Introduction:

Image: eaglesinvestors.com

Navigating the enigmatic world of options trading can be a daunting endeavor for the uninitiated. Envision yourself as a daring explorer venturing into an uncharted territory, armed with a profound quest for financial empowerment. This comprehensive guide will serve as your trusted compass, unraveling the complexities of options trading and equipping you with the knowledge and confidence to make informed decisions in this ever-shifting financial landscape.

Delving into the Options Trading Realm:

Options trading, in its essence, offers the right, but not the obligation, to buy or sell an underlying asset at a specified price on or before a certain date. These contracts grant you flexibility and leverage, empowering you to capitalize on potential market opportunities while mitigating financial risks.

A Journey into Options Basics:

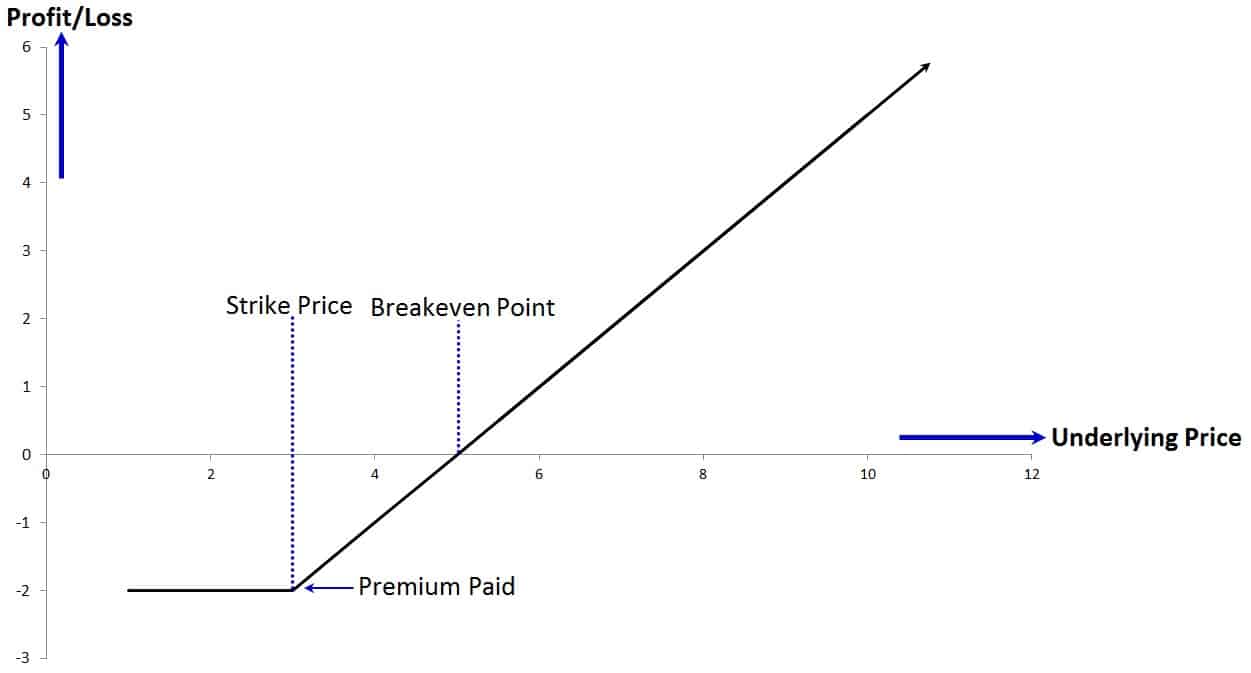

- Calls: Contracts that provide the buyer the right to purchase an asset at a predetermined price (strike price).

- Puts: Contracts that grant the buyer the right to sell an asset at a predetermined strike price.

- Expiration Date: The date on which the options contract expires, rendering it worthless.

Types of Options Trading Strategies:

- Covered Call: Selling a call option while owning the underlying asset.

- Cash-Secured Put: Selling a put option while holding sufficient cash to purchase the underlying asset.

- Bear Call Spread: A combination of buying and selling call options at different strike prices.

- Bull Put Spread: A combination of selling and buying put options at different strike prices.

The Art of Risk Management in Options Trading:

Options trading comes with inherent risks that demand a disciplined approach to risk management. Understanding delta, gamma, and vega – the Greek letters that measure the sensitivity of options prices to underlying factors – is crucial for assessing and managing these risks.

Seeking Expert Insights:

Navigating the complexities of options trading can be greatly enhanced by tapping into the knowledge and expertise of seasoned professionals. Industry analysts, financial advisors, and online resources provide valuable insights, helping you stay abreast of market trends and develop sound strategies.

Empowering Your Options Trading Journey:

Embrace a proactive approach to options trading by:

- Continuous Education: Dedicate time to learning from reputable sources and enhancing your knowledge base.

- Simulation and Virtual Trading: Utilize online platforms that offer simulated trading environments to gain practical experience without risking real capital.

- Seek Professional Guidance: Consider consulting with a financial advisor to tailor your options trading strategies to your unique goals and risk tolerance.

Conclusion:

Options trading holds immense potential for financial growth, yet it also demands a thorough understanding of its complexities and risks. By equipping yourself with the knowledge outlined in this comprehensive guide, coupled with a commitment to ongoing learning and responsible risk management, you can embark on your options trading journey with confidence, paving the road towards financial empowerment and successful navigation of the ever-changing markets.

Image: learn.financestrategists.com

Options Trading Form

Image: www.netpicks.com