In the ever-evolving landscape of financial markets, options exchange-traded funds (ETFs) have emerged as a game-changer for investors seeking both leverage and diversification. These innovative instruments provide a unique way to amplify potential returns while mitigating risk, making them a compelling option for seasoned traders and savvy beginners alike. Grasping the complexities of options ETF trading can unlock a world of possibilities and enhance your investment strategies.

Image: www.etftrends.com

The Power of Options: A Brief Overview

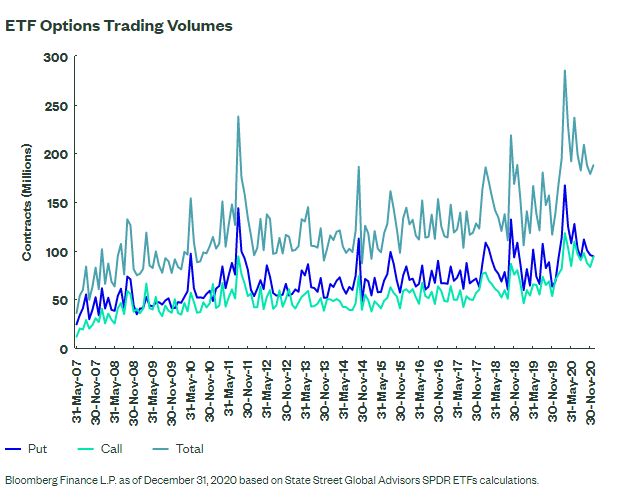

Options, unlike traditional stocks, offer a wider range of investment options. Call options grant the holder the right to buy an underlying asset at a predetermined price, giving investors exposure to potential upside. Put options, on the other hand, confer the right to sell the underlying asset, protecting investors from potential downside风险. The flexibility and versatility of options make them a powerful tool for managing risk and maximizing gains.

ETFs: A Gateway to Leveraged Exposure

Exchange-traded funds, or ETFs, essentially bundle together a basket of underlying assets, offering investors instant diversification and lower transaction costs. Options ETFs take this concept a step further by providing exposure to options contracts, essentially amplifying the potential returns while distributing risk across multiple options within the fund. This makes options ETFs an attractive option for investors seeking to magnify their market exposure.

Key Types of Options ETFs

The diverse world of options ETFs encompasses a wide array of choices, each catering to specific investment objectives and risk appetites. Some common types include:

- Single-Stock Options ETFs: Focus on options tied to a single underlying stock, providing targeted exposure to specific companies.

- Index Options ETFs: Track the performance of a particular index, such as the S&P 500, allowing investors to gain exposure to a broader market.

- Sector Options ETFs: Invest in options linked to specific industry sectors, enabling investors to capitalize on sector-specific trends.

- Volatility Options ETFs: Designed to provide exposure to market volatility, offering investors a way to hedge against potential market fluctuations.

Image: zeyeponohey.web.fc2.com

Trading Options ETFs: Strategic Considerations

Successful options ETF trading hinges on a comprehensive understanding of market dynamics, underlying options, and fund-specific characteristics. Traders should consider:

- Underlying Asset Performance: Analyze the performance of the underlying asset or index to gauge potential price movements and option premium volatility.

- Options Chain Analysis: Examine the options chain, including expiration dates, strike prices, and implied volatility, to identify trading opportunities.

- Fund Expense Ratio: Evaluate the fund’s expense ratio, as it can impact overall returns.

- Market Conditions: Monitor market conditions and economic indicators to assess the impact on options ETF performance.

- Covered Call: Selling a call option against a portion of the underlying stock held in a portfolio, generating income while limiting upside potential.

- Protective Put: Buying a put option alongside a stock position, providing downside protection while sacrificing some upside potential.

- Buy and Hold: Holding options ETF contracts over a longer term, relying on gradual price appreciation and dividend income.

Options ETF Trading Strategies: A Path to Profit

Options ETFs offer traders a diverse range of trading strategies, enabling them to tailor their approach to their risk tolerance and market outlook. Popular strategies include:

Options Etf Trading

Image: www.bigtrends.com

Conclusion: Unleashing the Potential of Options ETF Trading

Options ETF trading opens up a world of leveraged investment opportunities, allowing investors to enhance their returns while managing risk. By delving into the intricacies of options and the diverse landscape of options ETFs, traders can unlock the full potential of these instruments. Remember, thorough research, a disciplined trading plan, and a comprehensive understanding of market dynamics are paramount for successful options ETF trading. Embark on this exciting journey, and the rewards of enhanced market exposure and greater profitability may await you.