In the intricate realm of options trading, where calculated gambles dance amidst the ebb and flow of market sentiment, there dwells a specialized strategy known as “vanna option trading.” Coined by the financial wizard Emanuel Derman, “vanna” encapsulates the dynamic relationship between an option’s price and the curvature, or skewness, of the implied volatility surface. This volatility landscape, shaped by market expectations, provides a treasure trove of insights for astute investors seeking to navigate the uncertain seas of option pricing.

Image: thefindesk.com

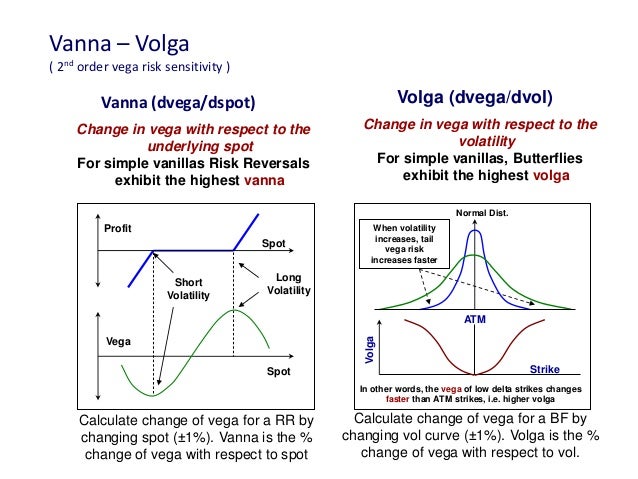

Vanna quantifies the change in an option’s delta for a given shift in implied volatility. A positive vanna implies that an increase in volatility will lead to a higher delta, amplifying the option’s sensitivity to changes in the underlying asset. Conversely, a negative vanna suggests that the delta will decrease as volatility rises. Understanding vanna becomes paramount in situations where implied volatility is anticipated to fluctuate, allowing traders to tailor their strategies accordingly.

At the heart of vanna option trading lies the concept of “volatility skew.” Implied volatility, the market’s forecast of future price swings, often exhibits a skewed distribution, with higher implied volatility at higher strike prices. This skewness can be attributed to various factors, including market sentiment, hedging strategies, and the influence of risk aversion. Traders adept at deciphering the volatility landscape can exploit these asymmetries to their advantage.

Consider an example where positive vanna reigns supreme. Suppose an investor holds a call option with a strike price above the prevailing spot price. As implied volatility ascends, the vanna of the option will increase, amplifying its delta. Consequently, the option’s price will surge, promising a windfall for the savvy trader who anticipated this volatility upswing. Conversely, if negative vanna dominates, a similar surge in volatility would dampen the delta, diminishing the option’s value.

Recognizing the power of vanna, traders employ various strategies to capitalize on its intricacies. One popular tactic involves selling options with positive vanna when implied volatility is low and repurchasing them when volatility spikes, profiting from the widening spread between the option’s price and its delta-adjusted price. Alternatively, traders can employ strategies that seek to neutralize vanna exposure, mitigating potential losses in scenarios where volatility deviates from expectations.

Vanna option trading demands a nimble approach, a keen eye for market sentiment, and a profound understanding of the forces that shape implied volatility. Armed with this knowledge, traders can navigate the treacherous waters of options pricing, crafting strategies that harness the power of vanna to maximize their returns and outwit the ever-shifting market landscape.

Image: www.slideshare.net

Vanna Option Trading