In the world of finance, options trading offers the tantalizing prospect of amplifying returns and mitigating risks. However, to navigate this intricate arena, a solid foundation in options trading calculations is indispensable. This comprehensive guide will unveil the secrets of options trading calculations, empowering you to seize opportunities and manage risk confidently.

Image: sinkanurse.co.jp

As a seasoned trader, I vividly recall the pivotal moment when a thorough understanding of options trading calculations propelled me to unprecedented success. The euphoria of executing precise trades, accurately gauging market risk, and extracting maximum value from options contracts became an exhilarating reality. Trust me, mastering these calculations is not just a step toward success; it’s the key that unlocks the gate.

The Essence of Options Trading Calculations

Options, financial instruments that confer the right but not the obligation to buy or sell an underlying asset at a predetermined price, hinge upon a complex interplay of factors. Intrinsic value, time value, volatility, and the underlying asset’s price all exert their influence on the pricing of options. Comprehending the interplay of these factors and employing accurate calculations empower traders to make informed decisions, maximizing potential profits while minimizing losses.

Decoding the Equation: Intrinsic Value and Time Value

Intrinsic value, the difference between the strike price and the current price of the underlying asset, reflects the immediate worth of an option. Time value, on the other hand, encapsulates the potential of an option to gain value over time. By understanding the intrinsic value and time value of an option, traders can assess its potential profitability and make calculated decisions.

Unveiling Volatility’s Impact

Volatility, measuring the fluctuation in the price of the underlying asset, plays a pivotal role in options pricing. High volatility indicates significant price swings, enhancing the potential for profit but amplifying the risk. Conversely, low volatility suggests a more stable market, reducing profit opportunities and risk exposure. Incorporating volatility into calculations allows traders to gauge the risk-reward profile of an options trade.

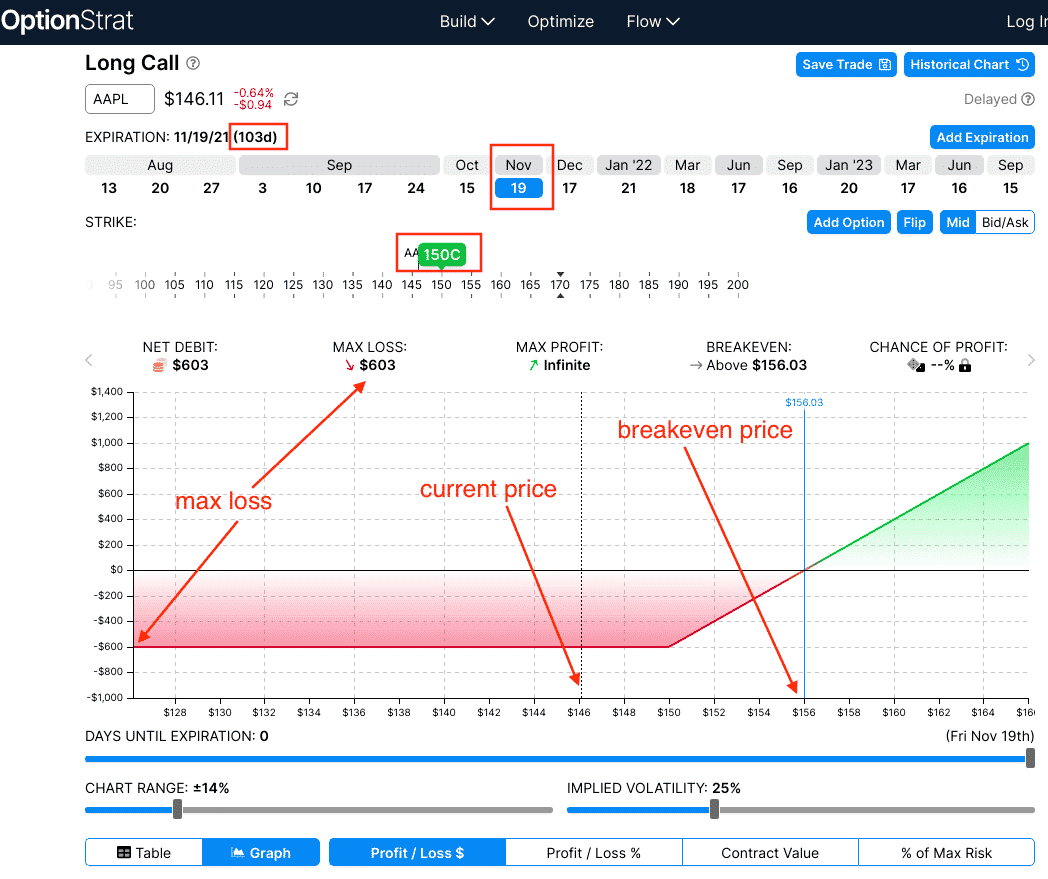

Image: alfaforex.ru

Harnessing the Power of Options Trading Calculations

Mastering options trading calculations unlocks a plethora of benefits. Accurate pricing enables traders to determine the fair value of an option, mitigating the risk of overpaying or underselling. Furthermore, calculations facilitate the assessment of potential profit and loss, enabling informed decision-making. By precisely calculating the risk-reward ratio, traders can meticulously manage their exposure.

Beyond valuation, options trading calculations empower traders to strategically construct options spreads, capitalizing on price movements and harnessing the interplay of different options. Whether it’s a bull call spread for bullish markets or a bear put spread for bearish scenarios, understanding calculations allows traders to tailor their strategies to specific market conditions and risk tolerance.

Expert Insights and Practical Tips

“Options trading Calculations are the GPS that guides traders through the complex terrain of options markets,” advises renowned options expert, Dr. Mark Sebastian. “Mastering these calculations empowers traders to navigate this dynamic landscape with precision and confidence.”

Echoing this sentiment, financial strategist, Mrs. Emily Carter, emphasizes, “The ability to accurately calculate option prices is a cornerstone of successful options trading. Understanding the nuances of these calculations unlocks the gateway to consistent profits and prudent risk management.”

Frequently Asked Questions (FAQs)

Q: How do I calculate the price of an option?

A: The price of an option is determined by a formula that considers factors such as the strike price, the underlying asset’s price, time to expiration, and volatility.

Q: What is the difference between intrinsic value and time value?

A: Intrinsic value represents the immediate worth of an option, while time value captures its potential to gain value over time.

Q: How does volatility affect option prices?

A: High volatility increases option prices due to the potential for significant price swings, while low volatility decreases prices due to reduced profit opportunities and risk exposure.

Options Trading Calc

Image: optionstradingiq.com

Embrace the World of Options Trading Calculations

Embarking on the path of mastering options trading calculations is akin to unlocking a treasure chest of knowledge. It not only enhances your understanding of the intricate mechanics of options markets but also equips you with the tools to navigate this dynamic landscape with precision. Whether you’re a seasoned trader or a novice eager to expand your horizons, investing the time and effort into comprehending these calculations will propel you toward success.

So, I urge you, embrace the challenge of mastering options trading calculations. Let this guide serve as your compass, leading you toward a deeper understanding of this rewarding investment strategy. The financial rewards and the thrill of calculated risk-taking await you. Are you ready to unlock your trading potential?