Title: Master Option Trading: A Beginner’s Guide to Profitable Strategies

Image: www.cityindex.com

Introduction:

In the realm of financial markets, where fortunes are made and lost, the world of options trading beckons with its allure of high rewards and calculated risks. For those seeking to navigate this dynamic landscape, understanding option trading strategies is crucial. In this comprehensive tutorial, we’ll embark on a journey to demystify the intricacies of options, equipping you with the knowledge and skills necessary to succeed in this thrilling arena.

Defining Options and Their Importance:

Options, a derivative financial instrument, provide traders with the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a specific price on or before a predetermined date. These powerful tools empower traders with the flexibility to capitalize on market movements, hedge against risks, or generate income. Embracing an understanding of options unlocks a wealth of opportunities in the financial markets.

Exploring Option Types and Their Applications:

-

Call Options:

Call options grant the holder the right to purchase the underlying asset at a specified strike price within a specified time frame. They are ideal for traders expecting an increase in the asset’s value, allowing them to profit if the prediction proves correct. -

Put Options:

Put options, on the other hand, give the holder the right to sell the underlying asset at a set strike price by a certain date. These options are particularly valuable when traders anticipate a decline in the asset’s value, providing a way to profit from price depreciation. -

Covered Calls:

This strategy involves selling a call option on a stock you own. The premium received for selling the option provides potential income, while the stock ownership limits your risk to the extent of the stock price. Covered calls are typically used when you believe the stock’s price will remain within a certain range. -

Cash-Secured Puts:

Similar to covered calls, cash-secured puts involve selling a put option while having the cash to cover the potential obligation to buy the underlying asset. This strategy is suitable when you have cash and are willing to consider buying the underlying asset at a specific price. -

Spreads:

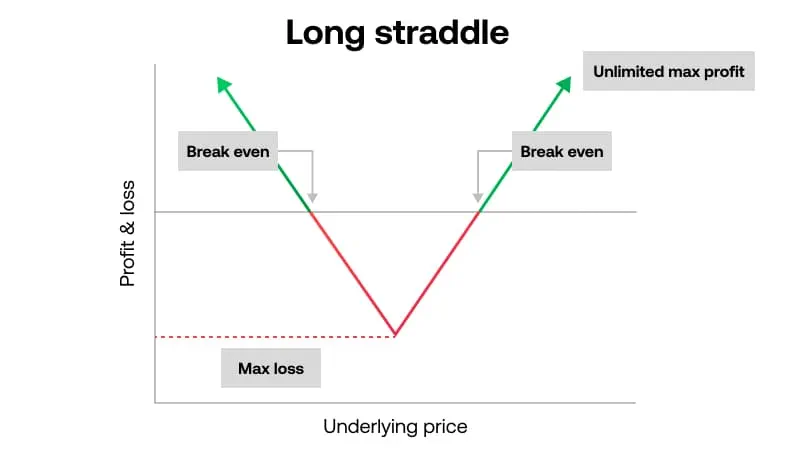

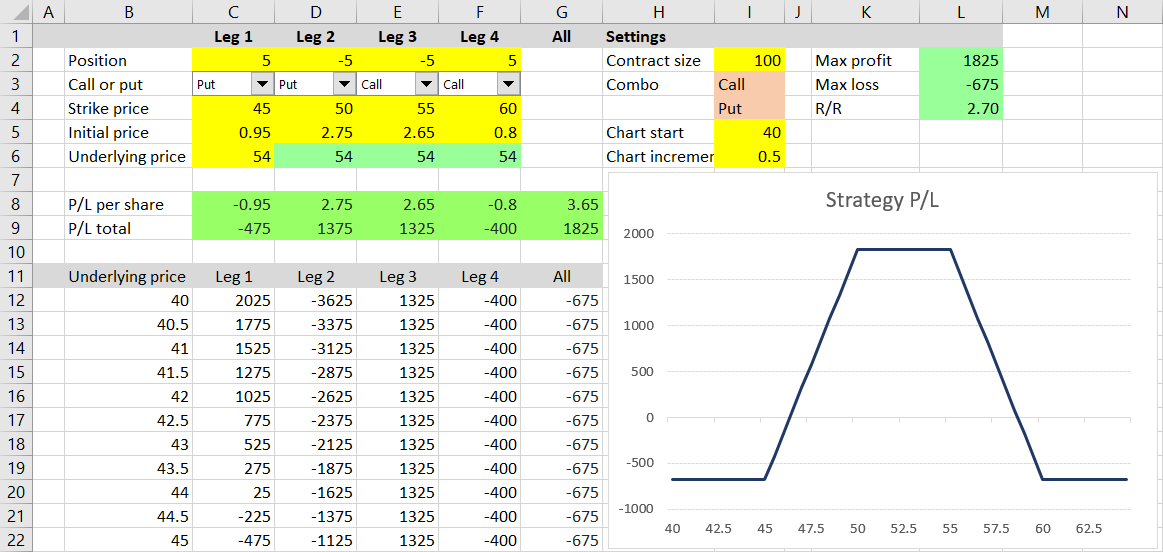

Options spreads involve buying one option and simultaneously selling another option of the same type but with a different strike price or expiration. Spreads can create various strategies with different risk and return profiles.

Navigating the Options Market: Tips for Success:

-

Understanding Greeks:

Mastering Greek letters (Delta, Gamma, Theta, etc.) is vital for assessing option value and risk. These Greek parameters provide insights into how an option’s price behaves in response to changes in underlying asset price, time to expiration, interest rates, and implied volatility. -

Managing Risk:

Options trading inherently carries a degree of risk. Employ effective risk management techniques, such as limiting position size, using protective stops, or adopting a disciplined trading plan to mitigate losses. -

Technical and Fundamental Analysis:

Combine technical analysis, which involves studying historical price patterns and market indicators, with fundamental analysis, which examines a company’s financial health and market environment, for a comprehensive understanding of the underlying asset. -

Choosing a Broker:

Select an options trading broker that aligns with your experience level, strategy, and financial capabilities. Consider factors like commissions, margin requirements, and platform functionality. -

Continuous Education and Experience:

Stay up-to-date on market trends and enhance your trading skills through ongoing education and practice. The more experience you gain, the more adept you will become at navigating the complexities of options trading.

Conclusion:

Embarking on an options trading journey empowers you with the ability to not only harness market opportunities but also manage risks effectively. By understanding the concepts, implementing strategic techniques, and embracing continuous learning, you can cultivate your prowess in this dynamic financial realm, opening doors to potential profits and financial freedom.

Image: www.tradethetechnicals.com

Option Trading Strategy Tutorial

Image: www.macroption.com