Introduction

Time value plays a crucial role in option pricing. It represents the premium an investor pays for the right to buy or sell an underlying asset at a specified price on or before a given date. Understanding how to calculate time value can provide valuable insights for informed trading decisions.

:max_bytes(150000):strip_icc()/TheImportanceofTimeValueinOptionsTrading2_3-6a8bae9f6ab84187808cffecf5840515.png)

Image: www.investopedia.com

Unveiling the Essence of Time Value

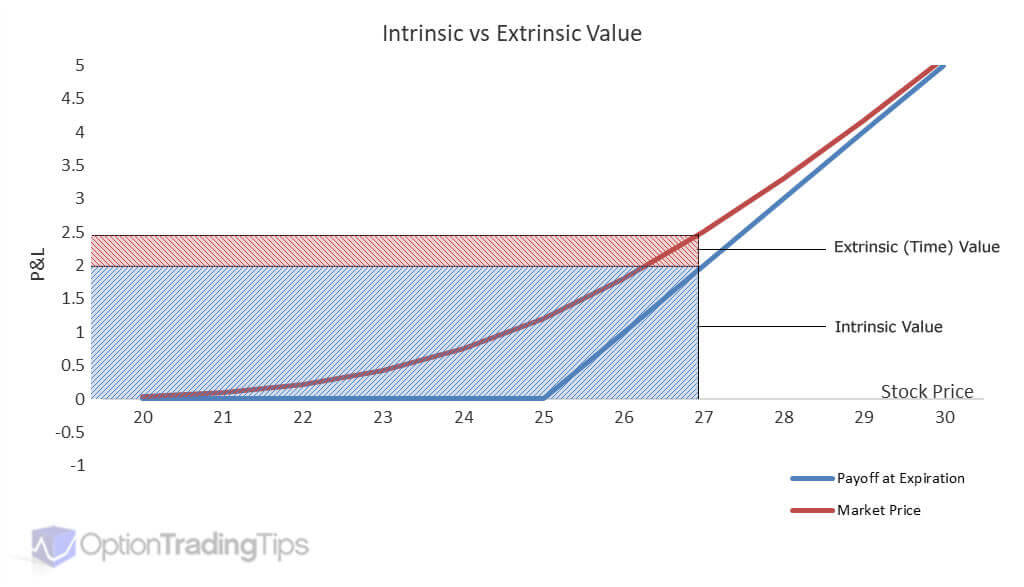

When a trader purchases an option, they invest a certain amount known as the premium. This premium comprises two components: intrinsic value and time value. Intrinsic value represents the difference between the strike price and the current price of the underlying asset. Time value, on the other hand, reflects the potential for the option to gain value as the expiration date approaches.

Time value is primarily influenced by three factors:

- Time to expiration: The longer the time remaining until expiration, the greater the likelihood that the underlying asset will experience favorable price movements, enhancing the option’s time value.

- Volatility: Higher volatility in the underlying asset’s price increases the potential for significant fluctuations, amplifying the time value of options.

- Interest rates: Interest rates impact the time value of options by influencing the cost of carry. Higher interest rates tend to reduce time value as investors can earn a greater return by holding cash or investing in other interest-bearing assets.

Calculating Time Value using the Black-Scholes Model

The Black-Scholes model is a widely used formula for determining the fair value of an option. It incorporates various parameters to estimate the intrinsic and time value components. The formula is expressed as follows:

C = S N(d1) – X e^(-rT) * N(d2)

where:

- C: Call option price

- S: Underlying asset’s current price

- X: Strike price of the option

- r: Risk-free interest rate

- T: Time to expiration (in years)

- N(d1) and N(d2): Cumulative distribution function of the standard normal distribution

By plugging in the appropriate values for these parameters, traders can determine the theoretical fair value of an option, including its time value component.

Implications for Option Trading

Grasping the concept of time value empowers options traders with valuable insights. Understanding how time value erodes as expiration approaches can help traders plan their trading strategies and make informed decisions about option holding periods. Additionally, recognizing the impact of volatility, interest rates, and price movements on time value can assist in identifying potential trading opportunities and managing risk.

Image: designersholoser.weebly.com

Tips and Expert Advice for Calculating Time Value

- Utilize online calculators: Numerous online tools and calculators are available to simplify the calculation of time value using the Black-Scholes model.

- Monitor market trends: Stay informed about news and events that could potentially influence volatility and interest rates, thereby impacting time value.

- Consider the underlying asset’s historical price movements: Analyze the historical volatility and price patterns of the underlying asset to make better-informed assumptions about future price movements.

FAQs on Time Value in Option Trading

Q: How does time value impact option strategies?

A: Time value plays a pivotal role in determining the profitability of option strategies. Options with longer time to expiration generally have higher time value, making them potentially more profitable if the underlying asset’s price moves favorably.

Q: Can time value be negative?

A: Yes, time value can be negative if the intrinsic value is greater than the option’s premium. This situation typically occurs when the option is deep in-the-money and has little time remaining until expiration.

How To Calculate Time Value In Option Trading

Conclusion

Understanding how to calculate time value in option trading is essential for savvy investors. By incorporating time value into trading decisions, traders can enhance their ability to navigate market fluctuations, identify potential trading opportunities, and manage risk. Whether you’re a seasoned trader or just beginning your journey in options, nắm vững the nuances of time value will empower you to make more informed and successful trading decisions.

Are you eager to unravel further intricacies of time value in option trading? Dive deeper by exploring specialized resources, connecting with experienced traders, and continuously honing your trading skills through practice and learning. The world of option trading awaits your curious exploration!