Are you ready to venture into the world of options trading, where time and precision play crucial roles in every decision? Whether you’re a seasoned trader or just starting your options journey, understanding the ins and outs of trading hours is essential for maximizing your potential. In this comprehensive guide, we’ll explore the intricacies of options trading hours, focusing on the renowned platform Fidelity, to equip you with the knowledge you need to succeed in this fast-paced market.

Image: inflationprotection.org

Options, financial derivatives that grant the right to buy or sell an underlying asset at a specific price on or before a specified date, offer traders a myriad of opportunities for profit. However, it’s critical to understand when you can execute these trades to make informed decisions. Let’s delve into the world of options trading hours and Fidelity’s unique offerings.

The Trading Landscape: When Can You Trade Options?

In the world of options trading, timing is everything. The standard trading hours for most options exchanges, including Fidelity, follow the regular stock market hours. This means you can trade options during these designated periods:

- Monday-Friday: 9:30 AM to 4:00 PM Eastern Time (ET)

- Extended Trading Hours: Some options exchanges offer extended trading hours from 8:00 AM to 6:00 PM ET, allowing you to execute trades outside of regular market hours.

Fidelity’s Options Trading Hours: A Comprehensive Overview

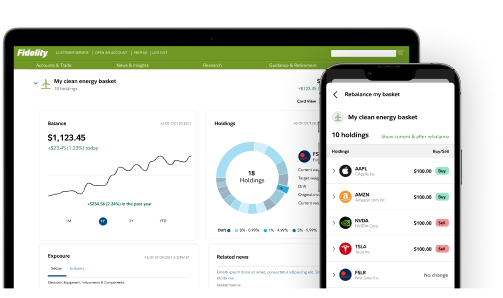

Fidelity, a leading brokerage firm, provides its clients with a comprehensive suite of options trading services. Here’s a detailed look at Fidelity’s options trading hours:

- Regular Trading Hours: Fidelity aligns with the standard market hours, enabling you to trade options from 9:30 AM to 4:00 PM ET from Monday to Friday.

- Pre-Market Trading: For those seeking an early start, Fidelity offers pre-market trading from 8:00 AM to 9:28 AM ET. This window allows you to enter or adjust orders before the official market open.

- Extended-Market Trading: Fidelity’s extended-market trading hours extend beyond the regular session, from 4:15 PM to 6:00 PM ET. This extended window provides flexibility for traders looking to execute trades after the market close.

Benefits of Extended Options Trading Hours

Extended options trading hours offer several advantages for traders, including:

- Increased Flexibility: Extended hours allow you to adjust positions or capitalize on market movements outside of regular trading hours.

- Reduced Market Risk: Trading during extended hours often involves lower trading volume, potentially minimizing the impact of market volatility on your positions.

- Improved Liquidity: While liquidity may be reduced compared to regular trading hours, extended hours can still provide opportunities for executing larger orders.

However, it’s important to note that extended trading hours come with different risk profiles and potential challenges:

- Reduced Trading Volume: Lower trading volume during extended hours can impact price discovery and may result in wider bid-ask spreads.

- Increased Volatility: Extended hours can be characterized by higher volatility due to the reduced participation of institutional traders.

- Liquidity Concerns: Some options may have lower liquidity during extended hours, making it more challenging to enter or exit positions quickly.

Image: ykumixyqatala.web.fc2.com

Mastering Options Trading Hours

To excel in options trading, it’s crucial to master the art of managing trading hours effectively. Here are a few tips to help you navigate the complexities of time-sensitive options trades:

- Plan Your Trades: Determine your trading strategy and entry and exit points before the market opens or during pre-market sessions.

- Monitor Market Conditions: Stay informed about upcoming economic events or news releases that may impact the underlying asset and option prices.

- Use Limit Orders: Limit orders allow you to specify the maximum or minimum price you’re willing to pay or receive for an option, providing control over your execution.

- Manage Risk: Employ risk management strategies such as stop-loss orders or position sizing to protect your capital from adverse price movements.

Options Trading Hours Fidelity

Image: mikkikerryann.blogspot.com

Conclusion

Understanding options trading hours is a cornerstone of successful options trading. By leveraging the insights and opportunities provided by Fidelity’s extensive trading hours, you can tailor your trading strategy to align with your unique risk tolerance and goals. Remember, mastery of time is key in the dynamic world of options trading, and Fidelity empowers you with the flexibility to execute your trades with precision and confidence.