Embrace the Market’s Potential for a Steady Income Stream

Embark on a transformative financial journey as you delve into the world of options trading for passive income. This savvy strategy allows you to harness market movements to generate a consistent cashflow, while mitigating risks compared to other investment avenues. Whether you’re a seasoned investor or a curious newcomer, this comprehensive guide will empower you with the knowledge and insights to navigate the options market and unlock its potential for financial freedom.

Image: www.audible.com.au

Options, derived from the Latin term “optio,” provide the holder with the right, but not the obligation, to buy or sell an underlying asset at a predetermined price. This unique characteristic enables investors to capitalize on both rising and falling markets. By carefully selecting options contracts based on their expiration dates, strike prices, and underlying assets, you can create strategic positions that potentially yield impressive returns.

Understanding the Options Market: A Journey into Financial Empowerment

The options market operates with two primary types of contracts: calls and puts. Call options grant the holder the right to buy, while put options offer the right to sell. Each contract represents a specific number of shares of the underlying asset, with the right to exercise the option on or before a predetermined expiration date.

Options premiums, which represent the cost of purchasing an option contract, are influenced by factors such as the strike price, expiration date, underlying asset’s price volatility, and market conditions. Understanding these dynamics is crucial for making informed decisions and maximizing profit potential.

Trending Developments in Options Trading: Stay Ahead of the Curve

The options market is constantly evolving, influenced by technological advancements, regulatory changes, and shifting market dynamics. Staying abreast of emerging trends and strategies can provide a significant edge for savvy investors.

Recent advancements include the proliferation of online trading platforms offering user-friendly interfaces, access to real-time market data, and sophisticated options trading tools. Social media platforms and online forums have emerged as vibrant marketplaces for sharing trading ideas, insights, and market analysis.

Expert Advice and Tips: Navigating Options Trading Success

Harnessing the insights of financial experts can accelerate your learning curve and enhance your trading acumen. Here are some valuable tips to set you on the path to success:

1. Research, Research, Research: Familiarize yourself with options terminology, contract structures, and market dynamics. Explore educational resources, attend workshops, and consult with experienced traders.

2. Manage Risk Prudently: Options trading involves inherent risks, so it’s crucial to establish risk management strategies. Determine your risk tolerance, limit your trading positions, and employ stop-loss orders.

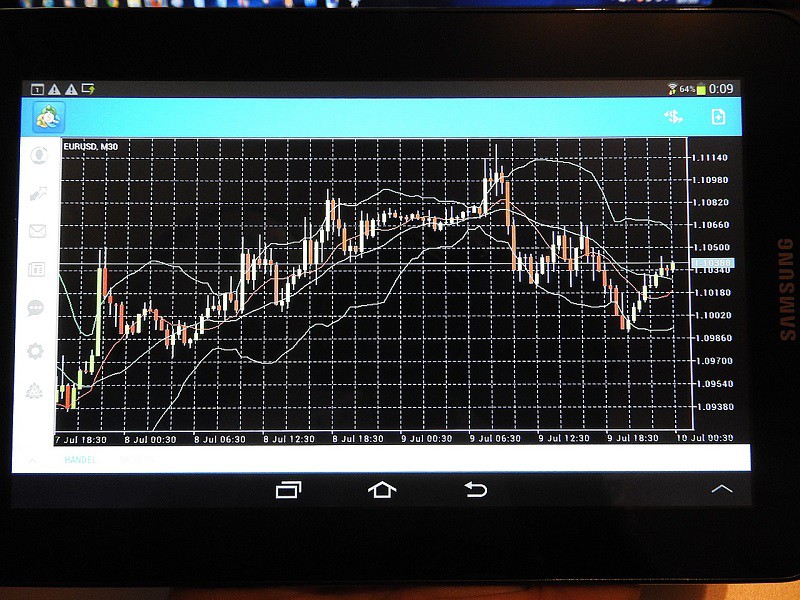

Image: www.walmart.com

Frequently Asked Questions: Illuminating the Options Market

Q: What’s the difference between a call option and a put option?

A: A call option gives the holder the right to buy, while a put option provides the right to sell.

Q: Can I profit from options trading even if the market is falling?

A: Yes, using put options, you can potentially profit when the underlying asset’s price declines.

Q: How do I determine the right options contract for my strategy?

A: Consider factors like strike price, expiration date, and market volatility to select an option contract that aligns with your trading objectives and risk management approach.

Options Trading For Passive Income

Image: nopassiveincome.com

Conclusion: Embracing Options Trading for Financial Empowerment

Options trading offers a compelling opportunity to generate passive income and enhance your financial resilience. By mastering the principles, embracing the latest trends, and implementing expert advice, you can leverage market movements to achieve your financial goals. Are you ready to embrace the transformative power of options trading and unlock the potential for a steady income stream?