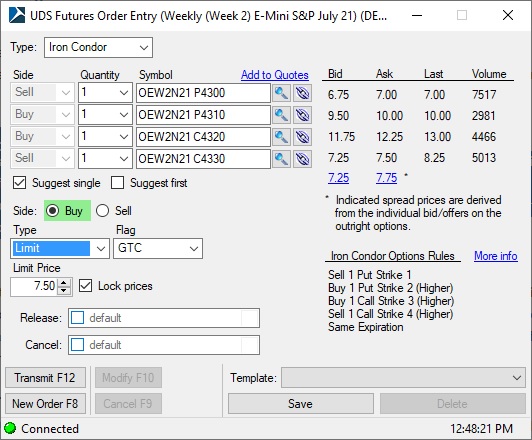

Image: hackershow1.blogspot.com

Actionable Tips: Maximizing Settlement Date Strategies

-

Thoroughly Research: Delve into the underlying asset’s historical performance, industry outlook, and potential catalysts that could impact its price.

-

Set Realistic Expectations: Avoid overleveraging or chasing unrealistic profit targets. Options trading involves inherent risks, and setting achievable goals is essential for sustainable trading.

-

Monitor Market Movements: Track the underlying asset’s price fluctuations diligently, along with relevant news and events, to gauge potential market shifts.

-

Hedge Your Bets: Consider employing hedging strategies to mitigate risks and protect against adverse market conditions.

-

Learn from the Experts: Seek guidance from experienced options traders or attend educational workshops to enhance your knowledge and decision-making abilities.

Options Trading Settle Date

Image: tradeprofutures.com

Conclusion: Unlocking Trading Success

Navigating the complexities of options trading settlement dates empowers investors to make informed decisions, optimize their trading strategies, and potentially reap significant rewards. By understanding the concept, considering expert insights, and implementing actionable tips, traders can unlock the full potential of this versatile financial instrument. Remember, the road to trading success is paved with knowledge, discipline, and a relentless pursuit of learning. Embrace the journey, and let the settlement date become a beacon of opportunity in your financial endeavors.