Introduction

In the dynamic world of financial markets, timing is everything. Nowhere is this more evident than in the world of options trading, where understanding settlement time is crucial for investors to minimize risk and maximize returns. This comprehensive guide will delve into the intricacies of option trading settlement time, providing a clear and insightful overview of this critical aspect of options trading.

Image: emugepavo.web.fc2.com

Defining Settlement Time

Settlement time in options trading refers to the specific time and date when a buyer and seller must complete the transaction and exchange funds and the underlying asset. For standard options contracts traded on exchanges, settlement occurs two business days after the trade execution date, also known as T+2. However, some options may have different settlement times, such as weekly options or less common futures-style options.

Historical Evolution of Settlement Time

The T+2 settlement time was introduced in 1995 to streamline and standardize the options trading process. Prior to this, settlement times could vary significantly depending on the type of option and exchange. The implementation of T+2 brought greater efficiency and reduced operational risks in the options market.

Implications for Investors

The settlement time has several key implications for investors:

- Order Placement: Investors need to factor in the settlement time when placing orders to ensure they have sufficient time to arrange for payment and delivery of the underlying asset.

- Risk Management: Understanding settlement time is crucial for managing risk effectively. For example, if an investor sells an option and the underlying asset moves significantly against them, they could face a margin call on an accelerated basis.

- Tax Implications: The settlement time can impact the timing of capital gains or losses for tax purposes.

Image: optionstradingiq.com

Settlement Process

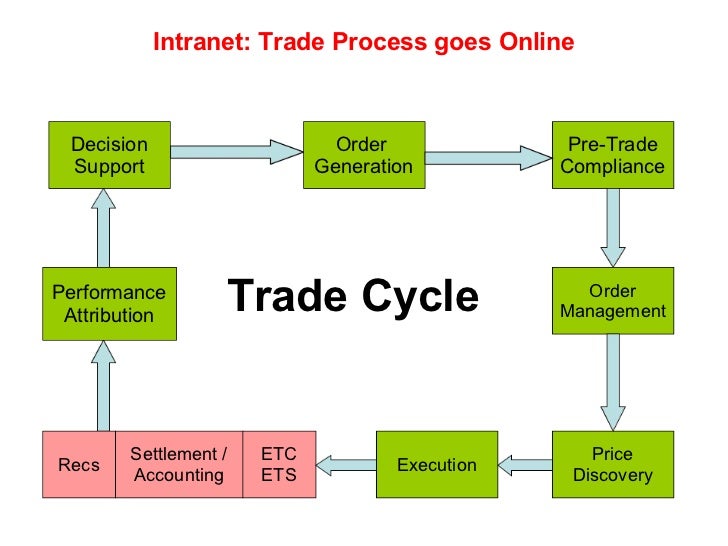

The settlement process for options typically involves the following steps:

- Clearing: The trade is cleared through a designated clearinghouse, which ensures the financial obligations of both parties.

- Assignment: For exercised options, the buyer is assigned the rights to the underlying asset, and the seller is obligated to deliver the asset on the settlement date.

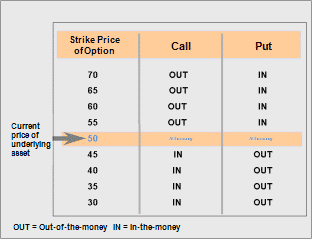

- Exercise Price vs. Strike Price: The settlement price is either the exercise price (for exercised options) or the strike price (for unexercised options).

- Payment: The buyer pays the settlement price to the seller, and the seller delivers the underlying asset or a cash equivalent.

Managing Settlement Risks

To mitigate settlement risks, investors should consider the following strategies:

- Monitor Position: Regularly track the progress of option trades and monitor the underlying asset’s performance.

- Hedging: Use hedging techniques to reduce potential losses from adverse price movements before settlement.

- Adequate Funding: Ensure sufficient capital availability to meet settlement obligations.

Exceptions and Special Cases

While T+2 is the standard settlement time for most options, exceptions exist:

- Weekly Options: Expire every Friday and settle on the following Monday.

- Futures-Style Options: Settle on the expiration date, similar to futures contracts.

Option Trading Settlement Time

https://youtube.com/watch?v=G1Q69Kv0D20

Conclusion

Understanding option trading settlement time is essential for successful navigation of the options market. By comprehending the timelines, implications, and risks involved, investors can make informed decisions and effectively manage their positions. Whether you’re a seasoned trader or a novice seeking to expand your knowledge, this guide empowers you with the foundational knowledge to navigate the world of options trading with confidence.