Introduction

As an avid options trader, I have often encountered the term “mark of underlying” and its crucial significance in the world of options trading. It represents the current market value of the underlying asset, be it a stock, index, commodity, or currency, at which the option premium is calculated. Understanding the mark of underlying is essential for option traders to make informed decisions and capitalize on market opportunities.

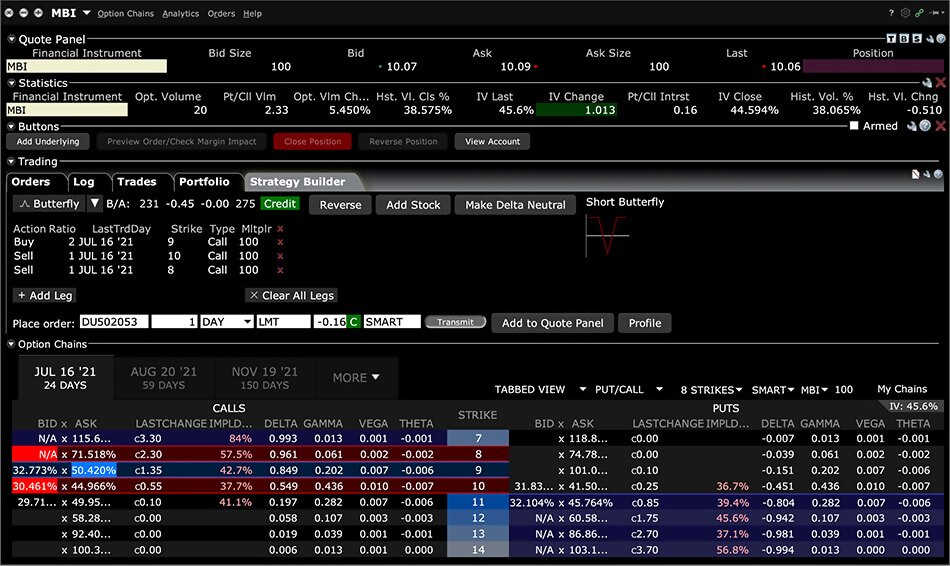

Image: www.interactivebrokers.com

Meaning of Mark of Underlying

Simply put, the mark of underlying is the real-time price of the underlying asset that an option represents. This price serves as the reference point for determining the option’s premium, which is the price paid or received to purchase or sell an options contract. The mark of underlying is typically sourced from reliable market data providers or exchanges where the underlying asset is traded.

Importance of Mark of Underlying

The mark of underlying plays a pivotal role in option trading for several reasons:

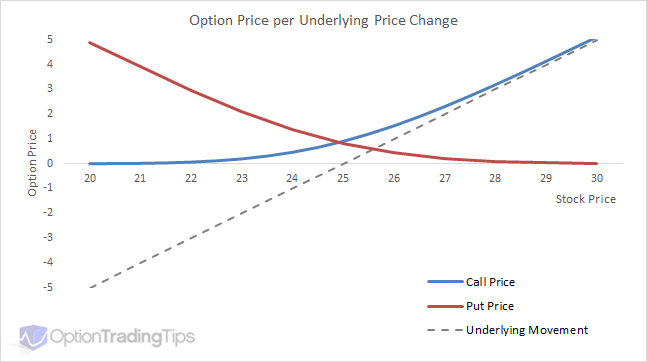

- Premium Calculation: The option premium is directly influenced by the mark of underlying. Changes in the underlying’s price will lead to corresponding adjustments in the option’s premium, making it a crucial factor in pricing options.

- Volatility Sensitivity: The relationship between the mark of underlying and option premium is affected by volatility, which measures the rate of change in the underlying’s price. Higher volatility generally means a higher option premium.

- Risk Assessment: Understanding the mark of underlying helps traders assess the potential risks associated with an option trade. Traders can use this information to determine the breakeven price where they would neither lose nor gain.

How Mark of Underlying is Determined

The mark of underlying is typically determined through a combination of market data analysis and modeling techniques. Here are some common methods:

- Real-Time Market Data: Data sources provide real-time market prices for underlying assets, which are used to establish the mark of underlying.

- Historical Data Analysis: Traders may use historical price data to identify patterns and trends in the underlying’s price behavior, aiding in the estimation of the mark of underlying.

- Statistical Modeling: Sophisticated statistical models can be employed to predict the future price of the underlying based on historical data and other market factors, which can inform the mark of underlying.

Image: www.usedhomeremodeling.com

Mark of Underlying in Practice

In practice, the mark of underlying is used by option traders in multiple ways:

- Pricing Options: Traders use the mark of underlying to calculate the fair value of an option contract, enabling them to make informed decisions on whether to buy or sell.

- Risk Management: By understanding the mark of underlying and its potential impact on the option’s premium, traders can adjust their positions accordingly to manage risk.

- Trading Strategies: Experienced traders often use mark of underlying to implement complex trading strategies, such as delta hedging and volatility arbitrage.

Tips for Using Mark of Underlying

Here are a few tips for traders to effectively utilize the mark of underlying in their trading:

- Consider Historical Volatilities: Historical volatility of the underlying asset can influence the option premium. Traders should analyze the volatility patterns to assess the potential price range of the underlying.

- Monitor Market News: Stay updated with the latest market news and events that may affect the price of the underlying asset. This information can help traders anticipate potential changes in the mark of underlying.

- Use Reliable Data Source: Ensure the accuracy and credibility of the data source providing the mark of underlying to avoid misinformation or delays.

FAQs on Mark of Underlying

Q: How does the mark of underlying affect option premiums?

A: Changes in the mark of underlying directly impact option premiums, either increasing or decreasing them, making it a crucial factor in pricing options.

Q: How can I calculate the mark of underlying myself?

A: While data sources typically provide the mark of underlying, some traders use historical price analysis or statistical models to estimate it independently.

Q: Why is it important to understand the mark of underlying?

A: Understanding the mark of underlying enables option traders to calculate option premiums accurately, assess potential risks associated with an option trade, and implement effective trading strategies.

What Is Mark Of Underlying In Option Trading

Image: www.optiontradingtips.com

Conclusion

The mark of underlying is a fundamental concept in option trading that represents the current market value of the underlying asset. Understanding its significance and how it is determined helps traders make informed decisions on pricing options, managing risks, and executing trading strategies. By embracing the tips and insights discussed, traders can enhance their understanding of the mark of underlying and leverage its power to navigate the complex world of options trading.

Are you interested in learning more about the intricacies of option trading? I encourage you to delve into further research and discussions with experienced traders to broaden your knowledge and maximize your potential in this dynamic market.