Delving into the World of Options Paper Trading

As aspiring options traders, dipping our toes into the alluring yet complex world of options trading might seem both thrilling and daunting. To equip ourselves for success, we must embrace a time-honored strategy: paper trading. In essence, paper trading provides an unparalleled virtual sandbox where we can refine our skills without risking a single penny. With a focus on paper trading spreadsheets, this comprehensive guide will empower you with the knowledge and techniques to navigate the options market confidently.

Image: optionstrategiesinsider.com

The Allure of Paper Trading Spreadsheets

Imagine an Excel spreadsheet that transforms into a battlefield, where virtual trades come to life. Options paper trading spreadsheets allow us to simulate real-time trading conditions without putting any capital at stake. They invariably include crucial features such as:

- Historical market data for accurate trade simulations

- Real-time charting capabilities for insightful data visualization

- Options pricing models to forecast option premiums

- Trade history logs for diligent record-keeping

Armed with these features, paper trading spreadsheets metamorphose into a priceless tool for honing our trading acumen. By simulating various trading strategies and testing our mettle in diverse market scenarios, we can amplify our chances of triumph when venturing into the real trading arena.

Options Trading: A Basic Overview

Options trading revolves around contracts that bestow the right, yet not the obligation, to buy or sell a specific underlying asset at a preordained price, known affectionately as the strike price, before an expiration date. These contracts, aptly named options, are either calls, entitling us to purchase the asset, or puts, bestowing the right to sell.

The interplay of time, volatility, and the underlying asset’s price profoundly influences option premiums, which represent the cost of acquiring these contracts. Understanding and incorporating these factors into our trading decisions are pivotal for reaping rewards in the options market.

Trading Strategies: Navigating the Options Market

The options market presents an expansive landscape of trading strategies, each tailored to distinct market conditions and individual risk appetites. Some of the most popular strategies include:

- Covered calls: Generating income by selling call options against an underlying stock we own

- Protective puts: Hedging against potential losses by buying put options on a stock we own

- Iron condors: A neutral strategy that capitalizes on low volatility by simultaneously selling both call and put options

- Butterfly spreads: A bullish or bearish strategy involving the purchase and sale of options with varying strike prices

Skillfully employing these strategies and customizing them to suit our unique trading objectives empowers us to maximize our chances of success in the options market.

