Each time we embark on a financial venture, our emotions dance on the edge of hope and fear. They sway to the rhythm of market fluctuations, rising like waves on a stormy sea during downturns and cresting with euphoria in uptrends. Options trading, with its potential for exponential returns, magnifies this emotional rollercoaster. The Relative Strength Index (RSI), a technical indicator that measures the momentum of price changes, can be an invaluable tool in navigating these emotional waters, especially when its value exceeds 70.

Image: in.pinterest.com

What is RSI and Why is it Important?

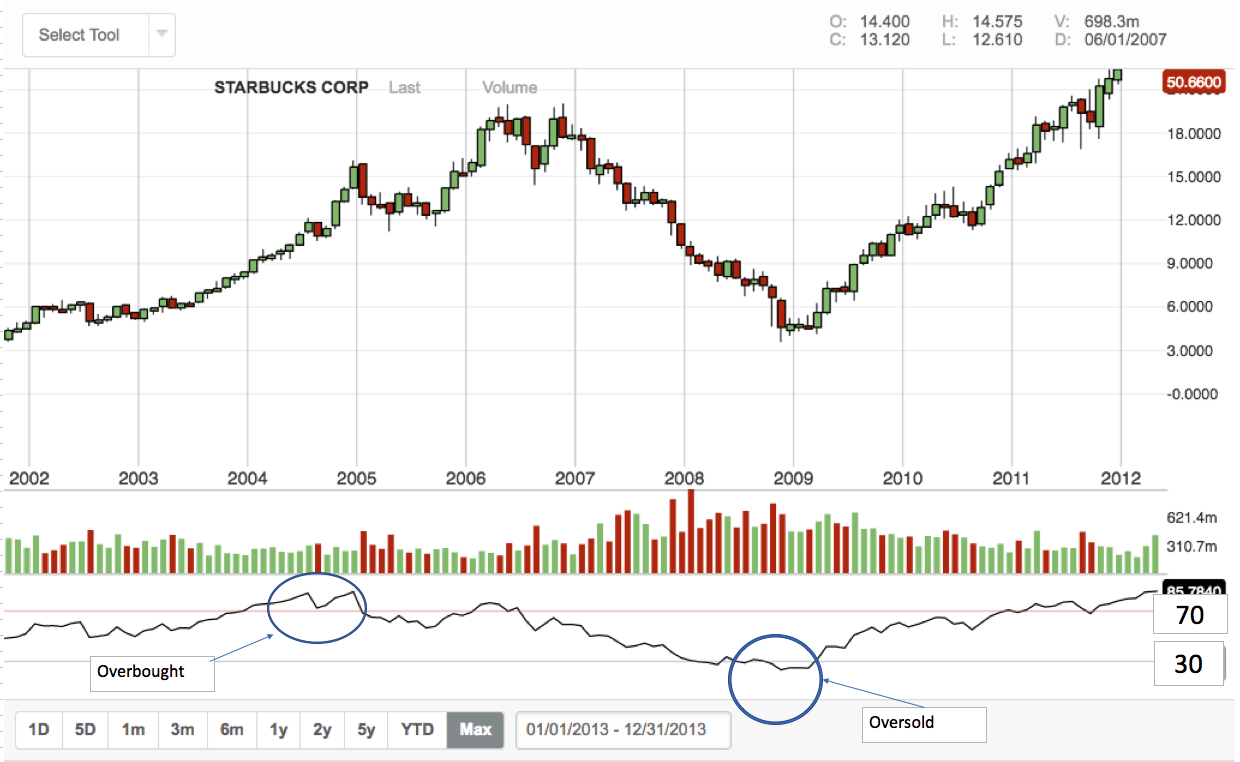

The RSI is a technical analysis tool developed by renowned trader J. Welles Wilder in the 1970s. It gauges the strength or weakness of market momentum, ranging from 0 to 100. A reading near 100 indicates overbought conditions, suggesting that an asset’s price may be unsustainable and due for a correction. Conversely, a value near 0 signals oversold conditions, indicating potential buying opportunities.

The Emotional Impact of RSI Over 70

When the RSI crosses above 70, it signifies that buyers have been aggressively driving up the price. Excitement and anticipation fill the air, fueling the belief that the uptrend will continue indefinitely. Yet, this emotional euphoria can cloud our judgment and lead to reckless trading decisions.

On the flip side, an RSI below 30 denotes oversold conditions, triggering fear and doubt. Sellers dominate the market, driving prices down. In this emotional state, we may panic and sell our assets prematurely, missing out on potential gains.

Understanding the Emotional Toll

Trading in an overbought or oversold market can take a significant emotional toll. Here’s how these conditions affect traders:

- FOMO (Fear of Missing Out) Over 70: The RSI’s overbought signal can trigger intense anxiety, driving traders to purchase assets they may not fully understand, simply to avoid missing out on potential gains.

- Panic Selling Below 30: The oversold signal can incite panic, leading traders to sell their holdings hastily, fearing further losses. This knee-jerk reaction often results in selling assets at a loss.

- Overtrading: In both overbought and oversold conditions, emotions can override rational decision-making, leading to excessive buying or selling.

Image: www.investallign.in

Mastering Your Emotions

To mitigate the emotional impact of RSI over 70, it’s crucial to cultivate emotional resilience and develop a structured trading plan. Here are some strategies:

- Recognize the Emotional Triggers: Acknowledge the emotions that arise when the RSI signals overbought or oversold conditions.

- Set Clear Trading Rules: Establish predefined entry and exit points based on your trading strategy. Let these rules guide your decisions, not your emotions.

- Focus on Long-Term Trends: RSI is a short-term indicator. Consider it in conjunction with longer-term analysis to avoid impulsive trades.

- Practice Patience: Avoid making rash decisions based on RSI readings. Allow the market to develop and confirm trends before entering or exiting trades.

- Seek Professional Advice: If your emotions are significantly impacting your trading, consider consulting with a qualified financial advisor.

Options Trading Rsi Over 70

Image: finance-heros.fr

Conclusion: A Path to Emotional Mastery

Navigating options trading RSI over 70 is a journey of emotional self-discovery and mastery. By recognizing the emotional triggers, setting clear trading rules, and cultivating a disciplined approach, we can tame the emotional storms and achieve sustainable trading success. Remember, options trading is not a get-rich-quick scheme. It requires patience, emotional resilience, and unwavering commitment to prudent trading practices. Embrace the challenges and setbacks as valuable lessons that empower you to navigate the complex world of financial markets with confidence and tranquility.