Introduction

In the ever-evolving landscape of financial literacy, options trading has emerged as a compelling avenue for teens eager to delve into the world of investing. Unlike traditional stock purchases, options trading provides the unique ability to speculate on price movements without the outright ownership of the underlying asset. Whether you’re a seasoned investor or just beginning your financial journey, understanding options trading can empower you to make informed decisions while navigating the complexities of the stock market.

Image: bank2home.com

The realm of options trading opens up a vast array of opportunities for young investors. By acquiring a firm grasp of its fundamentals, teens can unlock the potential of compounding returns, develop a discerning eye for market analysis, and lay the groundwork for long-term financial success.

Unveiling the Essence of Options Trading

An option is essentially a contract that grants the buyer the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset, such as a stock, at a set price (strike price) on or before a specified date (expiration date).

Holders of call options anticipate a rise in the underlying asset’s price, while put options are typically employed when a decline in price is expected. The premium paid for an option represents the cost of acquiring this contractual right. Options trading involves the strategic buying and selling of these contracts in pursuit of potential profit generation.

Weighing the Advantages and Disadvantages

As with any financial instrument, options trading offers both advantages and drawbacks for young investors. Here are some key considerations:

Advantages:

- Potential for Magnified Returns: Options provide leverage, enabling the potential for amplified gains compared to traditional stock investments.

- Flexibility and Risk Management: Options allow for customized strategies that suit specific market expectations, providing flexibility in portfolio construction and risk mitigation.

- Income Generation: Options can be used to generate income through premium collection strategies, such as selling covered calls or cash-secured puts.

Image: traderma.com

Disadvantages:

- Complexity: Options trading requires a thorough understanding of market dynamics, options pricing models, and trading strategies.

- Risk of Loss: Options can involve substantial risk, and the potential for losses can exceed the premium paid.

- Time Sensitivity: Options have a limited lifespan, and their value decays as the expiration date approaches.

Understanding the Dynamics of Options Trading

Navigating the intricacies of options trading requires a grasp of core concepts:

Call Options:

- Provide the right to buy an underlying asset at a specified strike price before the expiration date.

- Used when a trader anticipates a price increase.

- Profitable when the underlying asset’s price exceeds the strike price plus premium paid.

Put Options:

- Grant the right to sell an underlying asset at a specified strike price before the expiration date.

- Employed when a trader expects a price decline.

- Profitable when the underlying asset’s price falls below the strike price minus premium paid.

Intrinsic Value:

- The inherent value of an option contract based on the difference between the underlying asset’s spot price and the strike price.

- Positive for call options when the asset price exceeds the strike price and for put options when the asset price is below the strike price.

Time Value:

- Reflects the remaining time until the option’s expiration date.

- Accounts for the uncertain future price movements of the underlying asset.

- Higher time value means the option is worth more, as there’s more time for the underlying asset’s price to potentially reach the strike price.

Unveiling Basic Options Trading Strategies

While numerous strategies exist, two popular approaches for beginners include:

Covered Calls:

- Selling a call option against shares of an underlying asset you own.

- Generates income from premium collection and benefits from a rising or stagnant stock price.

- Limits potential upside gains if the stock price surges significantly.

Cash-Secured Puts:

- Selling a put option while holding cash to cover the potential obligation to buy the underlying asset.

- Generates income from premium collection and obligates you to buy the asset at the strike price if it falls below that level.

- Provides a safety net if the stock price falls but caps potential profit if the price rises.

Essential Elements for Effective Options Trading

For teens venturing into options trading, adherence to sound principles is paramount:

- Education and Research: Meticulously study options concepts, trading strategies, and market dynamics.

- Risk Management: Determine your risk tolerance and only invest amounts you can afford to lose.

- Market Analysis: Conduct thorough research and analysis to identify potential trading opportunities.

- Discipline and Patience: Maintain a disciplined approach to trading, adhering to your strategy and refraining from impulsive decisions.

- Diversification: Spread your investments across multiple assets and strategies to mitigate risks.

Options Trading For Teens

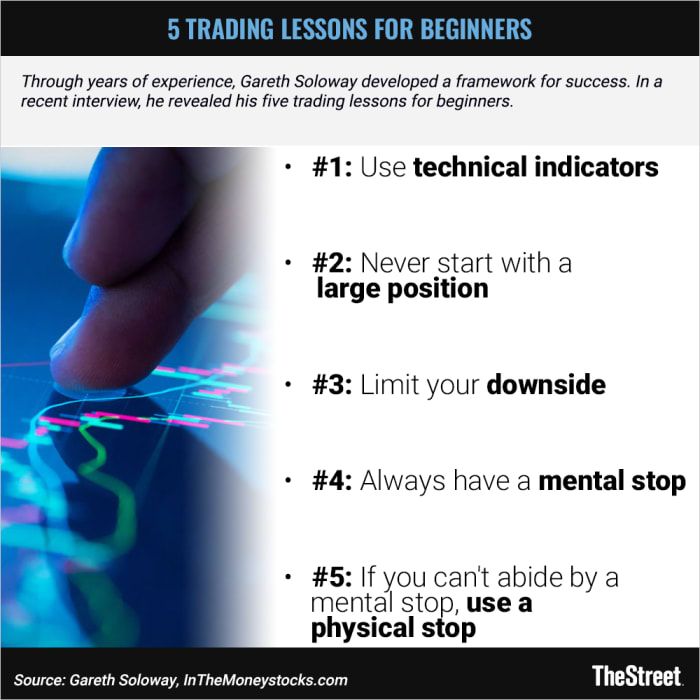

Image: www.thestreet.com

Conclusion

Embarking on options trading as a teenager can be an enriching and rewarding experience. By embracing the inherent opportunities while acknowledging the potential risks, you can cultivate a solid foundation for financial literacy and future financial success. Remember to approach options trading with a commitment to continuous learning, prudent risk management, and a long-term perspective. The realm of options trading awaits your exploration, so tread it with curiosity, enthusiasm, and a unwavering determination to excel.