Options trading, a potent financial strategy, presents traders with an avenue to harness the volatility of the markets and profit from time decay. Understanding option volatility is akin to deciphering the language of the market, empowering traders to make informed decisions that can yield substantial returns. In this comprehensive guide, we will unravel the intricacies of options trading, deciphering the enigmatic world of options volatility, and illuminating the myriad strategies that reside within this domain.

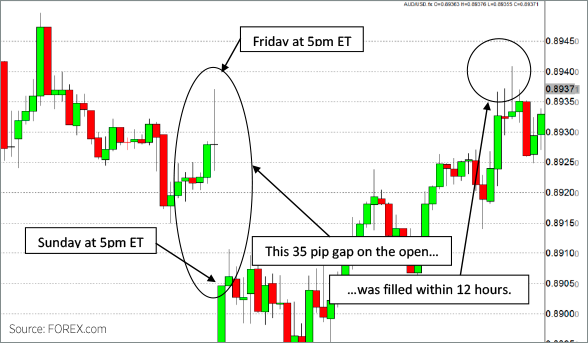

Image: www.forex.com

Options Demystified: A Bridge between Risk and Reward

An option, in essence, is a contract that confers upon its holder the privilege, yet not the obligation, to buy (call option) or sell (put option) an underlying asset at a predetermined price on or before a specific date. It serves as a financial instrument that enables traders to speculate on price movements while simultaneously mitigating risk. Options present traders with the versatility to capitalize on both bullish and bearish market sentiments, leveraging volatility to augment their profit potential.

The Essence of Volatility: Understanding the Market’s Pulse

Volatility, the lifeblood of options trading, manifests as the degree of fluctuation in an underlying asset’s price. It serves as a barometer of market sentiment, reflecting the collective expectations of investors concerning future price movements. High volatility, indicative of uncertainty and rapid price swings, amplifies the potential profit margins for options traders. Conversely, low volatility, characterized by relatively stable prices, constrains profit potential.

Deciphering Option Premiums: The Cost of Privilege

Options, like any other asset, come with a price tag known as the premium. This premium reflects the intrinsic value of the option, which is determined by factors like the underlying asset’s price, strike price, time to expiration, and volatility. The premium embodies the cost of acquiring the option contract and the potential profit an option holder stands to gain if the underlying asset’s price moves favorably.

Image: www.youtube.com

Strategies for Success: Navigating the Options Landscape

Options trading encompasses a vast array of strategies, each tailored to specific market scenarios and risk-reward profiles. From the elementary covered call to the sophisticated calendar spread, the options trading landscape teems with opportunities for traders seeking to capitalize on market fluctuations. Prudent strategy selection, guided by a comprehensive understanding of market dynamics and an unwavering focus on risk management, is paramount to maximizing profit potential while safeguarding capital.

Implied Volatility: Unveiling the Market’s Expectations

Implied volatility, a crucial concept in options trading, represents the market’s forecast of an underlying asset’s future volatility. It is embedded within the option’s premium and serves as a potent indicator of market sentiment. Options traders can harness implied volatility to gauge the market’s perception of risk and uncertainty, informing their trading decisions and enhancing their ability to navigate market fluctuations.

Options Trading Option Volatility &Amp

Image: www.pinterest.com

Conclusion: Empowering Traders with Market Mastery

Options trading, a sophisticated financial strategy, offers traders the potential to capitalize on market volatility while managing risk. By deciphering the enigmatic language of options volatility and employing prudent strategies, traders can unlock the power of time and harness market fluctuations to their advantage. This comprehensive guide serves as a beacon, illuminating the path towards successful options trading, empowering traders with the knowledge and tools to navigate the ever-evolving financial landscape.