In the labyrinthine world of financial markets, the enigmatic realm of binary option trading beckons investors with its allure of quick profits. Simply put, it’s a speculative endeavor where traders wager on the future direction of an asset’s price. Within a specified time frame, the underlying asset’s price either culminates in a profit or a complete loss for the trader, making this form of trading both an adrenaline rush and a potential pitfall. Understanding the intricacies of binary option trading is imperative for discerning investors who seek to navigate this unpredictable terrain successfully.

Image: blog.iqoption.com

Decoding Binary Options: Behind the Veil of Simplicity

At its core, binary option trading presents a seemingly straightforward concept. Traders speculate on whether the price of an asset will rise or fall within a predetermined time limit. If the prediction aligns with the actual price movement, the trader realizes a predefined payout, often expressed as a percentage of the investment. Conversely, if the prediction falters, the trader forfeits the entire investment, leaving no margin for partial gains or losses. This all-or-nothing proposition introduces an element of binary outcomes, hence the moniker “binary” option trading.

Unraveling the Anatomy of a Binary Option Trade

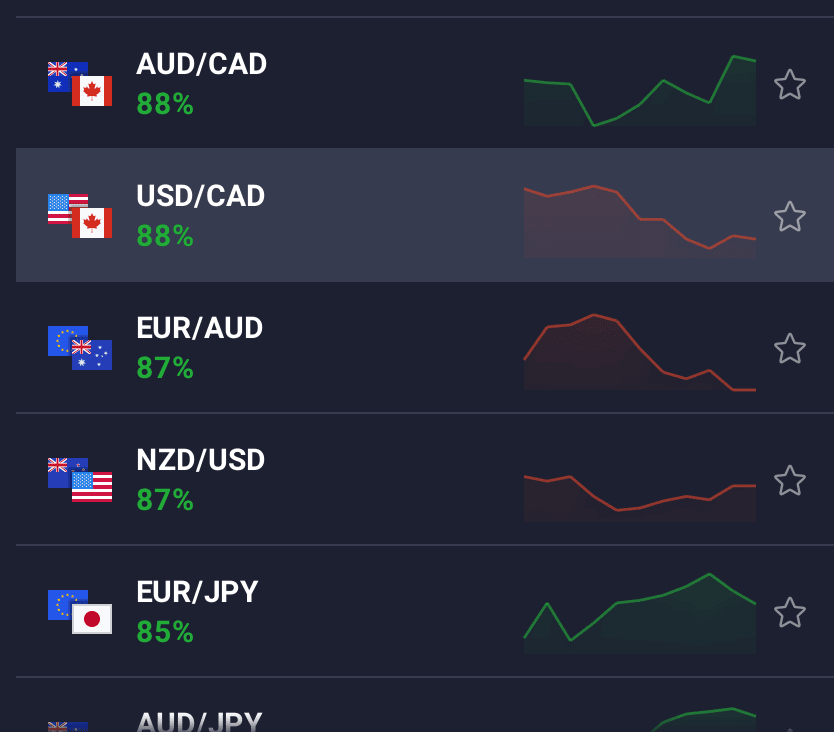

Delving into the anatomy of a binary option trade reveals its constituent parts. First, traders select an underlying asset, which could be a stock, currency, commodity, or index. Subsequently, they establish a time frame, ranging from minutes to hours or even days, during which the price behavior of the asset will be scrutinized. Armed with their market insights, traders choose whether the asset’s price will trend upwards (call option) or downwards (put option) relative to its current level. Finally, they set the expiration time, the moment of truth when the trade’s fate is sealed and the profit or loss is realized.

The Binary Option Trading Spectrum: Understanding Types and Strategies

Binary option trading encompasses a diverse range of instruments, each tailored to the varying preferences and risk appetites of traders. Some of the most prevalent types include:

-

Up/Down Options: The fundamental binary option, where traders speculate on an asset’s price moving above or below the current level at expiration.

-

One-Touch Options: As the name suggests, these options pay out if the asset’s price touches a predetermined level before expiration, irrespective of the final price movement.

-

Range Options: Traders wager whether the asset’s price will remain within a specified range or break out of it by expiration.

-

Turbo Options: A fast-paced variant with expiration times ranging from a mere 30 seconds to a few minutes, offering high volatility and adrenaline.

To navigate the complexities of binary option trading, traders employ various strategies to enhance their profitability and mitigate risks. Some common strategies include:

-

Trend Trading: Aligning trades with the prevailing market trend, exploiting the momentum of price movements.

-

Range Trading: Capitalizing on price fluctuations within predetermined boundaries, profiting from the asset’s oscillation.

-

News Trading: Leveraging breaking news and economic events to anticipate price movements and execute trades accordingly.

-

Martingale Strategy: A risky yet potentially rewarding strategy where traders double their stake after each loss in an attempt to recoup losses and ultimately secure a profit.

Image: forex-station.com

The Binary Option Trading Arena: Seeking a Credible Platform

Navigating the binary option trading arena demands caution and discernment, as the market is not without its pitfalls. Choosing a reputable and regulated broker is paramount for traders to safeguard their funds and protect against unscrupulous practices. Factors to consider when selecting a broker include:

-

Regulation: Ensure the broker holds valid licenses and is regulated by respected financial authorities.

-

Security: Verify the broker’s security measures, including data encryption and protection against cyber threats.

-

Asset Selection: Evaluate the range of underlying assets offered by the broker to align with your trading needs.

-

Platform Usability: Choose a trading platform that is user-friendly and intuitive, ensuring a seamless trading experience.

-

Customer Support: Assess the broker’s customer support, ensuring responsiveness and efficiency in addressing queries and resolving issues.

Binary Option Trading Class

Image: www.pinterest.com

The Psychology of Binary Option Trading: A Mental Game

While understanding the mechanics of binary option trading is crucial, mastering the psychological aspects is equally important. This form of trading