Options trading is a complex and multifaceted financial strategy that requires a thorough understanding of the underlying principles and methodologies. To achieve consistent success in options trading, meticulous record-keeping is paramount, and options trading history sheets serve as an invaluable tool in this endeavor. This in-depth guide will delve into the intricacies of options trading history sheets, providing a comprehensive overview of their components, functionalities, and applications. We will also explore the latest trends and advancements in options trading history sheets, equipping you with the knowledge and strategies to optimize your trading performance.

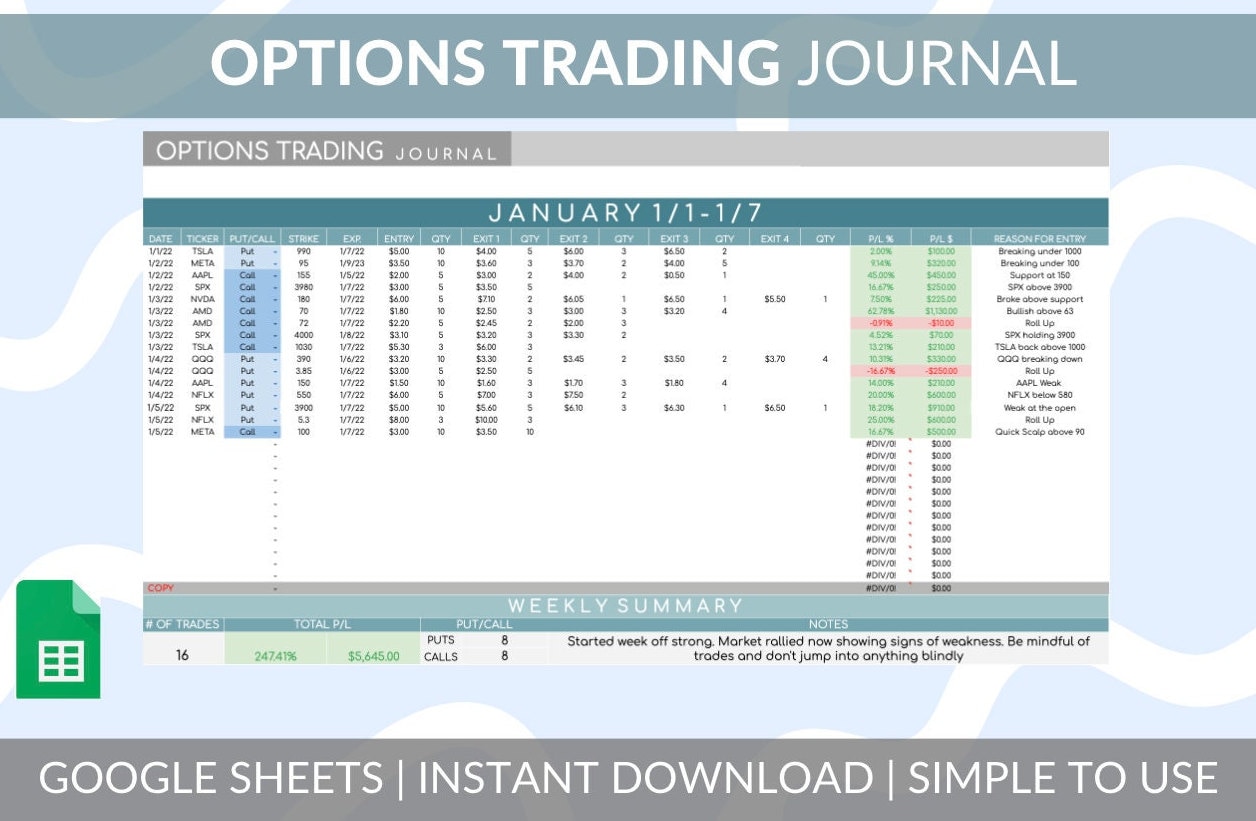

Image: www.etsy.com

A Comprehensive Definition of Options Trading History Sheets

Options trading history sheets are detailed records that meticulously track every trade executed by an options trader. They document essential data points such as the underlying asset, option type, strike price, expiration date, entry and exit prices, premium paid or received, net profit or loss, and commission fees. By diligently maintaining options trading history sheets, traders can gain invaluable insights into their trading patterns, performance, and areas for improvement. This systematic and organized approach to record-keeping empowers traders to make informed decisions, adjust their strategies, and ultimately maximize their profitability.

Historical Evolution and Significance of Options Trading History Sheets

The concept of options trading history sheets has evolved over time, reflecting the changing landscape of financial markets. In the early days of options trading, traders relied on handwritten notes and spreadsheets to track their trades. However, with the advent of computerized trading platforms, options trading history sheets have become increasingly sophisticated, featuring advanced data analysis capabilities and real-time updates. Today, electronic options trading history sheets are widely adopted by both retail and institutional traders, providing a wealth of information at their fingertips.

Essential Components of Options Trading History Sheets

To fully understand the power of options trading history sheets, it is crucial to delve into their essential components. The following elements play a vital role in providing a comprehensive overview of trading activity:

-

Underlying Asset: The underlying asset refers to the security or index upon which the option contract is based, such as stocks, commodities, currencies, or bonds.

-

Option Type: Options trading history sheets distinguish between call and put options, each with its unique characteristics and potential outcomes.

-

Strike Price: The strike price represents the predetermined price at which the underlying asset can be bought (for call options) or sold (for put options) upon exercise.

-

Expiration Date: This specifies the date on which the option contract expires and becomes worthless if unexercised.

-

Entry and Exit Prices: These prices record the respective prices at which the trader enters and exits an options trade.

