In the realm of options trading, receiving the dreaded “I got called” notification can be both a rewarding and sobering experience. But what exactly does this enigmatic phrase entail? In simple terms, when an option contract you’ve sold is exercised, you’ve “got called,” meaning the buyer has the right to acquire (call option) or sell (put option) the underlying asset at a specified price. While this can yield handsome profits, executing the contract also carries significant responsibilities.

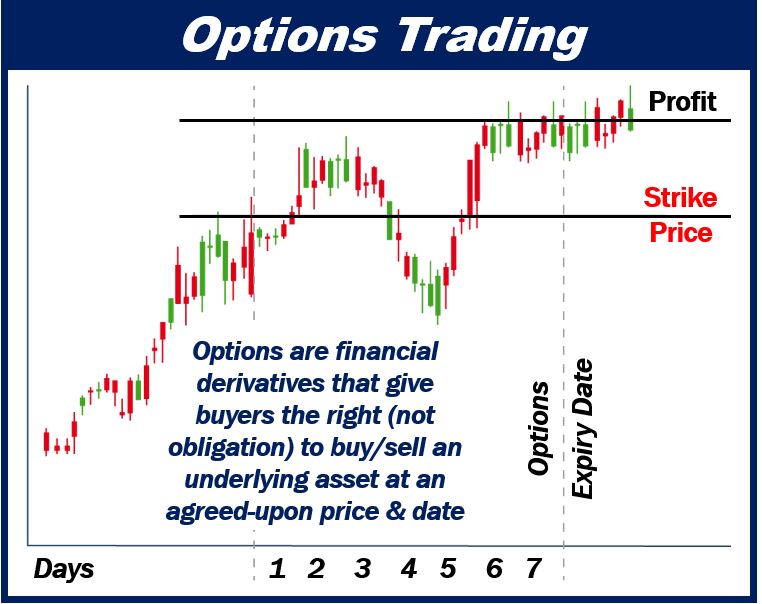

Image: marketbusinessnews.com

Delving into the Options Trading Arena

Understanding options trading requires a solid grasp of several foundational concepts. An option contract grants the buyer the right, but not the obligation, to buy (call option) or sell (put option) a specific asset at a predetermined price, known as the strike price. These contracts have a limited lifespan, with expiration dates that dictate the duration of their validity.

The volatility of the underlying asset plays a crucial role in the value of an option. When the market is turbulent, options tend to fetch higher premiums, providing astute traders with opportunities to capitalize on price fluctuations. However, with great potential comes elevated risk, so approaching options trading with prudence and a comprehensive understanding is paramount.

Exercising Options: The Nuances of “I Got Called”

When a call option is exercised, the buyer has the authority to purchase the underlying asset at the strike price. This happens when the market price of the asset surpasses the strike price, creating an arbitrage opportunity for the buyer. The seller, on the other hand, is compelled to deliver the asset to the buyer at the agreed-upon price, regardless of whether it aligns with the current market value.

Conversely, when a put option is exercised, the buyer has the right to sell the underlying asset at the strike price. This occurs when the market price of the asset falls below the strike price, prompting the seller to acquire it at the higher strike price, potentially incurring losses.

Mastering the Art of Options Trading

To excel in options trading, one must possess a thorough understanding of market dynamics, including volatility, liquidity, and time decay. Volatility gauges the magnitude of price fluctuations, affecting the value of options. Liquidity determines the ease with which options can be bought or sold, influencing their premiums. Time decay, on the other hand, reflects the gradual decline in an option’s value as its expiration date approaches.

Image: www.youtube.com

Strategies for Navigating the Market

Options trading encompasses a wide array of strategies, each catering to specific investment objectives and risk tolerances. Some strategies include:

- Bull Call Spread: This involves simultaneously buying a lower strike price call option and selling a higher strike price call option, profiting from a rise in the underlying asset’s price while limiting risk.

- Bear Put Spread: The inverse of the bull call spread, this strategy entails buying a higher strike price put option and selling a lower strike price put option, benefiting from a decline in the underlying asset’s price.

- Covered Call: Here, one sells a call option against an underlying asset they own, generating income from the premium while retaining the potential upside if the asset’s price rises.

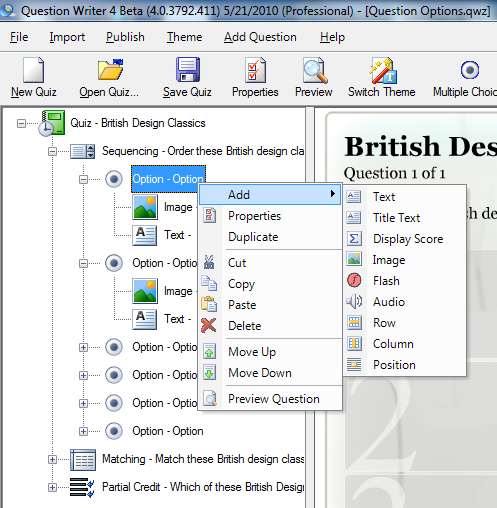

Options Trading I Got Called

Image: www.questionwriter.com

Conclusion: The Allure and Risks of Options Trading

Options trading offers both immense rewards and inherent risks, creating an alluring but potentially perilous arena for investors. Understanding the intricacies of options contracts, employing sound trading strategies, and diligently managing risk are essential for navigating this complex financial landscape.

Armed with knowledge and discipline, investors can harness the power of options to amplify their returns. However, it’s crucial to remember that options trading is not a quick-fix for wealth accumulation. Time, effort, and a robust understanding of the market are indispensable prerequisites for success in this exhilarating yet unforgiving realm.