In a world where markets are constantly evolving, investors seek innovative strategies to capitalize on opportunities and mitigate risks. Enter event-based option trading, a powerful tool that allows you to harness the impact of specific events on stock prices for potential profit.

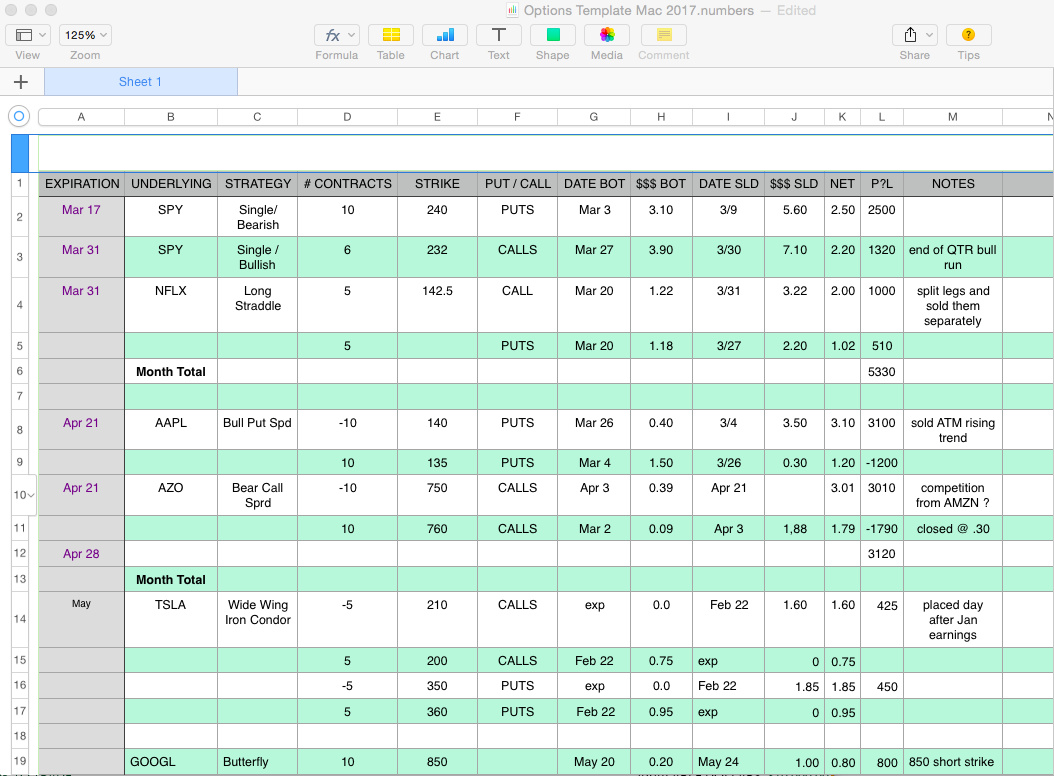

Image: www.honoluluoptionstraders.com

Understanding Event-Based Option Trading

Event-based option trading involves using options contracts to speculate on the potential price movement of an underlying asset following a significant event. These events can range from earnings reports to economic data releases, political announcements, or industry conferences. By understanding the potential impact of these events, traders can position themselves to benefit from the subsequent market volatility.

How It Works

When a significant event is approaching, traders can purchase or sell options contracts that give them the right (but not the obligation) to buy or sell the underlying asset at a predetermined price and expiration date. If the event causes the asset’s price to move in the direction predicted by the trader, they can exercise their option to buy or sell for a profit.

Types of Event-Based Option Trades

There are various types of event-based option trades, including call and put option purchases or sales. Call options give traders the right to buy the asset, while put options give them the right to sell. Traders can also use different expiration dates, depending on the timing of the event and their investment goals.