-

Premium Paid or Received: The premium represents the amount of money paid by the option buyer (for call options) or received by the option seller (for put options) at the inception of the trade.

-

Net Profit or Loss: This metric calculates the overall financial outcome of the trade, taking into account the premium paid or received and the difference between the entry and exit prices.

-

Commission Fees: Commission fees are charged by the brokerage firm for executing trades and should be accurately recorded for accounting purposes.

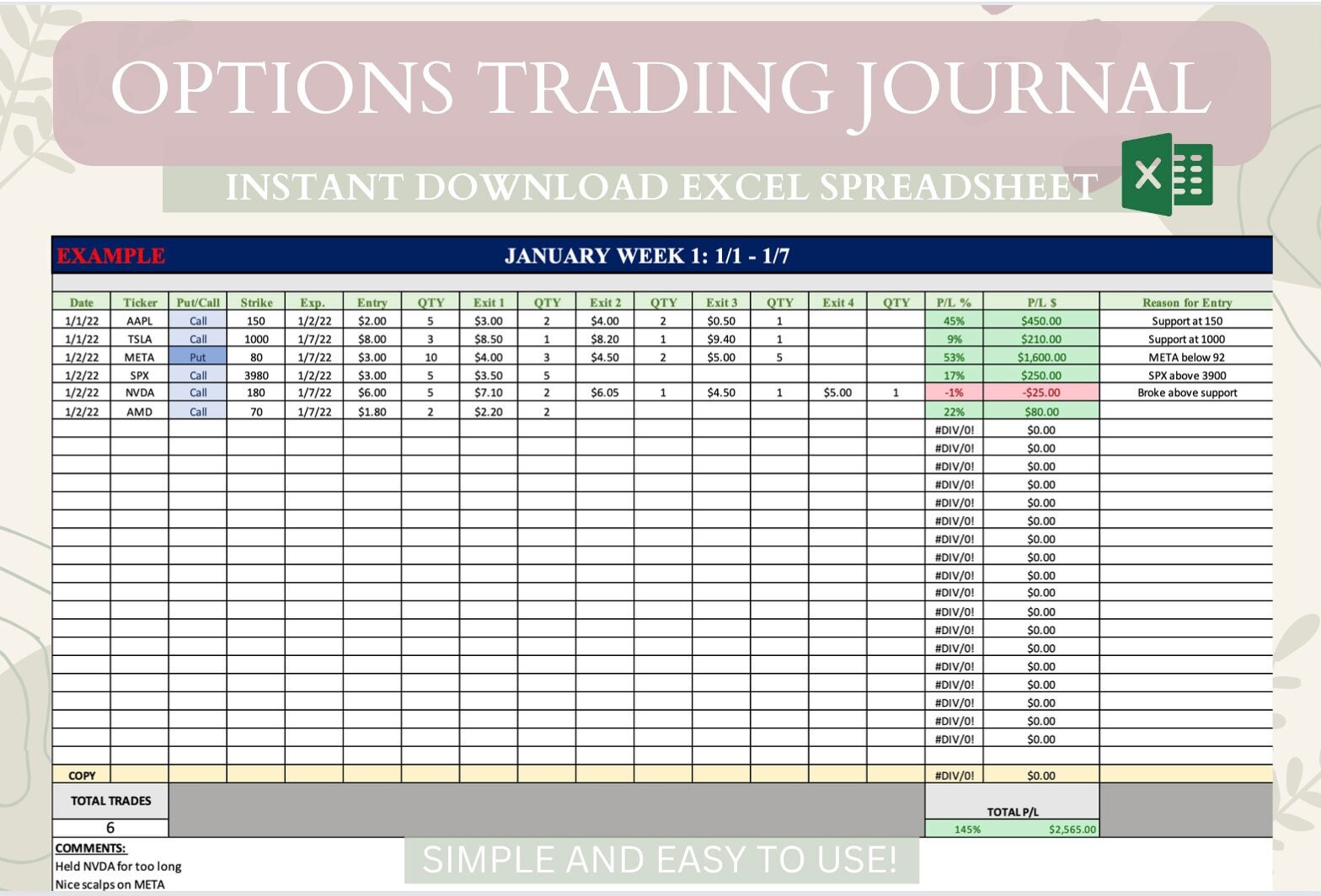

Image: www.etsy.com

Advantages and Applications of Options Trading History Sheets

Regularly maintaining options trading history sheets offers numerous advantages to traders of all levels:

-

Accurate Performance Tracking: Options trading history sheets provide an accurate and comprehensive record of trading performance, enabling traders to assess their overall profitability, win rate, and potential areas for improvement.

-

Risk Management: By analyzing historical data, traders can identify patterns and trends that help them refine their risk management strategies and mitigate potential losses.

-

Tax Reporting: Options trading history sheets serve as valuable documentation for tax reporting purposes, ensuring accurate calculations and minimizing potential tax liabilities.

-

Performance Comparison: Traders can compare their performance against different underlying assets, option types, strike prices, and expirations, identifying underperforming strategies and optimizing their portfolio allocation.

-

Educational Insights: Options trading history sheets facilitate self-education by providing a detailed roadmap of trading decisions and outcomes, enabling traders to learn from their experiences and refine their approaches.

Options Trading History Sheets Tmeplate

Image: tradeoptionswithme.com

Modern Trends and Advancements in Options Trading History Sheets

The field of options trading is constantly evolving, and options trading history sheets have kept pace with these advancements:

-

Real-Time Updates: Modern options trading history sheets are integrated with real-time data feeds, providing traders with up-to-date information on their trades and market conditions.

-

Advanced Analytics: Sophisticated data analysis tools embedded