In the dynamic financial landscape, options trading stands as a potent tool that can amplify returns, hedge against market volatility, and unlock a world of investment possibilities. Among the various options strategies, “buying the underlying” emerges as a fundamental yet remarkably effective approach.

Image: www.fundsindia.com

Imagine yourself as a seasoned investor, eager to acquire a coveted asset but wary of market fluctuations. This is where options trading steps in, empowering you to own the underlying asset while strategically mitigating risks. By purchasing an option contract, you gain the right, not the obligation, to buy the underlying security at a predetermined price within a specified timeframe.

Delving into Options Trading: A Path to Empowerment

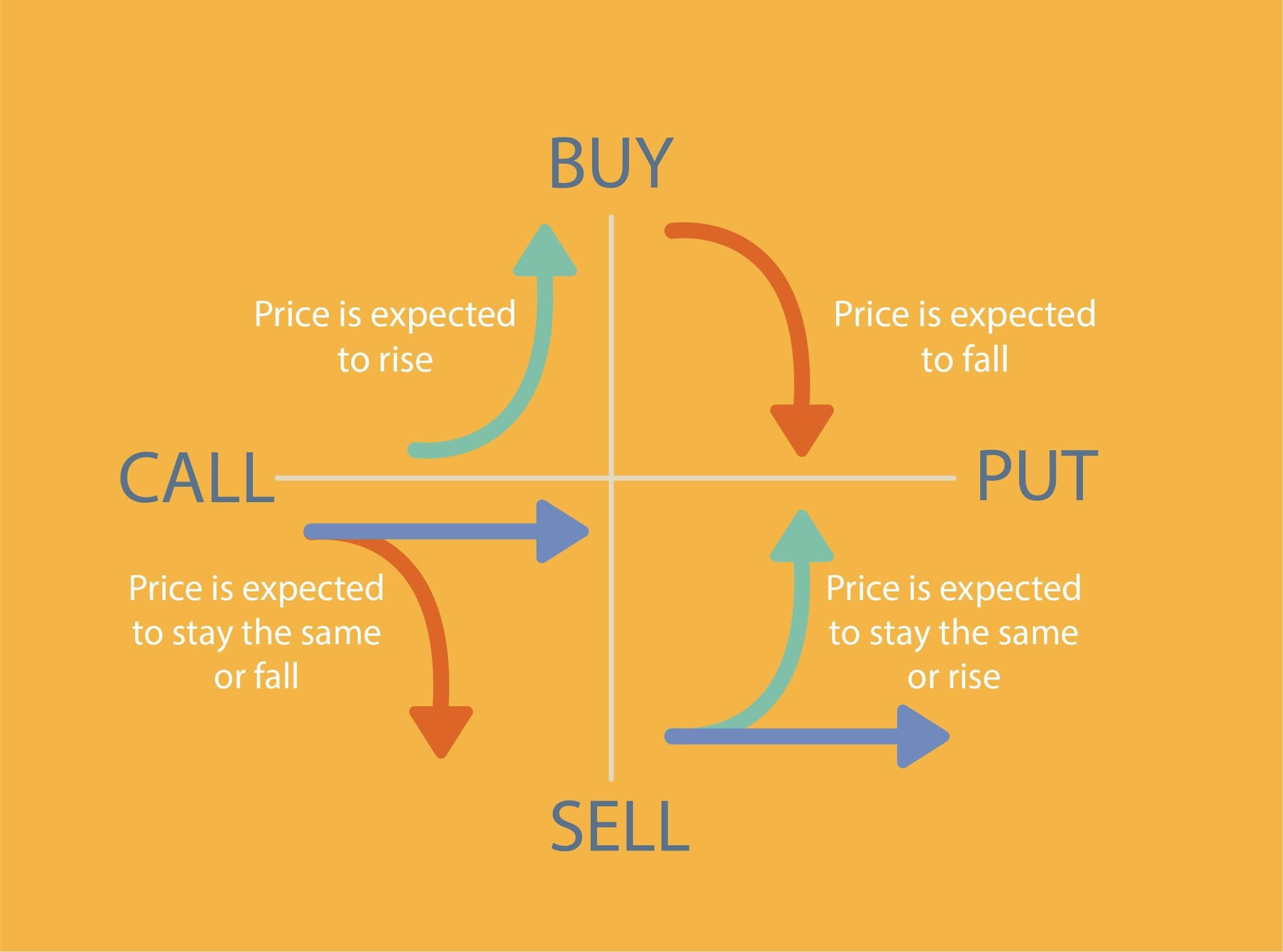

Options trading involves transacting contracts that represent the right to buy (call option) or sell (put option) an underlying asset at a predefined price, known as the strike price, on or before a specific date, known as the expiration date. Unlike futures contracts, options provide flexibility, allowing you to exercise your right to buy or sell at your discretion.

