Options trading, a sophisticated financial strategy, entails buying or selling contracts that grant you the right to buy (or sell) a specific number of shares of a particular stock or asset at a predefined price on or before a specific date. As an investor, navigating the myriad of options trading brokerage companies can be daunting, but unlocking the potential of options trading can be immensely rewarding with the right platform and knowledge.

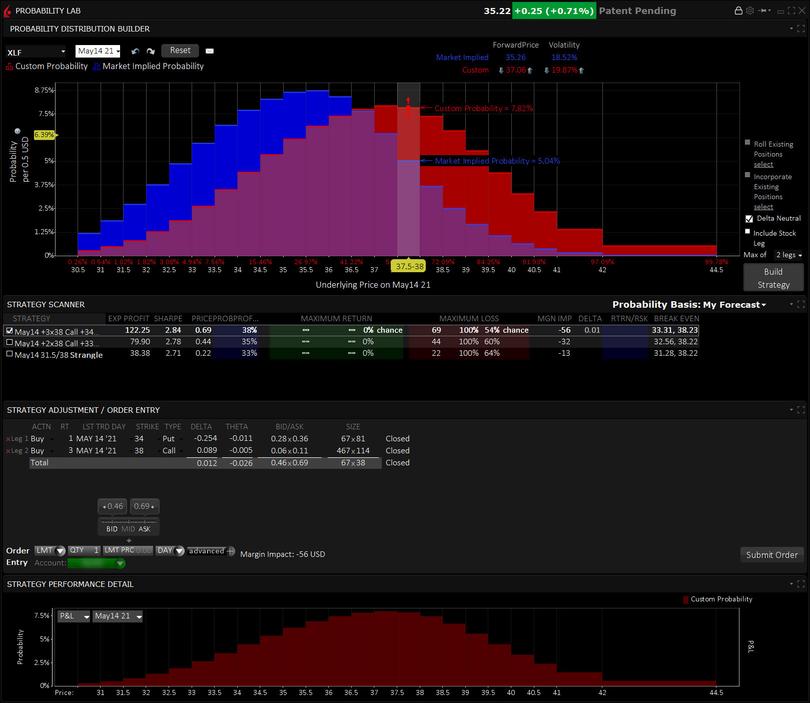

Image: www.interactivebrokers.com

In this in-depth guide, we’ll delve into the intricacies of options trading, exploring the fundamentals, guiding you through the selection of a reputable brokerage firm, and providing expert insights to empower your trading decisions.

Understanding the Options Market

Options contracts provide investors with the opportunity to amplify their returns or hedge against potential losses. Call options grant you the right to buy an underlying asset, while put options reserve the right to sell. Each contract represents 100 shares, offering flexibility and the ability to tailor your strategy to your investment goals.

Premiums, the prices paid for options contracts, vary based on factors such as the stock price, volatility, time to expiration, and the strike price (the price at which you can exercise your right to buy or sell). Seasoned options traders meticulously assess these variables to calculate potential risks and rewards.

Selecting an Options Trading Brokerage Company

An ideal options trading brokerage company should provide a robust platform, competitive pricing, dependable customer service, and educational resources. Research meticulously, considering the following parameters:

-

Platform Stability and Usability: Ensure seamless trade execution and intuitive charting tools for informed decision-making.

-

Commission and Fee Structure: Compare commission rates, account maintenance fees, and any potential hidden charges.

-

Customer Support: Efficient and knowledgeable support teams are invaluable for addressing queries and resolving issues promptly.

-

Educational Resources: Access to webinars, articles, and tutorials empowers traders to enhance their skills and navigate market complexities.

Expert Insights for Options Trading Success

-

Embrace Risk Management: Recognize that options trading carries inherent risks. Employ risk management strategies such as stop-loss orders and position sizing to mitigate potential losses.

-

Thorough Research: Conduct thorough due diligence on underlying assets, market trends, and overall economic indicators to make informed trading decisions.

-

Mindful Trading Psychology: Stay disciplined, avoid emotional decision-making, and adhere to a structured trading plan.

Image: exspeedite.com

Options Trading Brokerage Companies

Image: creditcarder.com

Conclusion

Options trading offers investors the potential to amplify returns or hedge against market downturns. By understanding options contracts, selecting a reputable brokerage firm, and embracing expert insights, you can unlock the扉of this powerful financial tool. Remember, knowledge is key, so continue to educate yourself, monitor market dynamics, and refine your strategies to maximize your trading success.