Are you weary of watching potential profits slip through your fingers due to unpredictable market fluctuations? Embrace the transformative power of TRO trading and master the art of capitalizing on trend reversals. In this comprehensive guide, we’ll delve into the intricacies of TRO options, empowering you to unlock the secrets of this powerful trading strategy.

Image: www.forexfactory.com

Unveiling TRO: A Game-Changer in Option Trading

TRO (Trend Reversal Options) are a sophisticated strategy designed to harness opportunities arising from price trend reversals. Unlike traditional options that profit from sustained price movements, TRO options thrive in volatile markets characterized by sudden and often unexpected price shifts.

By employing a carefully calibrated combination of options with different expirations and strike prices, TRO traders aim to capture both the upward and downward momentum of price movements. This innovative approach allows them to profit from both bullish and bearish markets, significantly diversifying their risk exposure.

Dissecting theTRO Strategy: A Blueprint for Success

To fully comprehend the mechanics of TRO trading, let’s break it down into its core components:

-

Trend Identification: The foundation of TRO strategy lies in identifying potential trend reversals. Technical analysis tools, such as moving averages and support/resistance levels, provide valuable insights into market trends.

-

Option Selection: Once a trend reversal is anticipated, traders carefully select a combination of options with appropriate expirations and strike prices. This selection process involves assessing factors such as market volatility and the trader’s risk tolerance.

-

Hedging: TRO trading often incorporates hedging strategies to mitigate risk exposure. Traders balance their positions by buying or selling options with opposite orientations or different underlying assets. This diversification strategy enhances risk management and optimizes profit potential.

Expert Insights: Unlocking the Secrets of TRO Trading

“In volatile markets, TRO options offer a unique advantage,” says industry expert Sarah Jones. “By meticulously identifying trend reversals and employing appropriate option combinations, traders can effectively capture market inefficiencies and maximize profit opportunities.”

“Remember,” emphasizes seasoned trader Mark Thompson, “risk management is paramount inTRO trading. Utilize hedging strategies and exercise sound judgment to safeguard your capital while pursuing potential rewards.”

Image: www.mql5.com

Empowering You with Actionable Tips

-

Master the Art of Trend Analysis: Enhance your technical analysis skills to identify trend reversals with greater accuracy.

-

Diversify Your Options Portfolio: Spread your risk across various options with differing expirations and strike prices.

-

Embrace Risk Management: Implement hedging strategies to mitigate risk exposure and protect your profits.

-

Discipline is Key: Adhere to your trading plan and avoid emotional decision-making.

-

Seek Continuous Education: Stay abreast of market trends and advancements in TRO trading techniques.

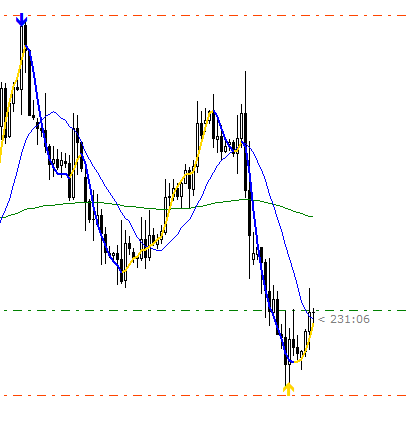

Tro Trading Trend Reversal Option Strategy

Image: forexwot.com

Conclusion: Embark on Your TRO Trading Journey

With the knowledge and insights gained from this comprehensive guide, you’re now equipped to venture into the world of TRO trading. Remember, success in any trading strategy hinges upon meticulous analysis, sound decision-making, and effective risk management.

Harness the transformative power of TRO options to unlock the potential of trend reversals. By embracing this powerful strategy, you’ll gain the upper hand in navigating volatile markets and increase your chances of achieving trading success.