In the realm of financial markets, options trading stands out as a complex yet rewarding investment strategy. While it can allure with the potential for substantial returns, it also harbors risks that must be carefully navigated. In this comprehensive guide, we delve into the intricacies of options trading, exploring its history, mechanics, and the elusive pursuit of annual returns.

Image: giaodichthongminh.com

The Allure of Options Trading

Options, financial derivatives that derive their value from underlying assets such as stocks, indices, or commodities, have captivated investors with their unique blend of risk and reward. These contracts confer the right, but not the obligation, to buy or sell an asset at a predetermined price, providing traders with leverage and flexibility. However, this power comes with a double-edged sword, as options can amplify both gains and losses.

Options Trading: A Year in Review

Annual returns in options trading are a highly individualized and dynamic proposition, influenced by myriad factors including market conditions, underlying asset performance, volatility, and the trader’s skillset. While some traders may boast impressive returns, others may incur significant losses. Therefore, it is crucial to approach options trading with a realistic understanding of both the potential upsides and the inherent risks.

Understanding Options: A Layman’s Guide

At their core, options contracts represent a type of insurance policy. When an investor purchases an option, they pay a premium in exchange for the right to exercise the option at a future date. The buyer has the choice to exercise the option or let it expire worthless, depending on whether the underlying asset’s price moves in a favorable direction.

Image: myasiaprivatebank.blogspot.com

Types of Options

- Call Option: Grants the buyer the right to purchase the underlying asset at a specified price (strike price) by the expiration date.

- Put Option: Provides the buyer the right to sell the underlying asset at the strike price by the expiration date.

Metrics that Matter: Understanding Option Pricing

Several critical factors influence the pricing of options, including the time remaining until expiration, the volatility of the underlying asset, and the prevailing interest rates. As the expiration date nears, time decay sets in, reducing the option’s value. Volatility, measured by the implied volatility index (VIX), also plays a pivotal role, with higher volatility typically leading to pricier options.

Maximizing Returns and Minimizing Risks

Navigating options trading for optimal returns requires a strategic approach, blending technical analysis, risk management, and a healthy dose of self-discipline.:

Tips for Enhancing Returns:

- Target Liquid Options: Opt for options with high open interest and volume to ensure liquidity and minimize slippage.

- Trade with Direction: Identify and trade in line with the prevailing market trend to increase the odds of success.

- Leverage Volatility: Capitalize on periods of high volatility, where options prices tend to inflate, to maximize premiums.

Expert Advice for Risk Mitigation:

- Implement Risk Management Strategies: Employ stop-loss orders, position sizing, and hedging to manage potential losses.

- Thorough Research: Diligently study the underlying asset, market conditions, and historical data to inform your trading decisions.

- Emotional Control: Maintain discipline and avoid making impulsive trades based on fear or greed.

Frequently Asked Questions about Options Trading

Q: Is options trading suitable for beginners?

A: Options trading carries substantial risk and complexity, making it ill-advised for novice investors.

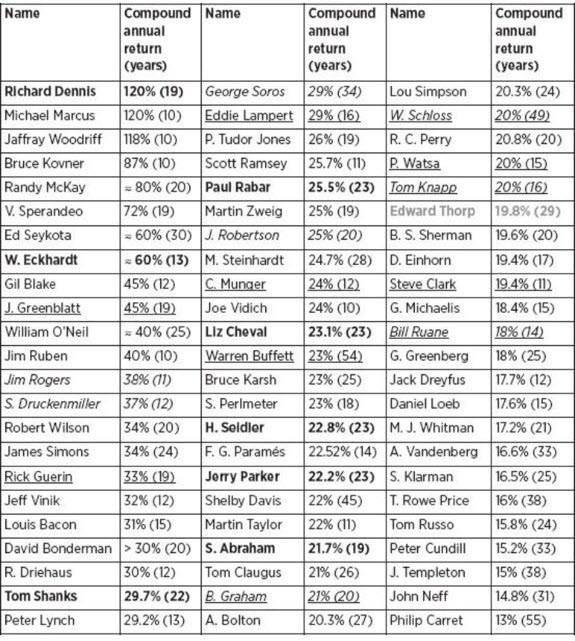

Q: What is the average annual return in options trading?

A: Average annual returns vary significantly based on trader skill, market conditions, and underlying asset selection.

Q: How do I calculate the profitability of an options trade?

A: Subtract the premium paid from the difference between the strike price and the underlying asset’s price at expiration for a call option, or vice versa for a put option.

Options Trading Annual Return

Image: www.cxoadvisory.com

Conclusion

Options trading presents a tantalizing blend of opportunity and risk, beckoning investors with the potential for amplified returns. However, embarking on this journey requires a thorough understanding of options mechanics, vigilant risk management, and a disciplined approach. By embracing the knowledge and strategies outlined in this article, traders can navigate the options market with greater confidence and unlock the potential for lucrative annual returns.

Interested in learning more about options trading? Explore our comprehensive resources to deepen your understanding and hone your skills.