Witnessing the Power of Options

As a seasoned investor, I have witnessed the extraordinary potential of options trading firsthand. I recall a particularly thrilling encounter with a tech stock that had been hovering around $100 per share. Through a well-timed options strategy, I was able to generate significant returns, even when the stock’s price remained relatively stagnant. Intrigued by this experience, I delved deeper into the world of options trading, eager to unravel its complexities and harness its power.

Image: binaryoptionsaustralia.com

Introducing Options Trading: Definitions and History

Options trading involves contracts that grant the buyer the right, but not the obligation, to buy or sell an underlying asset at a specified price within a defined period. Tracing its roots back to the 17th century, options trading has evolved into a sophisticated financial instrument, enabling investors to mitigate risk, enhance returns, and speculate on market movements.

Types of Options

Options fall into two primary categories: calls and puts. Call options allow the buyer to purchase the underlying asset, while put options provide the right to sell it. Each option contract represents 100 shares of the underlying security, enhancing the potential for significant gains or losses.

Option Premiums and Expiration Dates

The cost of purchasing an option contract is known as its premium. The premium is determined by various factors, including the underlying asset’s price, volatility, and the remaining time until expiration. Options have a finite lifespan, with expiration dates ranging from a few weeks to several years, influencing their value and risk profile.

Image: www.binoption.net

Navigating the Dynamics of Options Trading

Comprehending the intricate dynamics of options trading requires a thorough grasp of certain key concepts.

Volatility and Time Decay

Volatility, a measure of the underlying asset’s price fluctuations, directly impacts option premiums. Higher volatility typically translates to higher premiums. Additionally, time decay erodes the value of options as the expiration date approaches.

Delta and Implied Volatility

Delta measures the sensitivity of an option’s price to changes in the underlying asset’s price. Implied volatility, on the other hand, reflects the market’s expectations of future price volatility. Understanding these concepts is crucial for assessing options strategies.

Unveiling the Power of Options Trading Strategies

Options trading empowers investors with a vast array of strategies to meet their unique investment objectives.

Conservative Strategies: Covered Calls and Protective Puts

Covered calls involve selling call options against shares you own, generating income while limiting downside risk. Protective puts, on the other hand, purchase put options to hedge against potential losses on a stock position.

Aggressive Strategies: Naked Calls and Puts

Naked calls and puts involve selling or buying options without owning or selling the underlying asset. These strategies carry higher risk but also offer the potential for substantial returns.

Bullish and Bearish Strategies

Bullish strategies aim to profit from rising prices, while bearish strategies capitalize on falling prices. Common bullish strategies include buying call options or selling put options, whereas bearish strategies include buying put options or selling call options.

Tips and Expert Advice for Options Success

Based on my experiences and insights from industry experts, here are some invaluable tips for enhancing your options trading success:

1. Start with Paper Trading

Before venturing into live trading, consider practicing your strategies through paper trading platforms, which allow you to simulate real-time market conditions without risking actual capital.

2. Understand the Risks

Options trading can be inherently risky. Before engaging in this market, it is imperative to fully comprehend the potential risks involved and ensure your portfolio can withstand potential losses.

3. Stay Informed

Keep yourself abreast of market news, earnings reports, and economic indicators, as these factors can impact option valuations and market movements.

4. Seek Professional Guidance if Necessary

If you are new to options trading or encounter complex situations, don’t hesitate to consult with a qualified professional to gain additional insights and guidance.

Frequently Asked Questions (FAQs)

Q: What is the difference between call and put options?

- A: Call options grant the buyer the right to buy an asset, while put options grant the right to sell an asset.

Q: How do I determine the right option strategy for me?

- A: Consider your investment objectives, risk tolerance, and understanding of options dynamics to select the most suitable strategy.

Q: What is the potential for profit and loss in options trading?

- A: Options trading offers the potential for substantial gains, but also carries the risk of significant losses.

