Introduction

Image: www.projectfinance.com

In the realm of financial markets, options trading has emerged as a pivotal force. Options provide traders an avenue to speculate on potential price movements, allowing them to amplify gains while managing risks. Among the myriad options trading strategies, expiration trading holds a distinct allure. It harnesses the power of time decay to extract profits from the relentless march toward option expiry.

This comprehensive guide will delve into the nuances of options expiration trading strategies, empowering you with the knowledge and insights to navigate this dynamic market. We will explore the fundamental concepts, showcase real-world applications, and equip you with expert insights and actionable tips to maximize your trading success.

Unveiling Options Expiration Trading: Laying the Foundation

At its core, an option contract grants the buyer the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a predetermined price (strike price) on or before a specific date (expiration date). Options expiration trading strategies capitalize on this unique feature, leveraging time decay to their advantage.

As an option’s expiration date approaches, its value gradually erodes, particularly for options that are “out-of-the-money” (i.e., their strike price is significantly higher or lower than the current market price). This phenomenon, known as time decay, arises from the diminishing probability of the option expiring in-the-money (ITM).

Harnessing Time Decay: Crafting Profitable Expiration Trading Strategies

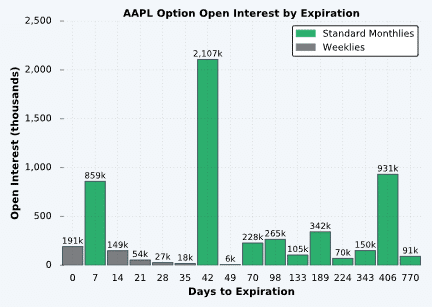

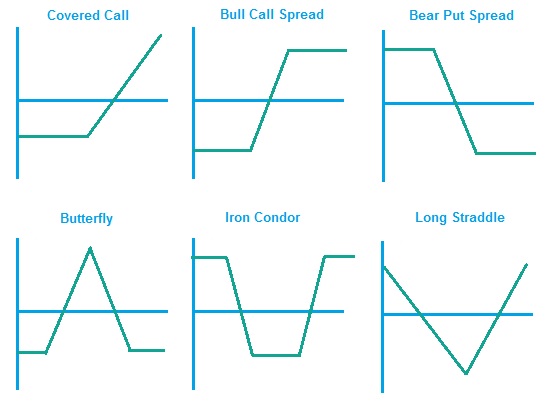

Traders can employ a diverse array of expiration trading strategies tailored to specific market conditions and risk appetites. One prevalent strategy involves selling out-of-the-money options close to expiration. By capturing the accelerated time decay near expiry, traders aim to generate profits from the rapid decline in option premiums.

Alternatively, traders may opt for a more sophisticated strategy known as “rolling options.” Here, out-of-the-money options are repeatedly sold closer to expiration and simultaneously replaced with new options with further expiry dates. This strategy seeks to capitalize on time decay while extending the duration of the trade, potentially amplifying profits.

Expert Insights: Unlocking the Secrets of Expiration Trading

“Understanding the relationship between time decay and option pricing is paramount in expiration trading,” advises industry veteran and options expert Dr. Mark Fisher. “By mastering the dynamics of time premium erosion, traders can position themselves to capture significant gains.”

Seasoned trader Emily Jones emphasizes the importance of managing risk, particularly when employing expiration trading strategies. “It’s crucial to set stop-loss orders and carefully assess risk-reward ratios,” she advises. “Protecting your capital is paramount, even in the pursuit of high-potential profits.”

Image: arebapinuho.web.fc2.com

Actionable Tips: Empowering Your Expiration Trading Strategy

-

Identify High Time Decay Options: Focus on selling options with short time to expiration (less than 30 days) and significant distance from the current market price.

-

Monitor Market Volatility: Volatility directly impacts option premiums. Sell options in stable market environments or consider volatility-adjusted strategies during periods of market turbulence.

-

Manage Your Risk: Use stop-loss orders to limit potential losses and adjust position size based on your risk tolerance.

Options Expiration Trading Strategy

Image: personalfinancelab.com

Conclusion

Mastering options expiration trading strategies requires a judicious blend of knowledge, skill, and discipline. By grasping the fundamental concepts, harnessing time decay, and incorporating expert insights, you can craft a robust trading strategy designed to exploit the dynamic market forces that shape option prices.

Remember, the path to success in options trading often involves learning from both victories and setbacks. Continuous research, discipline, and a commitment to honing your skills will propel you towards achieving your trading goals and unlocking exceptional profits. Embrace the power of options expiration trading, and let the countdown to success begin.