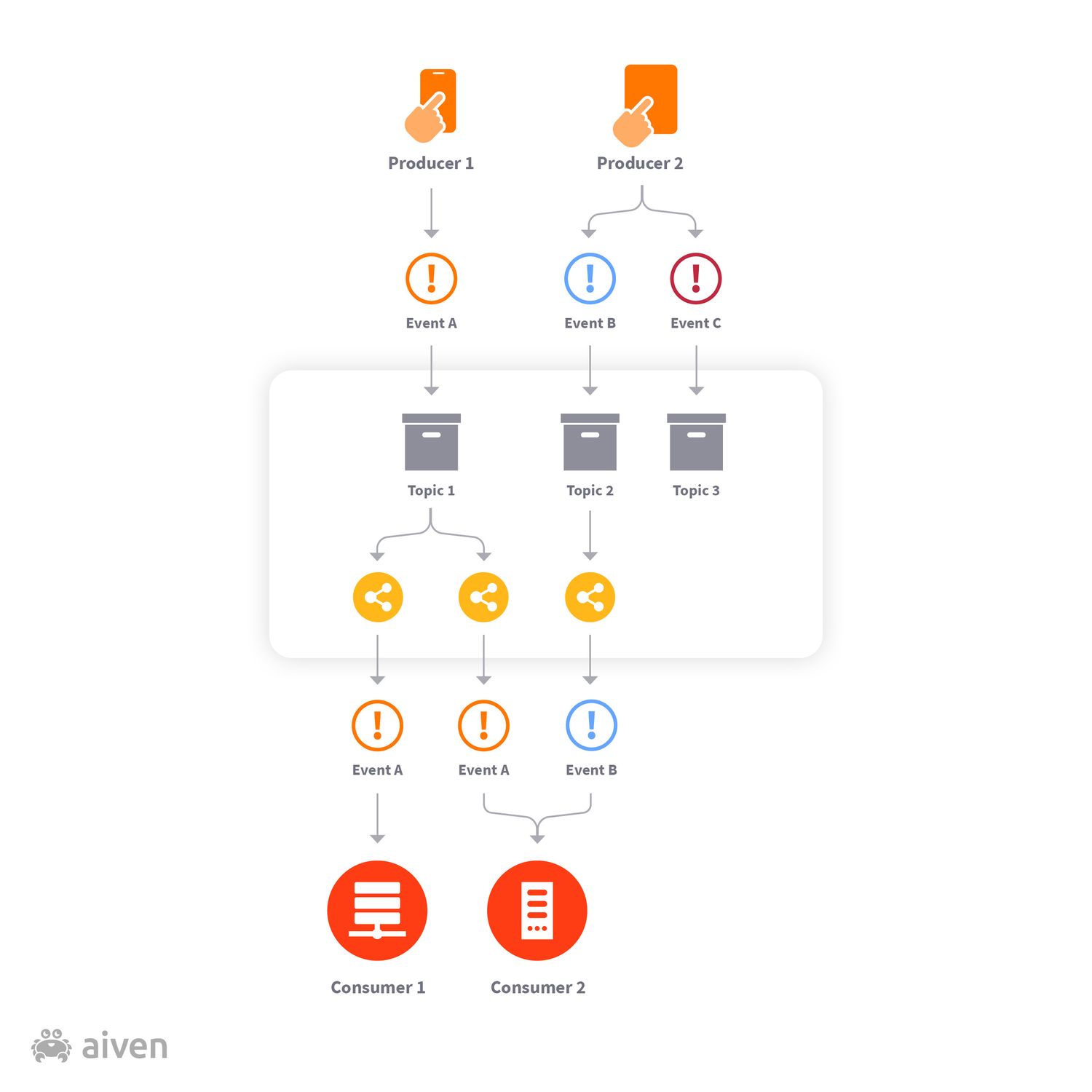

Image: diohysba.blogspot.com

Benefits of Event-Based Option Trading

Event-based option trading offers several benefits, including:

- Potential for High Returns: Events can trigger significant price movements, potentially yielding substantial profits for traders.

- Limited Risk: Options contracts have a defined risk profile, limiting potential losses to the premium paid.

- Flexibility: Traders can tailor their trades to suit specific events and market conditions.

Risks and Cautions

While event-based option trading can be lucrative, it also carries risks that traders should be aware of:

- Missed Trades: If the event fails to impact the asset’s price as anticipated, traders may lose the premium paid on their options.

- Market Manipulation: News and events can sometimes be manipulated, which can impact the accuracy of price predictions.

- Commission Costs: Trading options involves commission costs, which can reduce potential profits.

Expert Insights

To help our readers maximize their event-based option trading strategies, we consulted with industry experts.

“Conduct thorough research and understand the nature of the event,” emphasized Dr. Emily Carter, a financial analyst. “Historical data can provide valuable insights into potential price movements.”

“Position sizing is crucial,” advised Mr. Richard Thompson, an options trader. “Allocate only a portion of your portfolio to event-based trades, maintaining a balanced approach to risk management.”

Event Based Option Trading

Image: aiven.io

Conclusion

Event-based option trading presents a powerful technique for investors to harness the impact of significant events. By comprehending the concepts, types of trades, and potential risks involved, traders can strategically navigate market fluctuations and capture profit opportunities. Remember, thorough research, careful execution, and prudent risk management are key to maximizing your success in this dynamic arena.

As you embark on your event-based option trading journey, equip yourself with further resources and connect with reputable brokers to enhance your knowledge and maximize your potential profits.