Immerse yourself in the exhilarating realm of options trading, where abundant opportunities await. However, embarking on this journey requires an understanding of the eligibility criteria that govern access to this financial arena. Join me as we delve into the captivating world of options trading eligibility, unlocking its intricacies and empowering you to embrace the boundless possibilities it presents.

Image: www.pinterest.com

Know Your Options Trading Eligibility

Understanding your options trading eligibility is paramount to ensuring a smooth and successful trading experience. The Securities and Exchange Commission (SEC) has established regulations that determine who is eligible to trade options, safeguarding the integrity and stability of the market. These regulations aim to protect investors from potential risks associated with options trading and ensure that only knowledgeable and experienced individuals engage in such activities.

To ascertain your options trading eligibility, you must meet certain criteria set forth by your brokerage firm. Typically, these criteria include:

- Age: The minimum age to trade options varies by brokerage firm but generally falls between 18 and 21 years old.

- Investment experience: Brokerage firms may require you to demonstrate sufficient investment experience before granting you options trading privileges.

- Income and net worth: Some brokerage firms may consider your income and net worth when assessing your eligibility for options trading.

- Knowledge and understanding: You may be required to pass a knowledge test or complete educational courses to demonstrate your understanding of options trading.

- Risk tolerance: Options trading involves inherent risks, and brokerage firms need to ensure that you fully comprehend these risks and have an appropriate risk tolerance before granting you access.

Navigating the Eligibility Process

Navigating the eligibility process for options trading typically involves the following steps:

- Choose a brokerage firm: Select a reputable brokerage firm that offers options trading services. Research different firms to find the one that best aligns with your needs and experience level.

- Complete an application: Submit an application to the brokerage firm outlining your investment experience, income, net worth, and risk tolerance.

- Provide documentation: Gather and submit any necessary documentation to support your application, such as proof of income, account statements, and employment history.

- Pass knowledge test: Some brokerage firms may require you to pass a knowledge test to assess your understanding of options trading concepts and risks.

- Get approved: Once your application is reviewed and approved, you will be granted options trading privileges.

Expert Tips for Enhancing Your Application

To increase your chances of qualifying for options trading eligibility, follow these expert tips:

- Demonstrate ample investment experience: Highlight your experience in investing in stocks, bonds, or mutual funds, as it indicates your familiarity with financial markets.

- Emphasize financial stability: Present evidence of a stable income and net worth to demonstrate your ability to withstand potential losses associated with options trading.

- Seek regulatory compliance knowledge: Familiarize yourself with the SEC’s regulations governing options trading, showcasing your commitment to ethical and compliant practices.

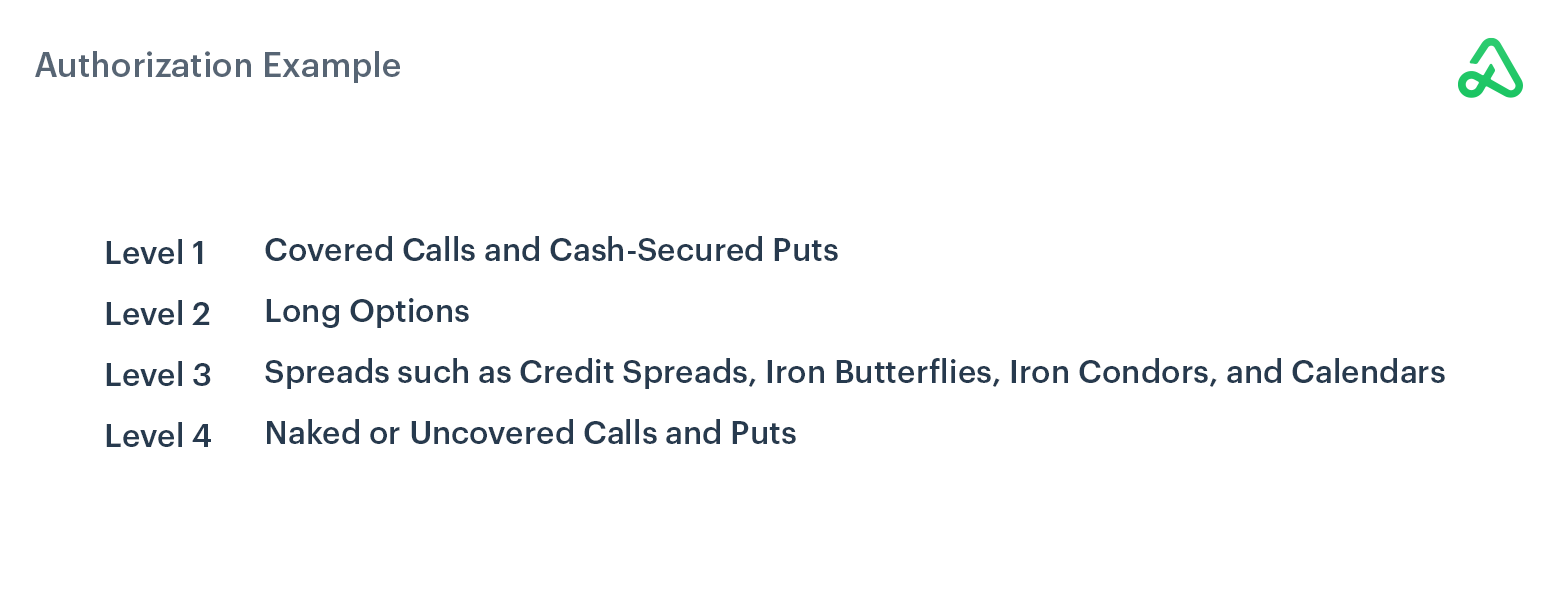

- Learn fundamental option strategies: Gain an understanding of basic option strategies, such as buying and selling calls and puts, to demonstrate your knowledge of the subject matter.

- Consult with a financial advisor: Seek guidance from a qualified financial advisor who can assess your eligibility and provide tailored advice.

Image: dcf.fm

FAQs on Options Trading Eligibility

Here are answers to some frequently asked questions regarding options trading eligibility:

- Can I trade options if I am under 18?

- What if I do not have a lot of investment experience?

- Does my income and net worth affect my eligibility?

- Can I appeal a denied application for options trading eligibility?

- Is it possible to trade options without being approved for options trading eligibility?

No, you must be at least 18 years old to trade options.

You may still be eligible to trade options, but you may need to complete additional educational courses and demonstrate a thorough understanding of the risks involved.

Some brokerage firms may consider your income and net worth to ensure you have sufficient financial resources to trade options.

Yes, you can appeal a denied application by providing additional information or completing additional training.

No, trading options without being approved for options trading eligibility is illegal and can result in severe consequences.

Options Trading Eligibility

Image: tradewithmarketmoves.com

Conclusion

Navigating options trading eligibility is a crucial step towards unlocking the boundless opportunities within this exciting financial arena. By meeting the established criteria, you demonstrate your commitment to responsible and informed trading practices. Remember, knowledge is power, and a thorough understanding of the risks and rewards associated with options trading is essential for long-term success. Embrace the challenge of eligibility and seize the chance to explore the world of options trading with confidence.

Are you eager to delve deeper into the world of options trading? Engage with us today and embark on a journey of financial exploration that will empower you to conquer the markets with knowledge and strategy.