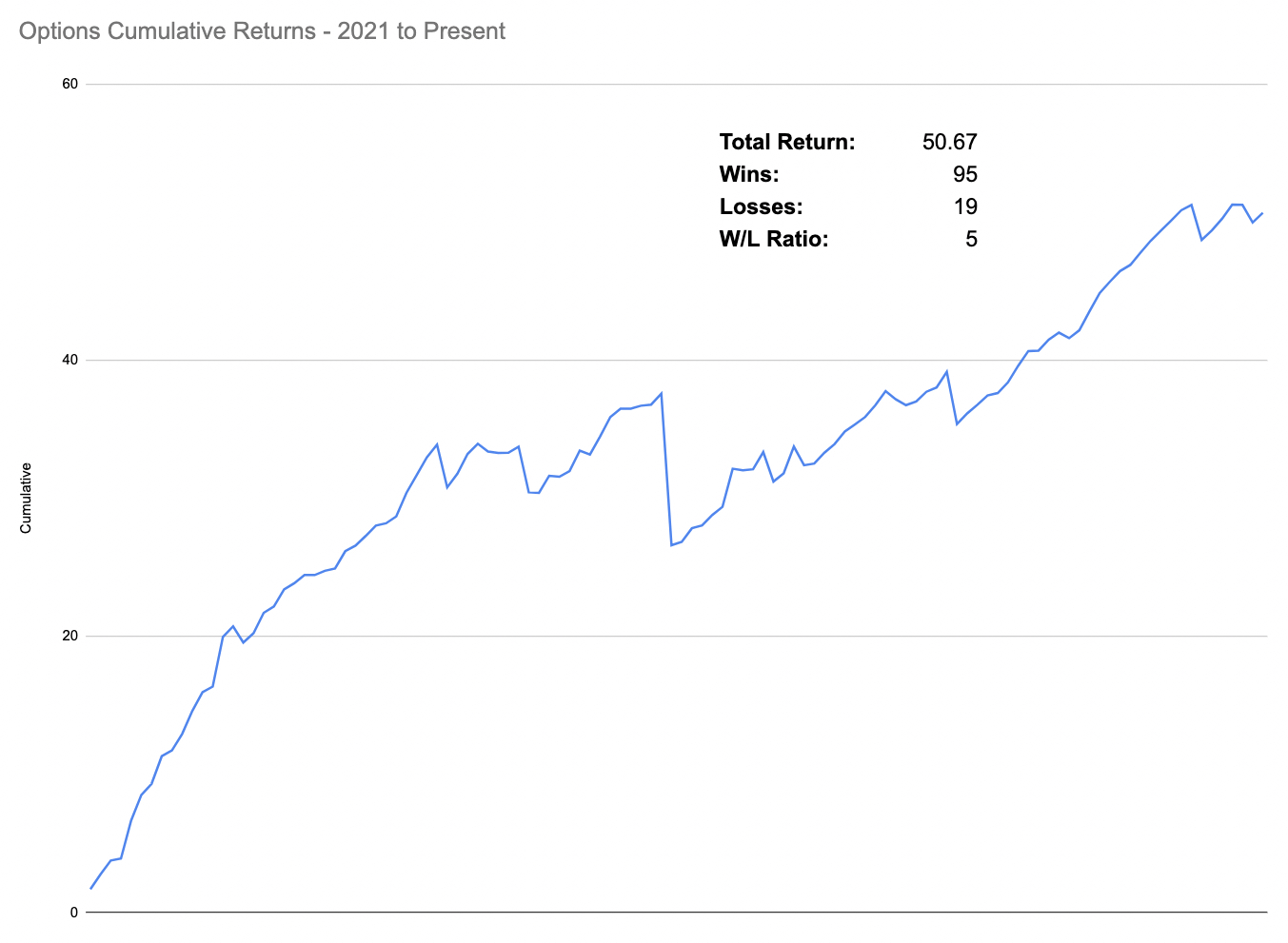

Options Trading Usa Best

Image: evilspeculator.com

Conclusion

Options trading in the US presents a wealth of opportunities for investors seeking to enhance returns, manage risk, and navigate market fluctuations. By fully grasping the complexities of options contracts, employing effective strategies, and embracing the guidance of experts, you can unlock the full potential of this dynamic and rewarding financial instrument.

Do you find this article on options trading in the US informative? Let us know if you have any further questions or would like to delve deeper into specific aspects of this topic.