In the realm of options trading, understanding the distinction between premium and non-premium options is crucial. It empowers traders to make informed decisions and optimize their strategies. This guide will delve into the nuances of options pricing, providing a comprehensive understanding of premium determination and its significance.

Image: idahc.com

Premium Options: A Detailed Overview

An options premium refers to the price paid by the buyer to acquire the right to buy (in the case of call options) or sell (in the case of put options) an underlying asset at a specific price (strike price) on or before a particular date (expiration date). This premium encompasses two components: intrinsic value and time value.

Intrinsic Value:

The intrinsic value represents the inherent value of an option based on its current market conditions relative to the strike price. For call options, it is calculated as the difference between the current asset price and the strike price if positive; otherwise, it is zero. For put options, the intrinsic value is determined by subtracting the strike price from the current asset price if positive; otherwise, it is zero.

Time Value:

The time value reflects the potential profit that an option holder anticipates will accrue before the expiration date. It is an estimate of the premium an option buyer is willing to pay for the opportunity to profit from future price movements of the underlying asset.

Time value decays gradually as the expiration date approaches, as there is less time for the option to appreciate in value. However, factors such as volatility, interest rates, and supply and demand can also influence time value. High volatility and low interest rates tend to increase time value, while the opposite conditions can lead to its decline.

Image: club.ino.com

Identifying Premium Options

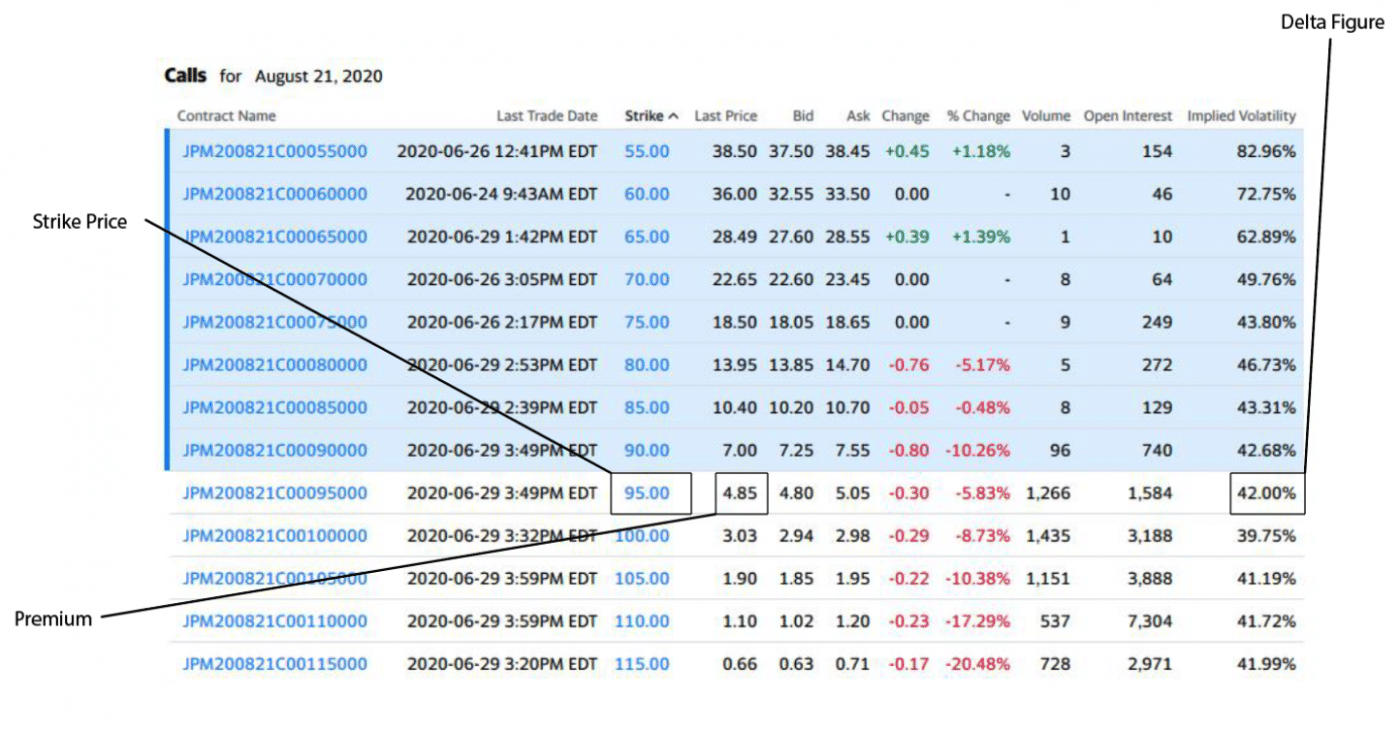

Traders often rely on various indicators to identify premium options in trading platforms. One common approach is to observe the options chain, a tabular display of available options for a specific underlying asset, sorted by their strike prices and expiration dates. Options with higher premiums are typically found towards the top of the chain.

Additionally, implied volatility (IV) is a key indicator of option premium. IV measures the market’s expectation of the future volatility of an underlying asset. Higher IV generally implies higher option premiums, as traders are willing to pay more for the potential of significant price fluctuations.

Tips and Expert Advice

- Consider the underlying asset’s price and volatility when evaluating options premiums.

- Monitor IV and factor it into your premium assessment.

- Use options chains to compare premiums across different strike prices and expiration dates.

- Research and understand how various factors (liquidity, interest rates, market sentiment) influence premiums.

- Consult with experienced traders or financial advisors to gain insights into premium valuation.

FAQ

- What is the difference between premium and non-premium options?

- How can I determine the time value of an option?

- What factors affect the premium of an option?

Premium options have a positive intrinsic value, indicating that they could potentially be exercised for a profit immediately. Non-premium options have no intrinsic value, meaning they expire worthless unless the underlying asset price moves significantly.

Time value is calculated as the difference between the option’s premium and its intrinsic value.

Factors such as the underlying asset’s price, volatility, time to expiration, interest rates, and supply and demand can all influence option premiums.

Conclusion

Mastering the distinction between premium and non-premium options is a pivotal skill for successful trading. By comprehending the factors that influence option premiums, traders can make informed decisions about which options to trade and how to position their strategies. Whether you are a seasoned trader or just starting to explore the world of options, understanding premium dynamics is essential for maximizing your potential profits and navigating the market with confidence.

How Do You Tell If Options Are Premium When Trading

![Foundations of Trading: Options [Part 4] • TradeSmart University](https://tradesmartu.com/wp-content/uploads/2022/05/options_cover1-1024x576.jpeg)

Image: tradesmartu.com

Are you interested in learning more about options trading?