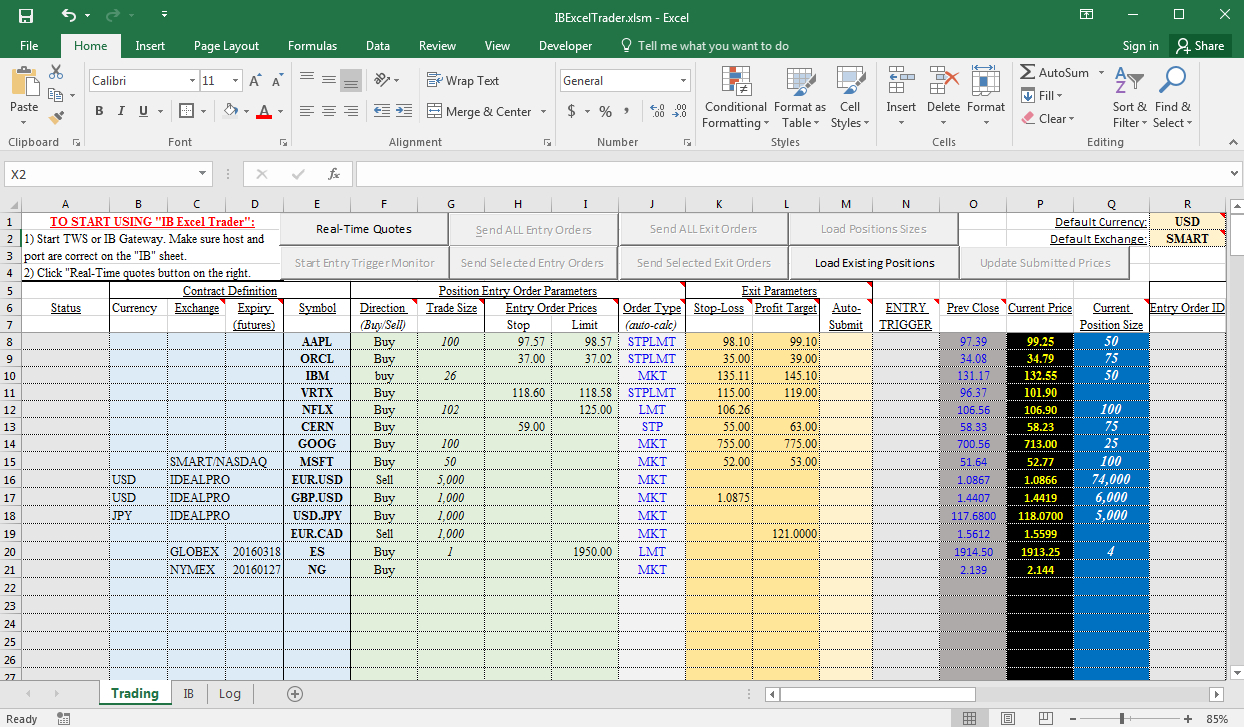

Image: db-excel.com

Tips and Expert Advice: Empowering Our Trading Journey

Drawing from the wisdom of seasoned options traders and our own experiences, we have culled a treasure trove of tips and expert advice to fortify your trading journey:

- Choose a reliable paper trading platform: Thoroughly research and select a platform that aligns with your trading needs and preferences

- Simulate realistic trading conditions: Treat virtual trades with the same gravity as real trades. Embrace discipline, patience, and sound risk management practices

- Study historical market data: Analyze charts, identify patterns, and glean insights into market behavior. This knowledge will serve as a compass in your trading endeavors

- Stay abreast of market news and events: Events and news can dramatically impact market sentiment and option premiums. Stay informed to make judicious trading decisions

- Seek guidance from mentors or trading communities: Engage with experienced traders to absorb their knowledge and insights. Join forums or online communities to connect with fellow traders and share strategies

By adhering to these principles, we augment our chances of harnessing the potential of options trading while mitigating risks and maximizing returns.

Frequently Asked Questions: Illuminating Common Queries

Q: Can paper trading adequately prepare me for real-world options trading?

A: While paper trading provides an invaluable training ground, it’s a virtual simulation that may not fully replicate the psychological and emotional aspects of real trading. Transitioning to real-world trading requires discipline, resilience, and a measured approach.

Q: How long should I engage in paper trading before transitioning to real-world trading?

A: The optimal duration of paper trading varies depending on individual learning curves and trading goals. Aim for at least several months of consistent paper trading, ensuring proficiency in executing trades, understanding market dynamics, and managing risk effectively.

Q: Can I make money paper trading?

A: While paper trading can enhance our trading skills, it does not yield real financial gains or losses. It serves primarily as a simulated environment for experimentation, learning, and refining strategies.

Q: What are the limitations of paper trading?

A: Paper trading lacks the psychological pressure and emotional rollercoaster inherent in real-world trading. It also may not fully account for market nuances such as slippage, liquidity constraints, and order execution delays.

Options Paper Trading Spreadsheet

Image: residentrugby25.gitlab.io

Conclusion: Embracing Options Trading with Confidence

Embarking on the odyssey of options trading, we must recognize that understanding, practice, and meticulous planning are indispensable. By embracing paper trading spreadsheets, incorporating effective strategies, and adhering to expert advice, we can significantly enhance our odds of achieving success in this complex and potentially lucrative market. As we delve deeper into the world of options trading, let us embrace the challenge with enthusiasm, confidence, and an unwavering commitment to learning.