By buying the underlying, you effectively acquire the asset and assume ownership. This strategy enables you to take advantage of the potential appreciation in the asset’s value while safeguarding yourself against downside risks. If the market moves in your favor, you have the option to exercise your right to purchase the asset at the strike price, even if its market value exceeds that price.

Unlocking the Power of Buying the Underlying: A Key to Financial Success

Buying the underlying in options trading offers a multitude of benefits:

1. Controlled Investment Horizons: Unlike traditional stock purchases where you own the asset indefinitely, options provide flexibility to set your own investment horizon. You can choose to exercise your right to buy the underlying at any time until the expiration date. This control empowers you to adapt to changing market conditions and make informed decisions about your investment timeline.

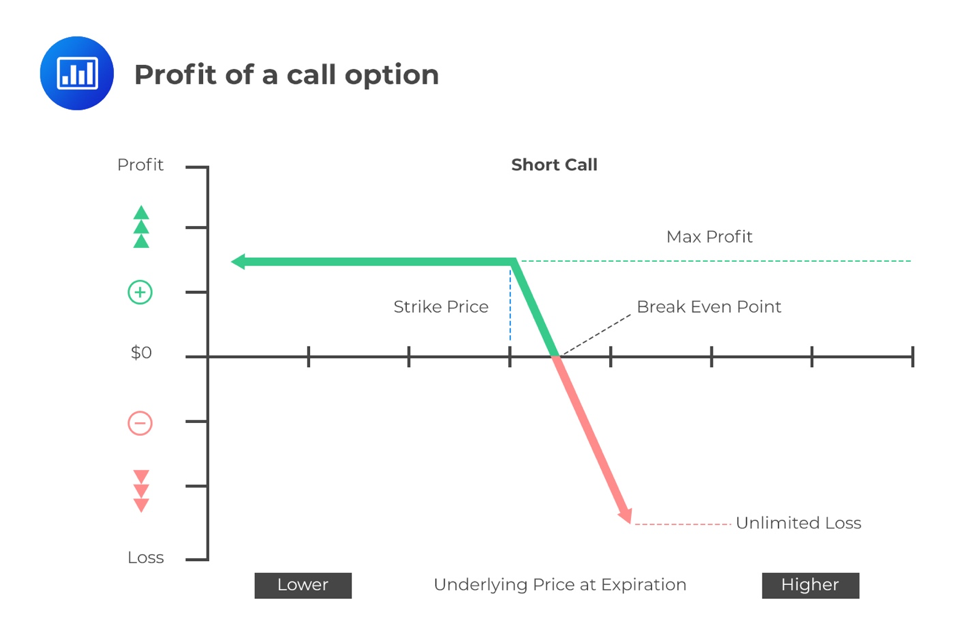

2. Limited Risk Exposure: Unlike buying the underlying asset directly, purchasing an options contract limits your potential loss to the premium you pay upfront. Even if the market moves against you, your maximum loss is defined and known. This risk mitigation is a crucial aspect that sets options trading apart.

3. Leverage Potential: Options trading leverages the power of leverage, enabling you to control a larger position with a smaller investment. By purchasing an options contract, you gain the potential to reap significant returns if the underlying asset’s value aligns with your expectations. Of course, with leverage comes the potential for amplified losses, so it’s essential to manage risk prudently.

Insights from Seasoned Traders: Wisdom from the Experts

“The beauty of buying the underlying in options trading lies in its versatility,” says seasoned trader Mark Douglas. “It allows you to customize your investment strategy based on your risk tolerance, market outlook, and timeframe. By understanding the nuances of options contracts, you can effectively navigate market fluctuations and increase your chances of success.”

Echoing Douglas’s sentiments, acclaimed investor Tom Sosnoff adds, “Buying the underlying empowers you to take ownership of the asset while maintaining the flexibility to adjust your strategy as the market evolves. This flexibility is a key advantage that seasoned traders leverage to maximize returns and minimize risks.”

Image: www.markettradersdaily.com

Options Trading Buy The Underlying

Image: analystprep.com

Harnessing the Power: A Path to Investment Mastery

To fully harness the potential of buying the underlying in options trading, consider these practical tips:

-

Educate Yourself: Before you dive into the world of options, invest time in educating yourself about the intricacies of options contracts, market dynamics, and risk management. Knowledge is the foundation upon which successful trading strategies are built.

-

Define Your Strategy: Clearly define your investment objectives, risk tolerance, and investment horizon. This will guide your decisions regarding which options contracts to purchase and when to exercise them.

-

Manage Risk: Risk management is the cornerstone of successful options trading. Use stop-loss orders, position sizing, and hedging strategies to mitigate potential losses and protect your capital.

-

Monitor the Market: Stay informed about market news, economic data, and industry trends that may impact the underlying asset. The ability to adapt to changing circumstances is crucial in options trading.

Buying the underlying in options trading empowers you with the flexibility and potential to navigate market fluctuations and enhance your investment returns. By understanding the nuances of options contracts and employing prudent risk management strategies, you can unlock the limitless horizons of financial success.