In the ever-evolving world of finance, options trading has emerged as a powerful tool for investors seeking to maximize their portfolio’s potential. With the volatility and opportunity present in the options market, understanding the intricate nuances of this strategy is crucial for achieving success. This comprehensive guide explores the ins and outs of options trading in May 2019, providing valuable insights and practical tips to empower investors with the knowledge they need to navigate this dynamic market.

Image: www.analyticssteps.com

Unveiling the Fundamentals of Options Trading

Options contracts are financial instruments that grant the buyer the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a predetermined price (strike price) on or before a specified expiration date. This flexibility allows investors to speculate on future price fluctuations without committing to outright ownership, providing both potential profits and risk management possibilities.

The underlying asset can be a range of financial instruments, including stocks, bonds, commodities, and even other options. The strike price represents the target price where the investor believes the asset will head, while the expiration date signifies the deadline by which the option must be exercised or expires worthless.

By understanding the fundamental mechanics of options trading, investors can unlock the potential for strategic investments and risk mitigation within their portfolios.

Essential Considerations for Options Trading in May 2019

In May 2019, the options market is characterized by several key trends that investors should be aware of:

- Heightened volatility: Geopolitical uncertainties and economic headwinds have injected volatility into the markets, creating both risks and opportunities for options traders.

- Impact of interest rates: The Federal Reserve’s monetary policy decisions can significantly influence option prices, particularly for interest rate-sensitive assets.

- Sector rotation: Investors are rotating into sectors that are expected to benefit from the current market conditions, such as healthcare and technology.

- Technological advancements: The advent of high-frequency trading and algorithmic execution has impacted the options market, increasing liquidity and reducing transaction costs.

Maximizing Returns with Options Trading Strategies

Seasoned options traders employ various strategies to enhance their returns while managing risk. Some of the most popular strategies include:

- Buying calls: This strategy involves purchasing call options, betting on the asset’s price to rise above the strike price before expiration.

- Selling puts: Selling put options implies an expectation that the asset’s price will remain above the strike price or decline moderately.

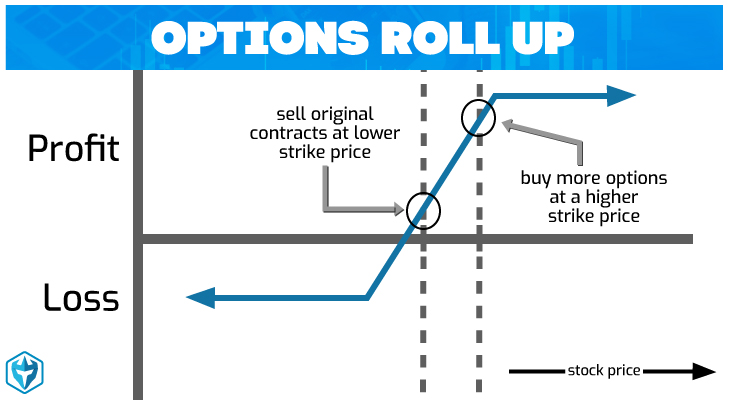

- Spreads: Spread strategies involve combining multiple options with different strike prices and expiration dates to create customized risk-reward profiles.

- Credit spreads: Credit spreads are structured to generate income by selling options with different premiums and buying options with lower premiums.

The choice of strategy depends on the investor’s market outlook, risk appetite, and investment goals. By mastering these strategies, investors can diversify their portfolios, hedge against losses, and capitalize on market opportunities.

Image: www.adenshop.rs

Expert Insights and Actionable Tips for Success

Renowned options strategist, Mark Sebastian, advises, “Options trading provides investors with enormous flexibility. Understanding risk management and avoiding common pitfalls is essential for long-term success.”

Here are some additional tips from industry experts:

- Define your objectives: Determine your investment goals and risk tolerance before engaging in options trading.

- Research and educate yourself: Thoroughly study options concepts, strategies, and market dynamics.

- Start with paper trading: Simulate trading in a virtual environment to hone your skills and gain experience without financial risk.

- Monitor the market closely: Stay updated on market news, earnings reports, and economic data that can impact option prices.

- Manage your risk: Implement appropriate risk management strategies, such as setting stop-loss orders or utilizing hedging techniques.

Options Trading May 2019

Image: letscrowd.eu

Conclusion

Options trading in May 2019 presents a compelling opportunity for investors to enhance their portfolio’s performance and manage risk. By embracing the knowledge shared in this guide, investors can navigate the intricacies of this dynamic market, cultivate a strategic mindset, and unlock the potential for success. Remember, continuous learning, careful planning, and unwavering discipline are the cornerstones of a successful options trading journey.