Greetings, my fellow financial explorers! Are you ready to delve into the mesmerizing world of option trading and uncover the secrets of the enigmatic volatility surface? Fasten your seatbelts as we embark on a journey through its depths, comprehending the forces that shape this dynamic landscape and how it impacts your trading strategies.

Image: stockpickreviews.com

In an ever-evolving market, where risks and opportunities dance in a delicate balance, volatility reigns supreme. Imagine yourself as a fearless adventurer, navigating the treacherous waters of uncertainty, with your compass guiding you towards profitable shores.

Enter the Volatility Surface

The volatility surface, a labyrinth of numbers and symbols, provides a comprehensive map of implied volatility’s movements across various strike prices and expiration dates. Think of it as a living, breathing entity, constantly shifting and reshaping in response to market whispers and global events.

By decoding the intricate language of the volatility surface, you gain the power to decipher the market’s expectations of future volatility. This knowledge empowers traders to tailor their strategies, navigating risk with precision and seizing opportunities as they emerge.

Navigating the Nuances

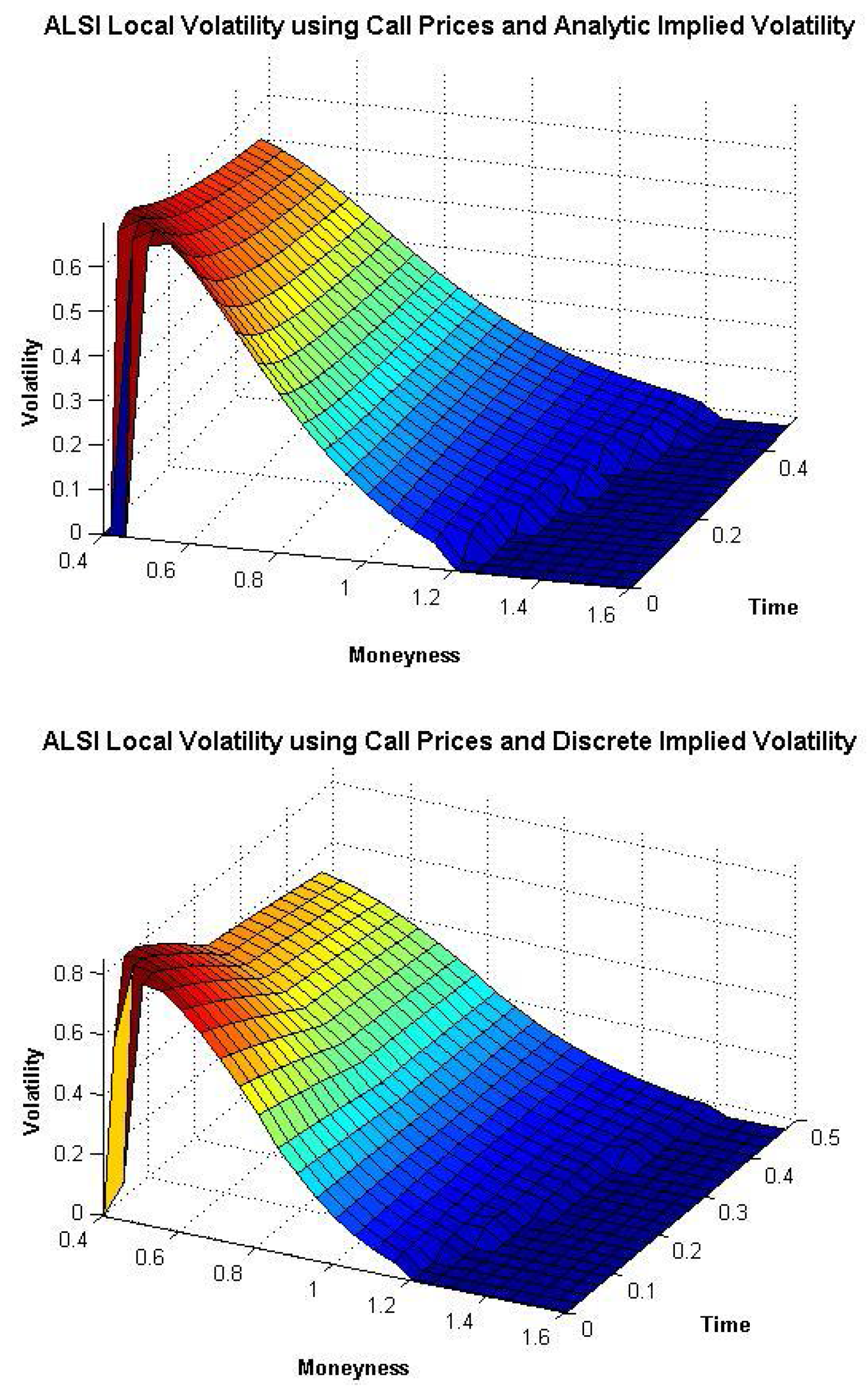

The volatility surface is a kaleidoscope of colors, each hue representing a different strike price and expiration combination. Higher volatility translates into brighter hues, indicating heightened market uncertainty. Conversely, lower volatility manifests in muted tones, suggesting a calmer market landscape.

Understanding the curvature of the volatility surface is crucial. A steep surface signifies a wide range of volatility expectations across strike prices, while a relatively flat surface implies a more uniform market outlook. These nuances provide valuable insights, shaping the trader’s approach to option pricing and risk management.

Tracking Market Pulse

The volatility surface is a mirror reflecting the market’s collective consciousness. By continuously monitoring its movements, traders gain invaluable insights into prevailing market sentiment and expectations. This information serves as a guiding light, informing decisions on market positioning, hedging strategies, and profit-taking tactics.

Staying abreast of the latest news and events, both domestic and global, is essential in deciphering the volatility surface. Geopolitical tensions, economic data releases, and central bank policy announcements are just a few of the factors that can trigger shifts and reshape the volatile landscape.

Image: www.pinterest.co.uk

Tips and Expert Guidance

Mastering the nuances of the volatility surface is an art form, requiring a combination of technical proficiency and experiential wisdom. Here are a few tips to enhance your understanding and improve your trading prowess:

– Stay Informed: Regularly monitor the volatility surface and track its evolution over time. Market news and expert commentaries provide valuable insights into the underlying drivers.

– Utilize Volatility Tools: Leverage specialized software and online platforms that offer advanced visualization and analysis tools for the volatility surface, aiding in pattern identification and strategic decision-making.

Frequently Asked Questions

**Q: What factors influence the shape of the volatility surface?**

A: The volatility surface is primarily influenced by market sentiment, economic cycles, and geopolitical events, among others.

**Q: How can I use the volatility surface to refine my trading strategies?**

A: By understanding the volatility expectations, traders can tailor their strategies accordingly, optimizing strike price selection, expiration date choices, and risk management.

Option Trading Volatility Surface

Image: forexrobottrader1.blogspot.com

Conclusion

The volatility surface, a captivating and ever-changing landscape, holds the key to unlocking the secrets of option trading. By comprehending its intricacies, traders gain an unparalleled advantage in navigating the treacherous financial waters, maximizing opportunities while mitigating risks.

Are you ready to embark on this exciting odyssey, where uncertainty transforms into strategic insights? Join me on this quest for knowledge and empowerment. Embrace the volatility surface and unlock the full potential of your option trading endeavors.